Published :

Updated :

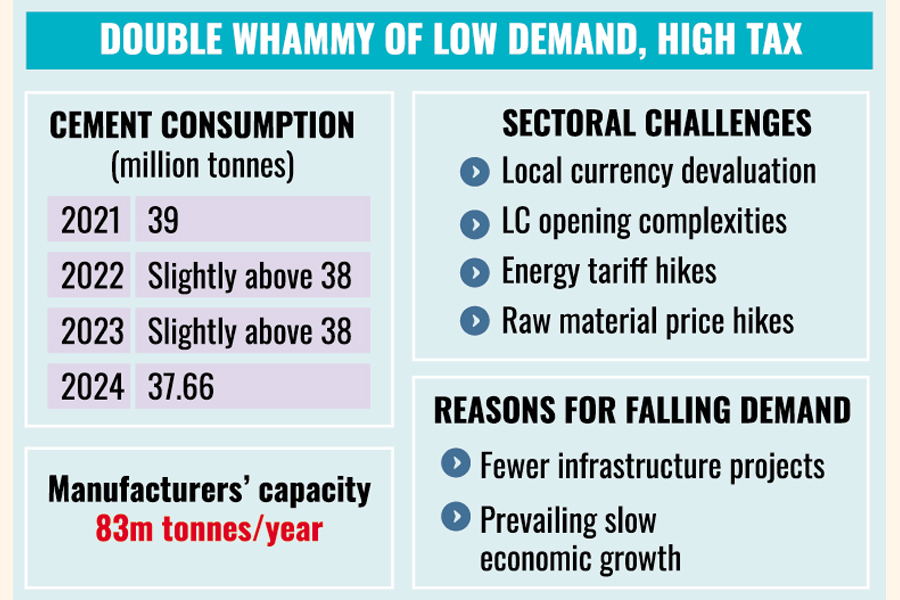

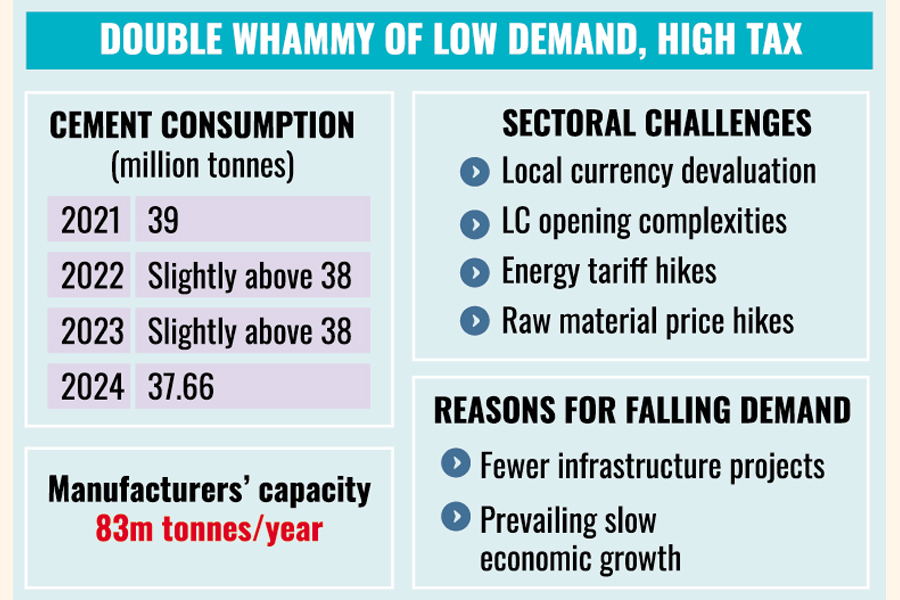

A persistent lower consumption has been affecting the growth of the local cement industry for the last few years, according to industry insiders.

They have attributed such sluggish demand for the construction material to fewer infrastructure projects, especially in the public sector, coupled with the prevailing slower economic growth.

While they are walking a tightrope due to poor demand, their situation is exacerbated by the heavy tax burden, they added.

According to the Bangladesh Cement Manufacturers Association (BCMA), the sector has been witnessing de-growth since 2022.

The country's construction sites consumed approximately 39 million tonnes of cement in 2021.

Since then, it went on witnessing a slightly negative growth each year as the key construction material's demand was slightly above 38 million tonnes in 2022 and 2023, before declining to 37.66 million tonnes last year.

This demand trend is much lower than their effective capacity of around 83 million tonnes per annum, indicating huge unused capacity of manufacturers.

Sources said manufacturers have increased their capacity or new operators entered the market in the last two decades as there have been strong indications of demand to increase with Bangladesh's vision to become a developing country, entailing a number of mega projects like the Padma Bridge, metro rail, and elevated expressway.

The BCMA recently shared the present struggle of manufacturers during a pre-budget meeting with the National Board of Revenue (NBR).

The budget proposal submitted to the NBR said, "This potential cement manufacturing sector is going through tough times due to several reasons, such as the devaluation of local currency, complexities related to letter of credit (LC) opening, and energy tariff hikes and their supply disruption."

"In addition to this, the sector has been logging de-growth over the last several years on the backdrop of curtail in construction activities," it added.

Highlighting various tax-related incongruities, the BCMA said customs duty (CD) on clinker, a key raw material of cement, is around 15 per cent, whereas such tax on key ingredients of any manufacturing sector in usual cases is only 5.0 per cent.

"The cement manufacturers consider this customs duty on the major raw material an inconsistent measure. It is laying an additional burden on consumers, leading to a fear that the overall construction work would lose momentum," it said.

The sector pays advance income tax (AIT) at different rates, including 2.0 per cent on clinker, 3.0 per cent on slug, and 5.0 per cent on limestone at the import level. Besides, a 2.0 per cent AIT is also imposed at the sales phase.

The letter said as AIT is considered the final liability, operators have to pay income tax even when they incur losses.

Managing Director (MD) of Premier Cement Mills Mohammed Amirul Haque identified the existing AIT and tax structures as incompatible measures that impact the sector's growth, which is directly linked to the nation's economic development.

The due payment of a company after AIT adjustment is not properly returned, he said.

"We have repeatedly asked them [NBR] to review the matter. A company pays AIT as per the rule, but it is not given back the money after settlement," he said.

Besides, the customs authorities make an over-assessment of imported raw materials than their invoice price, Haque said.

"Whereas we import clinker per tonne at $42, they [customs] perform over-assessment at $60 per tonne," he said.

According to the BCMA, per tonne slug is imported at $15.5-$16.5, whereas it is assessed at $30. Similarly, slug, fly ash, and gypsum are also over-invoiced by the customs.

Besides, 10 per cent supplementary duty (SD) was imposed on limestone afresh in January this year, though the raw material is not a luxury item.

"Different types of taxes are much higher on the cement sector than rational levels," said Haque.

Underscoring the need for a congenial tax regime, he said this is also vital for fetching foreign direct investment in the country at the desired level.

In addition to different internal bottlenecks, manufacturers also encounter external challenges like raw material price hikes, said Haque.

"On average, the prices of various raw materials have increased by 20 per cent over a quarter. Yet, manufacturers cannot pass it on to customers," he said, indicating shrinking profit margins.

Regarding weak demand, he said though public infrastructure development is in a downward trend, rural infrastructure development activities at the individual level now consume most of the cement sold.

Currently, around 40 companies - including seven listed ones - are operating in the country. The sector has created direct employment for 60,000 people, while indirect employment amounts to over a million.

saif.febd@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.