Third review of $4.7b IMF loan package next month

Govt plans to pay off power dues amid Fund push

Published :

Updated :

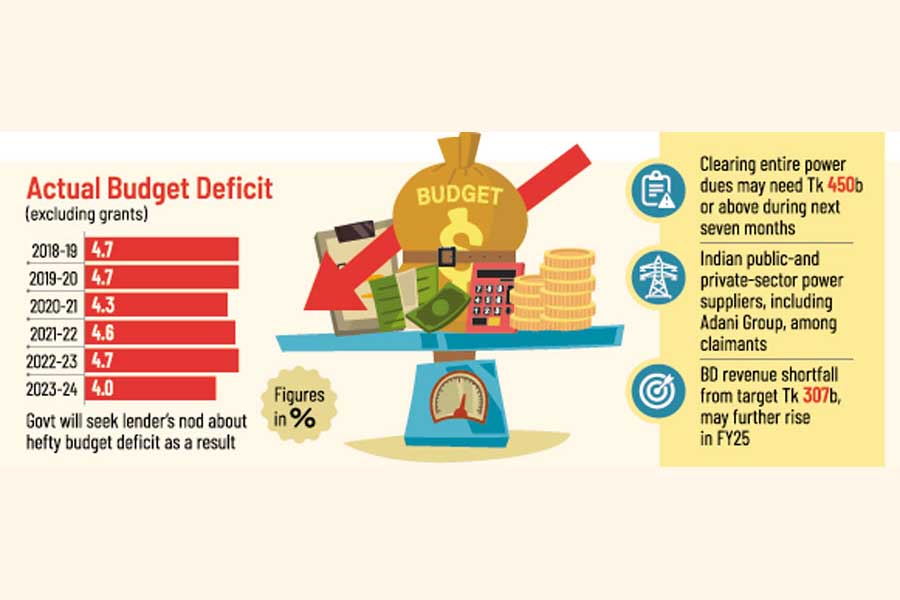

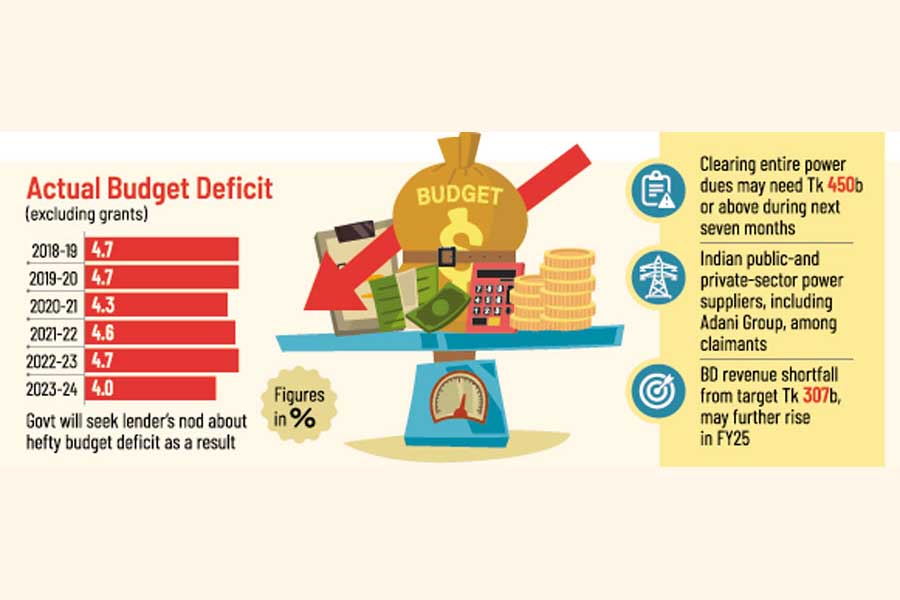

A risk of higher budget deficit looms as the government is set to commit to paying off all the accumulated power-sector dues by this fiscal yearend during a third review of the current IMF loan package next month.

Officials say that, in the context of huge payoff of power dues, the current interim government will seek consent from the lender about possible rise in budget deficit.

Clearing up the entire power-sector dues may need a hopping chunk of Tk 450 billion or more during the next seven months.

The debts have ballooned for payment backlog to independent power producers (IPPs), gas companies, public-sector power plants, and Indian public-and private-sector power suppliers including Adani Group.

Such splurge of money will push up the actual budge deficit significantly at the end of this fiscal year, officials believe, breaking the usual trend.

A senior finance official has told the FE that the government always tries to keep the budget deficit within 5.0 per cent of the gross domestic production (GDP).

In the fiscal year 2023-24, the actual budget shortfall stood at 4.0 per cent. Following payment of a large sum in power-sector arrears may ramp it up to nearly 5.0 per cent of GDP in the current fiscal year.

The official said revenue earnings could face a significant shortfall this fiscal year as fallout from the political turmoil surrounding recent changeover. In four months, until October, the revenue-generation shortfall over the target reached Tk 307 billion, which mayfurther rise in the coming months due to the import duty and tax cuts on various essential items.

Moreover, he predicts, the public-sector expenditure may not decrease this fiscal year rather may increase for various reasons following the regime change.

"The gap between income and expenditure, including the payment of the power-sector arrears, may raise actual budget deficit significantly," said the official Thursday, seeking anonymity.

Another finance-division official has said the government may make the payment of arrears both in cash and also by issuing bonds.

He mentions that the IMF has been pushing for lessening the power-sector dues under the conditions of its $4.7-billion lending programme. The issue was prominently discussed during the finance adviser and the central-bank governor's Washington visit last month.

A team of the IMF will visit Dhaka on December 3-17 reviewing the progresses Bangladesh had made under the lending package until June last before releasing fourth tranche of the loan.

"We will make a commitment to clearing power-sector arrears during the IMF team's visit. At the same time, we will request them to accept the higher budget deficit," he says about a sort of trade-off.

According to an official of the Bangladesh Power Development Board (BPDB) step is underway to issue bonds worth Tk 50 billion as soon as possible. Last month, the BPDB sought finance ministry's approval in this regard.

Each month, some Tk 35 billion to Tk 40 billion is added up as new power dues. Indian power producer Adani Group last month halved electricity supply to Bangladesh in a huff over failure in paying huge arrears stemming from its cross-border electricity export.

In the last fiscal year, the government issued some Tk 200 billion worth of bonds to pay power-and fertiliser-sector arrears.

syful-islam@outlook.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.