Published :

Updated :

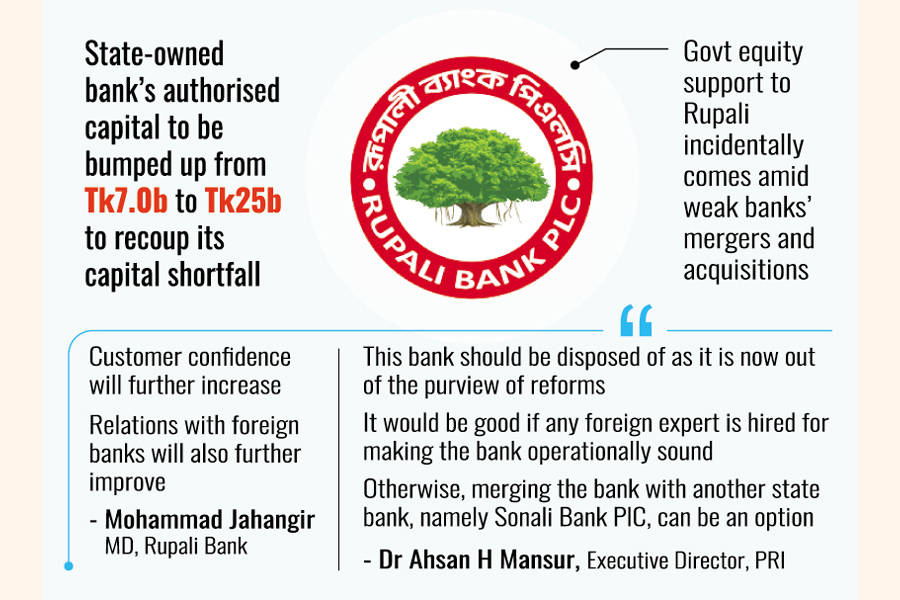

Capital-deficient state-owned Rupali Bank's authorised capital is being bumped up from Tk 7.0 billion to Tk 25 billion to bolster its financial base and enhance clientele confidence, sources said.

The commercial bank, Rupali Bank PLC, had a capital shortfall of Tk 22.73 billion as of December2023, according to Bangladesh Bank data.

Now the bank will be able to raise its paid-up capital To Tk 25 billion through issuance of bonus and rights shares, the sources said about the government equity support which, incidentally, comes in the wake weak banks' mergers and acquisitions under financial-sector reforms.

Currently, the paid-up capital of the bank is as low as Tk 4.64 billion. Its authorised capital is now Tk 7.0 billion, a senior executive officer of the bank said.

The bank earlier had sought approval from the Financial Institutions Division (FID) in this regard long before. The FID under finance ministry on March 20 last approved the bank proposal.

The government has approved the decision to increase the authorised capital of Rupali Bank PLC from Tk 7.0 billion to Tk 25 billion for the issuance of ordinary shares against government equity, an officer concerned of the bank said.

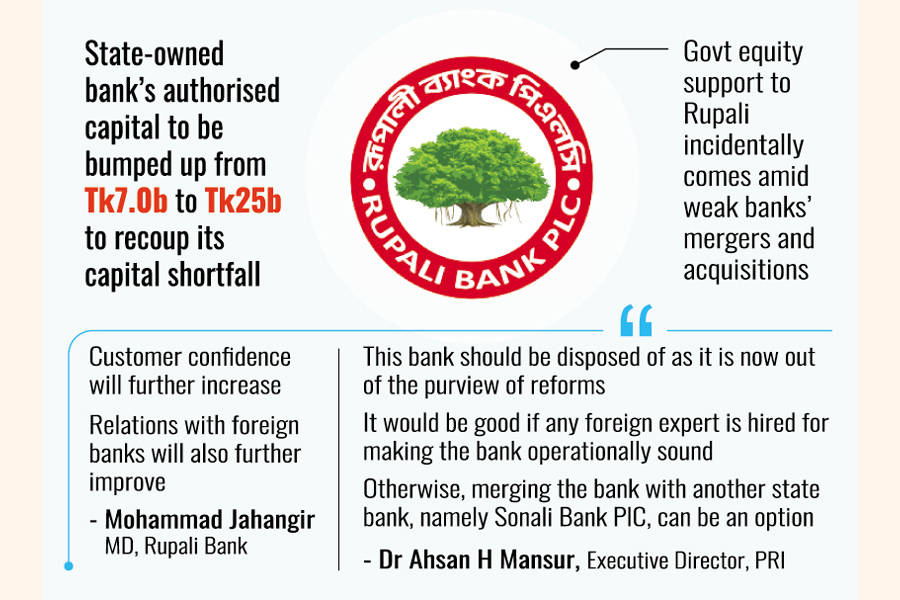

Contacted over the developments, Rupali Bank Managing Director and CEO Mohammad Jahangir said, "The government has recently given approval for raising authorized capital. We will be able to increase the capital base to Tk 25 billion by turns. It was our longstanding demand."

He thinks a good prospect has been created by the approval for raising capital base. "Customer confidence in the bank will further increase. Besides, relations with foreign banks will also further improve."

The increase in the bank's authorised capital from the existing 7.0 billion to 25 billion has been approved to facilitate the issuance of ordinary shares against government equity, according to the order that a noted economist appears critical of.

Earlier, many foreign banks were reluctant to do business with the weakened Rupali PLC because of lower capital level.

The bank is listed on the country's two bourses. Presently, 90.19-percent shares of the bank are owned by government while the rest 9.81 per cent by institutions and the public.

"The bank is the only state-owned bank listed on both the bourses," the official mentioned.

Two years ago, the bank had proposed that the government permit it to issue rights shares to increase its paid-up capital. Once again, it sought approval in this regard, according to the bank's document.

The volume of its default loans was Tk 76.01 billion at the end of December 2023. There are 586 branches of the bank across the country.

Policy Research Institute of Bangladesh (PRI) Executive Director Dr Ahsan H. Mansur says this bank "should be disposed of as it is now out of the purview" of reforms.

"It would be good for the state run bank if any foreign expert is hired for making the bank operationally sound," he adds.

Otherwise, he suggests, merging the bank with another state bank, namely Sonali Bank PlC, can be an option.

"We support injection of capital, but in the context of major fundamental reform that it did not comply earlier…," he says.

Dr Mansur, who had earlier served the IMF, says the state-run bank is being operated "by intervention of the government and influential quarters" and they will take loans from the banks and many of them do not repay the same.

Rupali Bank got listed on the stock market in 1986. Its stock price closed at Tk 31.70 on Thursday, after gaining 3.59 per cent over the day before.

The bank's consolidated net profit had made a quantum jump by 364 per cent year on year to Tk 432 million in nine months through September 2023, up from Tk 93 million in the same period of the previous year.

Recently, the lone publicly traded bank raised Tk 1.20 billion through issuing a bond to reduce its capital shortfall.

The bank will use this fund to strengthen the Tier-2 capital base under Basel-III requirement.

rezamumu@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.