Direct tax regime getting a facelift

Maiden income tax act shifts govt reliance on import taxes

Published :

Updated :

Bangladesh is getting a full-fledged income-tax law after 39 years from July with an updated direct-tax regime shifting government reliance on import taxes that make imported goods costlier.

The changes in direct tax measures would come through ‘The Income Tax Law 2023’’ meant for action from the upcoming fiscal year, officials said.

Currently, income-tax measures are enforced through the Income Tax Ordinance1984.

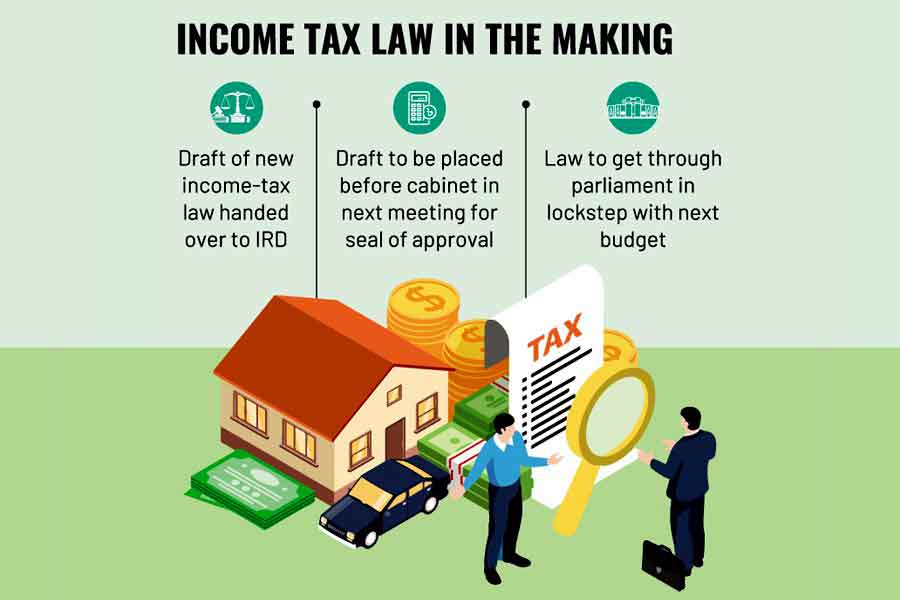

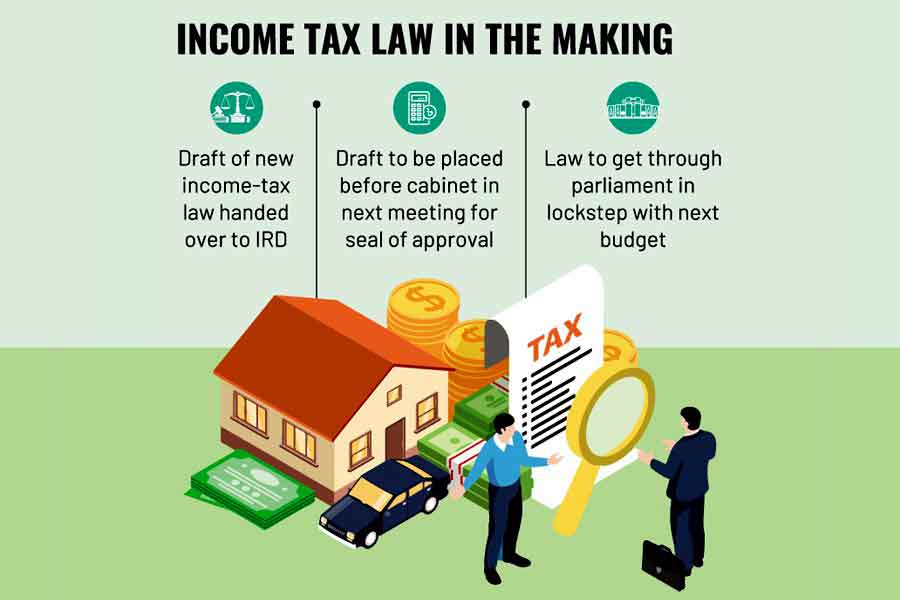

An updated draft of the new income-tax law was handed over to the Internal Resources Division (IRD) on Monday to proceed further on the latest taxing modalities.

After the vetting of the new law, a draft would be placed before the cabinet in its next meeting for its seal of approval before the law gets through parliament in lockstep with the next budget.

Officials have said there is a “high possibility of introducing the new law from the upcoming fiscal year” in compliance with the conditions accompanying the International Monetary Fund (IMF) loan.

“The government is also serious about replacing the age-old ordinance on income tax with an updated law,” said one official.

A senior official of the National Board of Revenue said, “The relentless efforts of NBR’s income-tax policy wing to complete the draft accommodating stakeholders’ opinions would pay off in the next fiscal year.”

Earlier, the NBR had uploaded draft of the income-tax law for public opinion on October 2021.

Later, a committee comprising stakeholders from businesses and tax experts was formed to review the draft and compile their recommendations.

He said the provisions of direct taxes would be proposed in the budget on June 1, 2023 for next FY accommodating provisions from new law in the income tax ordinance 1984.

In its pre-budget proposal, Snehasish Mahmud & Co said the new act would ensure international standards, foreign direct investment and reduction in discretionary powers of tax officers.

In fiscal measures in the upcoming budget, the NBR may impose 15-percent capital-gain tax on sales of shares of private companies.

The Registrar of Joint Stock and Companies (RJSC) would not execute share transfer of private companies unless due capital-gain tax is paid.

Currently, there is such provision for transfer of shares from non-residents to residents but no such provision for swaps from residents to residents.

A senior tax official has said the new area has been identified for upcoming fiscal to check corporate-tax evasion.

“Most of the private companies usually show face value of share at the time of transfer. To ensure proper tax collection, there would be mandatory provision for corporate taxpayers to get valuation of share done by certified professional accountants,” he said.

Provisions for imposition of Tk 2,000 as minimum tax on all TIN- holders, upward revision of tax-free limit, scrapping provision of off-shore tax amnesty, expansion of area on mandatory submission of tax returns might be proposed in the upcoming budget.

Currently, proof of submission of tax return is required for availing 38 types of services. The NBR may make it mandatory for obtaining house rents or lease for selected persons in city corporation area, opening and continuing bank accounts of any society, cooperative trusts, fund, foundation, non-government organization and microcredit organization, ‘deed writer’ for registration as stamp or court fee etc.

The government may halve VAT for consumers of sweetmeat to 7.5 per cent, waive advance tax (AT) on fuel to resolve complexities on refunding the tax, lift import duties on a number of products and so.

doulotakter11@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.