Published :

Updated :

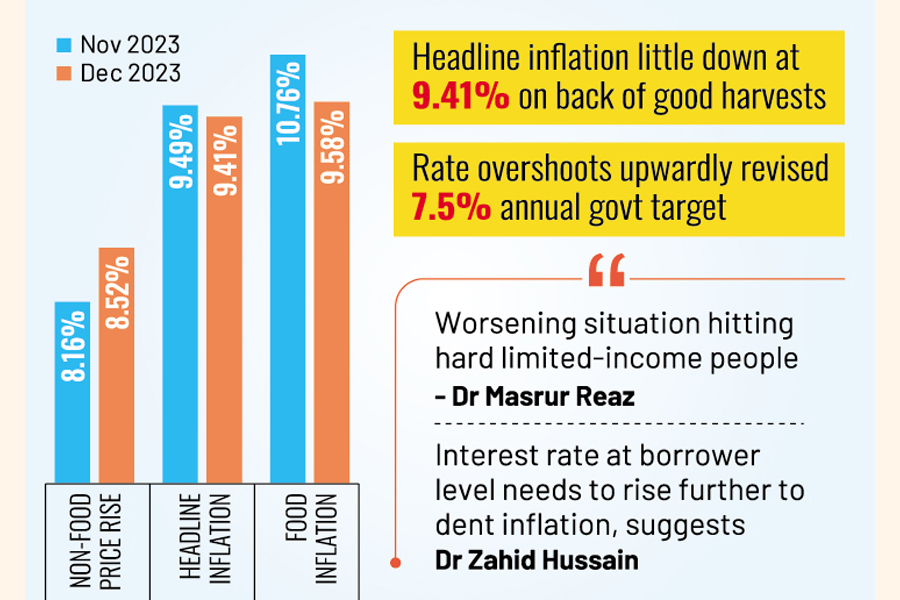

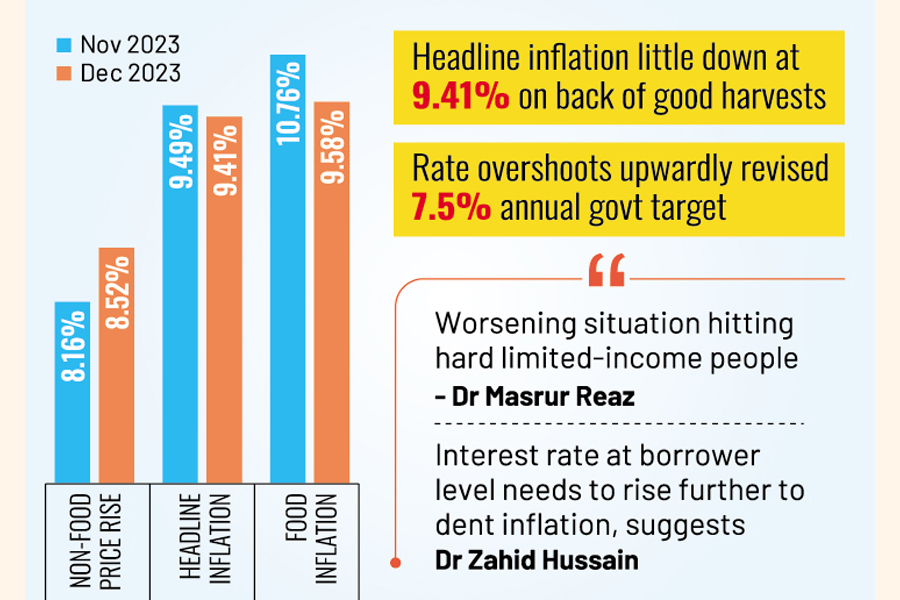

Overall headline inflation showed a modest slowing in December 2023, according to official data.

But the core inflation fired up at the yearend and economists forecast further upturn in months ahead as western economies feel growing heat of price rises.

As per latest data Bangladesh's national statistical organisation or BBS published Sunday, the overall rate of headline inflation stood at 9.41 per cent in December in a slight 0.08-percentage-point decline from November by official count.

The December overall inflation, however, saw acceleration when compared with 12-month average (Jan-Dec) the BBS shows at 9.48 in December. It was 9.42 per cent in November.

The core price indices, which consider a large basket of non-food items, climbed to 8.52 per cent in December 2023. It was 8.16 per cent in November 2023 on a descent.

The food inflation declined to 9.58 per cent in December from 10.76 per cent in November, according to the BBS data.

The government recently revised upward yearly inflation to 7.5 per cent amidst repercussions of the persisting higher inflation in the economy. It earlier had targeted 6.0 for fiscal year 2024.

Core inflation is often viewed as a better predictor of inflation's future path than the overall numbers, according to some economists.

"The progress on inflation over last one and more than a year has been worsening, hitting hard the limited-income-bracket people," says Dr Masrur Reaz, chairman and CEO of Policy Exchange of Bangladesh.

Core prices rose in December as people paid more for transportation, health and communications and clothing, he mentions the main inflation hikers.

Dr Zahid Hussain, an independent economist of Bangladesh, says the decline in headline inflation came entirely from a decline in food inflation at the time of count.

"This is largely attributable to good agricultural harvests."

He points out that increased nonfood inflation shows underlying inflationary pressures have not eased.

"Too little too late monetary tightening cannot realistically be expected to make a visible contribution to inflation reduction," observes Dr Hussain, who had once worked with the World Bank as chief economist at Dhaka office.

He feels that interest rates at the borrower level need to rise further and stay there for a while to make a dent in inflation.

"Import controls need to be eased to improve supply, but this cannot be done without easing the dollar crunch."

In the meantime, the central bank of Bangladesh is set to unveil its half-yearly monetary policy on January 17 which may tighten the money supply further as part of containing the inflationary pressure on the economy.

"Our major target is to contain inflation," says one central banker.

But the inflation in EU is rising again as the inflation in December rose to 2.9 per cent against 2.4 per cent in November. The US inflation also edged up.

The consumer price index rose 3.4 per cent last month relative to a year earlier, the U.S. Department of Labor reported. That's a larger increase than the 3.1 per cent in November and 3.2 per cent in October.

The retail headline inflation in India in December also rose 5.7 per cent in a four-month high. So, the economists believe, the inflation readings in the months to come could be much bigger.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.