Government debt at last fiscal end ballooned

Banks draw heavily on treasuries as govt borrowed for deficit financing

Published :

Updated :

Commercial banks' borrowing from the central bank made a significant rise by the end of June last with the outstanding figure having soared by Tk 370 billion in just three months from March-end period, banking on government need for deficit financing.

Officials and bankers have said the government domestic bank borrowing normally goes up at the last quarter of a financial year to finance the budgetary deficit, in a policy switch from printing money.

Against the investment in government securities - treasury bills and treasury bonds-the banks can avail liquidity supports from Bangladesh Bank (BB), the country's central bank. And huge difference of rates in favour of cash supports prompted the banks to invest more in securities and get more low-cost funds from the BB, according to them.

Simultaneously, some of the crisis-ridden banks having not enough receipts of security instruments took a good volume of LR (lender of last resort) supports from the banking regulator and these two factors contributed to the remarkable rise in bank borrowing from the BB, they said.

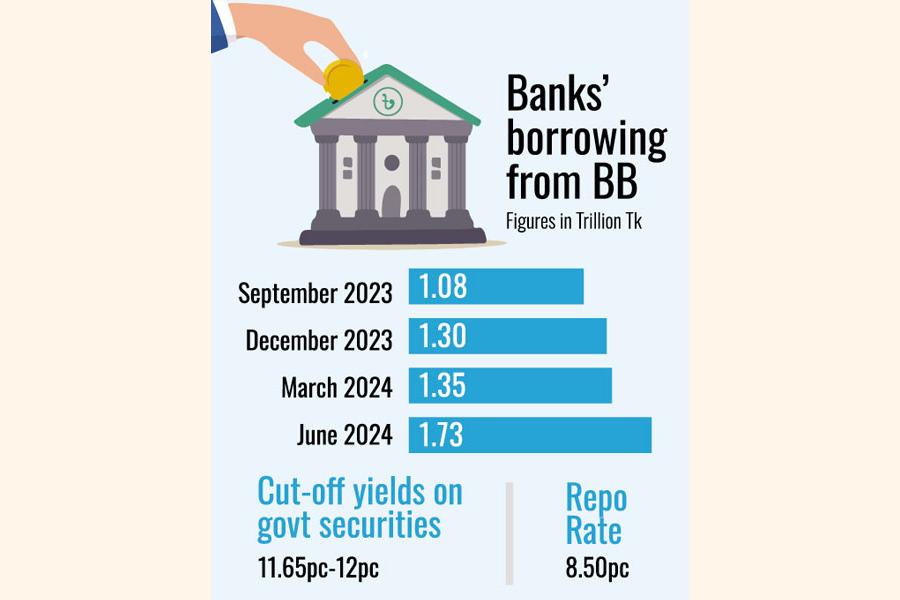

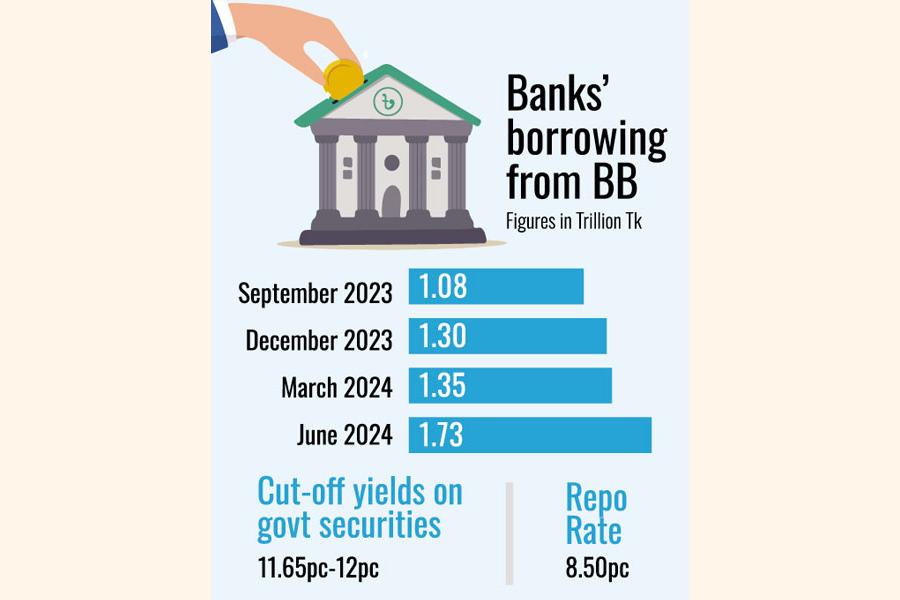

According to BB statistics, the outstanding figure of borrowing from the central bank stood at Tk 1.73 trillion by June 2024, which was Tk 1.35 trillion until March 2024.

In the previous two quarters, the stock of commercial banks' debt from the BB was Tk 1.30 trillion and Tk 1.08 trillion in October-December and July-September periods last year respectively.

The figure was only Tk 1.05 trillion in previous year's June-end period, the official data showed.

Seeking anonymity, a BB official said the government borrowed a significant volume of money from the banking system through issuing treasury bills and bonds in the last April-June period, which was the last quarter of FY'24, to complete its ADP or annual development programme.

Against such investments, the central banker said, the banks can get liquidity supports from the BB at Repo Rate to avert post-securities-investment cash crunch.

And the banks took the opportunity and borrowed largely from the BB. On the other hand, some of the liquidity-starved banks also borrowed from the regulator using the option of LR. "These factors are the major reasons behind such boom in the borrowing scenario from the BB," the BB official said.

Managing director and chief executive officer of Mutual Trust Bank (MTB) Syed Mahbubur Rahman says the cut-off yields on government securities, treasury bills in particular, were hovering in-between 11.65 per cent and 12 per cent.

And the banks used to get cash supports from the BB at Repo Rate which is 8.50 per cent against such investment. So, there is a gain of more than three percentage points.

"And the banks use this option as many as they can. This is probably the main reason behind the rise in borrowings from the central bank," the experienced banker says.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.