Published :

Updated :

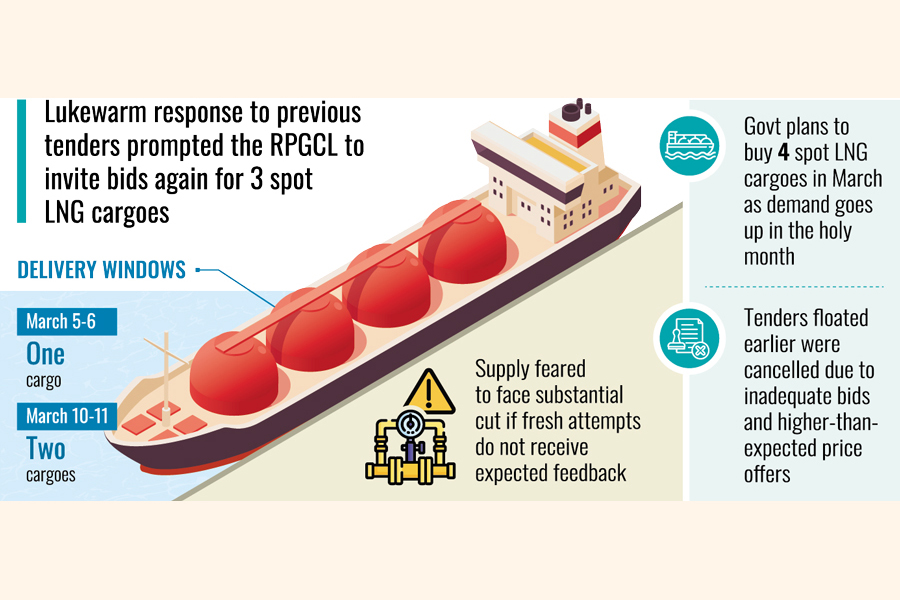

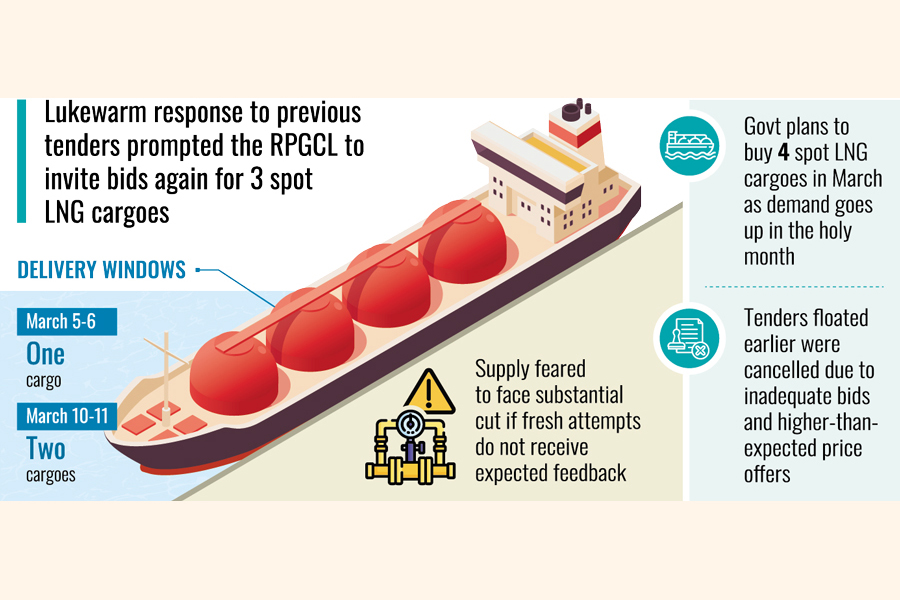

State-run Rupantarita Prakritik Gas Company Ltd (RPGCL) has floated tenders again to purchase three spot liquefied natural gas (LNG) cargoes for March 05-06 and March 10-11 delivery windows.

The RPGCL's previous tenders, which were re-issued ones and closed on February 16, could not attract suppliers.

Only one bidder took part in the bids and the price quoted was also higher, said an official, explaining the need for the re-tenders.

Bangladesh might have to face an acute gas crisis during the coming Ramadan if its latest attempts also fail, he feared.

State-run Petrobangla intends to buy one spot LNG cargo for March 05-06 delivery window and two spot LNG cargoes for March 10-11 delivery windows, a senior RPGCL official said.

The RPGCL initially had floated these tenders separately over the past couple of weeks and cancelled those as it got an inadequate number of bidders for one tender and received higher than expected prices, more than US$15.5 per million British thermal units, for the remaining, the official said, without elaborating.

The government has a plan to buy a total of four spot LNG cargoes for March delivery windows to meet the energy demand especially during the month of Ramadan beginning in early March.

Energy demand will go up during the Ramadan and the subsequent months afterwards to meet growing demand for irrigation and summer.

The volume of each of the spot LNG cargoes will be around 3.36 million MMBtu.

Bangladesh previously awarded its latest spot LNG cargo tender to Vitol Asia Pte Ltd for February 13-14 delivery window at US$13.82 per MMBTu, the RPGCL official said.

Apart from spot LNG cargoes, Bangladesh has been importing LNG from its two existing long term LNG suppliers - Qatargas and OQ Trading International for regasification in its two operational FSRUs.

Officials said Bangladesh has planned to import an increased volume of LNG from the spot market as part of its previous plan to ramp up LNG imports to feed mounting demands from industries, power plants and other gas-guzzling consumers as domestic natural gas output is on the wane.

A senior Petrobangla official said state-run Petrobangla has planned to import a total of 115 LNG cargoes -- 59 from spot market and 56 from long-term suppliers, which marks a 33.72 per cent increase compared to that of the previous year.

Last year, the country imported a total of 86 LNG cargoes -- 56 from long-term suppliers and 30 from the spot market, the official added.

The country has been importing the same number of LNG cargoes -56 - from its two existing long-term LNG suppliers-Qatargas and OQ Trading International-over the past three years when the LNG demand across the world grew after initiation of Russia-Ukraine war, said the RPGCL official.

Of the total long-term LNG cargoes for 2025 -- Qatargas will supply 40 LNG cargoes and OQ Trading will supply 16 LNG cargoes. The regular size of an LNG cargo is 138,000 cubic metres.

Considering the current market price, Bangladesh has to pay US$45-50 million to import one spot LNG cargo from the international market.

Country's overall natural gas output is currently hovering around 2,653 mmcfd, of which around 753 mmcfd is re-gasified LNG, according to official Petrobangla's data as of February 18, 2025.

Azizjst@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.