Published :

Updated :

The stock market witnessed yet another massive setback on Thursday, with the key index of the Dhaka Stock Exchange (DSE) plunging below the 'psychological' threshold of 5,000-mark again in six months despite regulatory efforts to elevate it.

The relentless bearish spell remained dominant during the ninth session in a row as investors saw no sign of hope that the market would rebound in near future.

Lingering macroeconomic challenges had already dissuaded investors from making fresh investments in stocks. But the latest financial disclosures showing less-than-expected quarterly earnings of some companies and gas price hikes further dampened the investor sentiment.

Jittery investors continued to dump their holdings to escape further losses in the absence of any positive trigger to revive the market.

"Due to the continuous market decline, many margin accounts came under forced sale, which exacerbated the index plunge," said Md Sajedul Islam, managing director of Shyamol Equity Management.

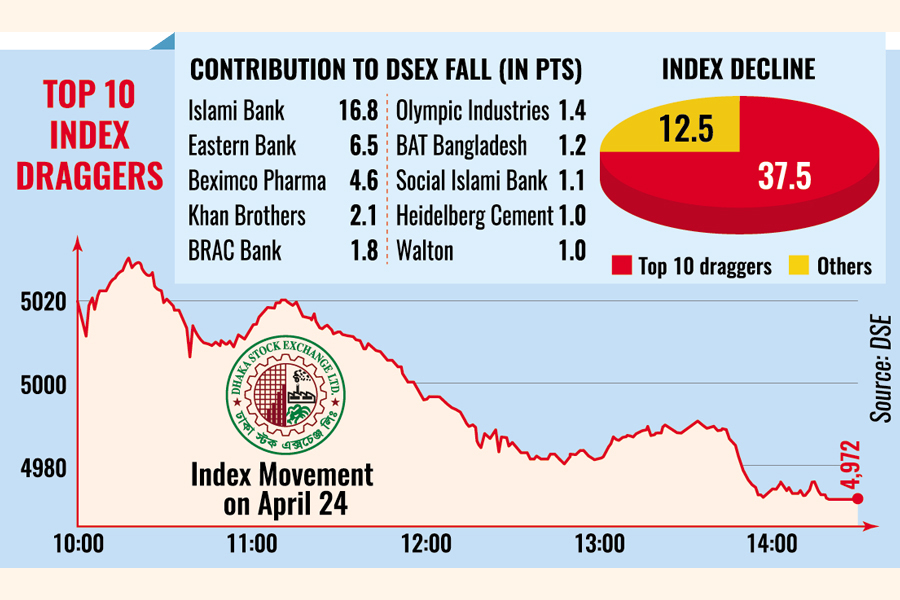

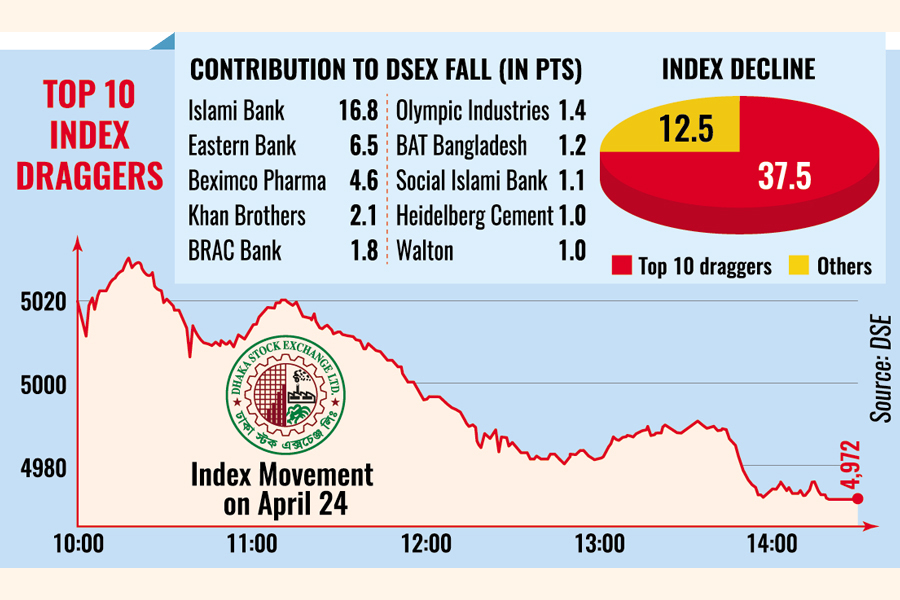

Right from the start of the trading session on Thursday, worried investors were selling off their holdings. Substantial price erosion of large-cap stocks finally dragged the benchmark index of the Dhaka bourse down almost 50 points or 1 per cent to 4,972, the lowest since October 28 last year.

In the wake of the market's erosion at an alarming rate throughout this week, the market watchdog held a meeting with top brokers on Tuesday to find out the reasons behind the plunge.

The prime index lost 233 points or 4.5 per cent in the past nine trading days and the market cap was reduced by Tk 82 billion during the time.

Market analysts attribute the grim situation of the market to factors including negative equity that has persisted since the 2010 market debacle and turned into a heavy burden on the equity market.

Before the 2010-11 stock market crash, lenders had disbursed margin loans aggressively boosting liquidity in the market. The outstanding negative equity against margin loans taken for investments in the equity market amounted to Tk 78.24 billion by October last year.

Brokers said margin loans had deepened financial distress and weakened intermediaries in the stock market and banks. There were spill-over impacts onto the whole market affecting even those who have not taken any margin loan.

"The long-pending negative equity has been hindering the market's growth for more than a decade," said Mr Islam, while issues are emerging one after another to heighten pessimism surrounding the market.

He insisted on strict regulations on margin loans to clients.

In the meantime, abrupt gas price hikes led to fresh concerns over the market outlook while higher returns from Treasury bonds are encouraging savers to move to the money market from the stock market, said Mr Islam.

Usually, the equity market tends to weaken when interest rates rise and funds get diverted to the money market.

Moreover, institutional investors have mostly been in a hands-off position amid a liquidity crunch while small investors are not confident enough to inject fresh funds into the market at present, Mr Islam added.

Islami Bank, Eastern Bank, Beximco Pharma, Khan Brothers, and BRAC Bank suffered huge losses and contributed largely to Thursday's market plunge. They jointly accounted for 32-point fall of the index.

The blue chip index DS30, a group of 30 prominent companies, also lost 23 points to 1845 while the DSES Index, which represents Shariah-based companies, shed 16 points to 1,104.

Turnover, a crucial indicator of the market, was Tk 3.67 billion on Thursday, up from Tk 3 billion the day before, amid a sell pressure.

More than 75 per cent shares saw price fall. Out of the 398 issues traded, 300 declined, 52 advanced, and 46 remained unchanged on the DSE trading floor.

The large-cap sectors posted negative performance. The non-bank financial institutions experienced the highest loss of 1.96 per cent, followed by banking, engineering, food, pharmaceuticals and telecom sectors.

Energypac Power was the day's top gainer, rising 9.26 per cent, while Khulna Printing was the worst loser, shedding 9.71 per cent.

Beach Hatchery dominated the turnover chart, with shares worth Tk 460 million changing hands, followed by Fine Foods, BRAC Bank, Shahjibazar Power, and Lovello Ice-cream.

The Chittagong Stock Exchange ended lower with its All Shares Price Index (CASPI) shedding 54 points to 13,957 and the Selective Categories Index (CSCX) losing 26 points to 8,525.

Meanwhile, a group of stock investors took to the streets on Wednesday in protest against the continuous market fall and demanded immediate resignation of Khondoker Rashed Maqsood, chairman of the Bangladesh Securities and Exchange Commission (BSEC), for his "failure" to bring back stability in the market.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.