Published :

Updated :

Forced mergers of commercial banks in Bangladesh sans thorough asset-quality assessment may be counterproductive and could erode investor confidence in the financial sector, the World Bank says in an exhaustive economic reassessment.

"….it will still require a thorough assessment of asset quality in weak banks to protect the good banks. Guidelines on mergers and acquisitions will need to be developed as part of a comprehensive strategy on bank resolution. Before setting out this framework, forced bank merger could diminish investor confidence in the financial sector," said Abdoulaye Seck, WB Country Director for Bangladesh, during the presentation Tuesday.

He was speaking at the launch of 'Bangladesh Development Update' report followed by 'South Asia Development Update: Jobs for Resilience' at its Dhaka office.

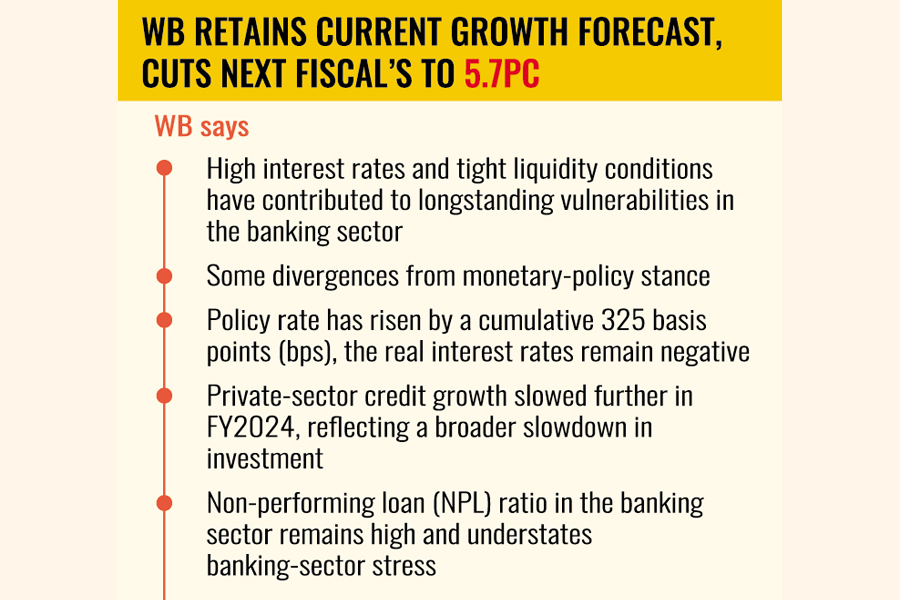

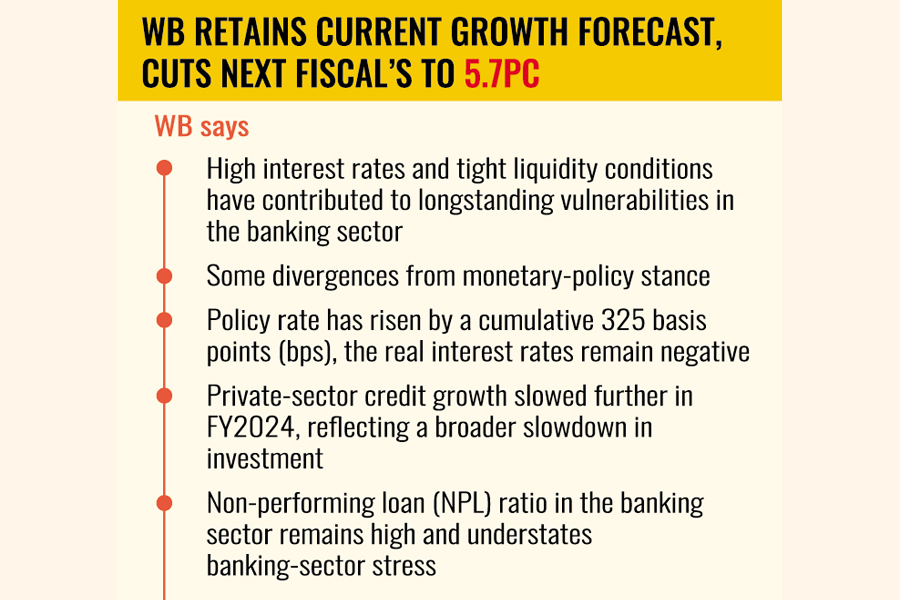

Mr Seck thinks high interest rates and tight liquidity conditions have contributed to longstanding vulnerabilities in the banking sector.

In its development-update report the World Bank has downsized the Bangladesh economic growth by 0.1 percentage point in its forecast for the next fiscal year (FY 2024-25) to 5.7 per cent from 5.8 per cent projected in October 2023.

The Washington-based multilateral financier, however, kept the current FY'24 gross domestic product (GDP) growth projection stable at 5.6 per cent. In its last Update in October 2023 it also projected the growth rate same for Bangladesh.

The WB in its development update notes some divergences from monetary-policy stance. Bangladesh Bank's monetary-policy transmission remains impaired by a variable cap on bank-lending rates, it says.

While the policy rate has risen by a cumulative 325 basis points (bps), the real interest rates remain negative.

The central bank continued to tighten monetary policy in FY2024, to slow inflation. It introduced an interest-targeting framework over the past year.

In its elaborate observations on the state of banking sector, the WB cautions that the private-sector credit growth slowed further in FY2024, reflecting a broader slowdown in investment.

The non-performing loan (NPL) ratio in the banking sector remains high and understates banking-sector stress due to lax definitions and reporting standards, forbearance measures, and weak regulatory enforcement, it has observed.

The global lender says monetary-policy transmission is hindered by the SMART lending-rate cap, which slows pass-through to lending rates due to the use of a moving average.

The use of treasury bills for the reference rate, rather than the policy rate, "further complicates pass-through".

"The real policy rate and deposit rates remain negative, while the weighted average lending rate is approaching the inflation rate."

It says the real interest rate on new lending at or near the SMART rate plus the maximum margin interest (currently 3.5 per cent above SMART) has turned positive.

The advance-to-deposit ratio (ADR) stood at 80.4 per cent at the end of 2023, significantly below the regulatory limit of 87 percent set for conventional banks.

Regarding the recent bank-merger initiative of the BB, the World Bank says the guidelines on mergers and acquisitions will need to be developed based on international best practices and provide alternative merger mechanisms for banks to choose from depending on the status of the banks/non-bank financial institutions deciding to merge.

It suggests that bank mergers should require an evaluation of internal systems, branch networks, staffing levels, adequacy of management arrangements, impacts on banks' cross-border business and international risk ratings.

Given the high prevalence of NPLs and undercapitalized banks, additional tools will likely be required to address vulnerabilities, including strengthening corporate governance, and introducing stronger financial-safety nets such as modern least-cost-resolution tools for insolvent banks, and stronger deposit insurance.

On the foreign-exchange reserves, the WB says the crawling-peg mechanism of the central bank would need to be a market-clearing exchange-rate mechanism that reduces the gap between the formal and informal exchange rates.

"This (market-clearing exchange-rate mechanism) would help rebuild external buffers by attracting remittances through formal channels, making informal channels less attractive, and reducing the financial-account deficit by expanding trade credit and other forms of external financing."

The Bank thinks the reform would also help ensure sufficient foreign-exchange liquidity, essential for fulfilling debt service and other external-payment commitments.

Implementing a sustainable exchange-rate policy is the key to stemming the significant depletion of foreign-exchange reserves and restoring market confidence.

Further delving into the situation of banking sector, the WB noticed that the gross NPL ratio stood higher at 9.0 per cent in December 2023 in a climb from 8.2 per cent a year before.

"The actual magnitude of the NPL problem is likely to be significantly higher due to the legacy of regulatory forbearance. Capital adequacy of the banking system stood at just 11.1 per cent in September 2023, with at least a dozen banks severely undercapitalized for years despite capital injections."

"Inadequate bank capital is a significant factor constraining private credit and investment," the development financier observes in its assessment report.

Continued regulatory forbearance and weak credit-risk assessment systems hamper the productive allocation of credits, thereby risking further deterioration in bank asset quality.

And impaired bank balance sheets also prevent effective transmission of monetary policy as the incentives for weak banks to conduct intermediation in response to market signals remain limited.

Implementation of the PCA framework and modern resolution and crisis-management frameworks to identify the magnitude of the NPL problem and expedite its resolution are needed to reduce risks of financial instability and strengthen monetary-policy transmission, the WB suggests in a gamut of dos for straightening banking and financial sector of Bangladesh.

The update cautions that delays in exchange-rate reforms can result in continued depletion of international reserves to critically low levels.

"Failure to make timely adjustments could result in the persistence of arbitrage opportunities and reduced foreign currency inflows through official channels, thereby perpetuating import restrictions and input shortages."

Inadequate supply of natural gas during the peak season and inability to import sufficient LNG due to foreign-exchange shortages can disrupt industrial production and investment.

In the near-term outlook, risks and priorities, the WB says the Bangladesh economy is expected to remain stressed with higher inflationary pressure, poor asset quality and weak capital base of the banking system.

The fiscal deficit will remain moderate, but fiscal space to undertake productive expenditures will increase only gradually, the WB forecasts.

It suggests a set of structural reforms including creation of an efficient resolution framework for reducing NPLs, and bolstering domestic revenue generation.

In its assessment update on the region, the WB has made upward economic-growth forecast for South Asia by 0.4 percentage points to 6.0 per cent in the current FY2024.

The next FY2025 has also been shaped in better picture with a 6.1-percent GDP growth for the SA region.

"The growth forecast has been upgraded as the Indian economy will be doing well," says the WB update about the growth hiker at regional level.

When his attention was drawn to a recent statement by Finance Minister Abul Hassan Mahmud Ali on Bangladesh's better economic positioning, the WB country chief, Mr Seck, said: "It is your choice as to whether you will express a half glass of water as ' half is empty or half is full'".

The finance minister at a pre-budget discussion with a delegation of the Economic Reporters Forum (ERF) said concern about the country's economic condition "is now all over".

kabirhumayan10@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.