M KABIR HASSAN AND JOSÉ ANTONIO PÉREZ AMUEDO

Published :

Updated :

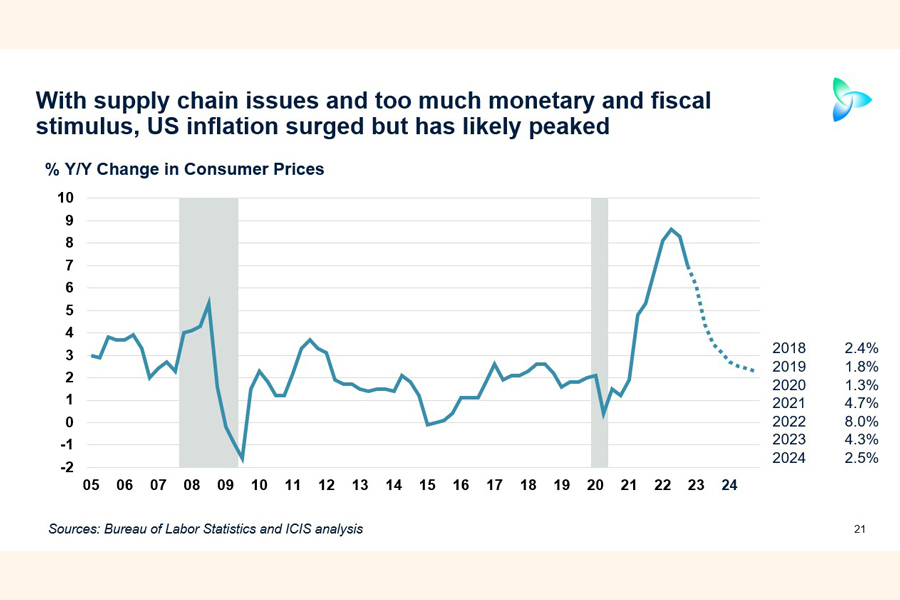

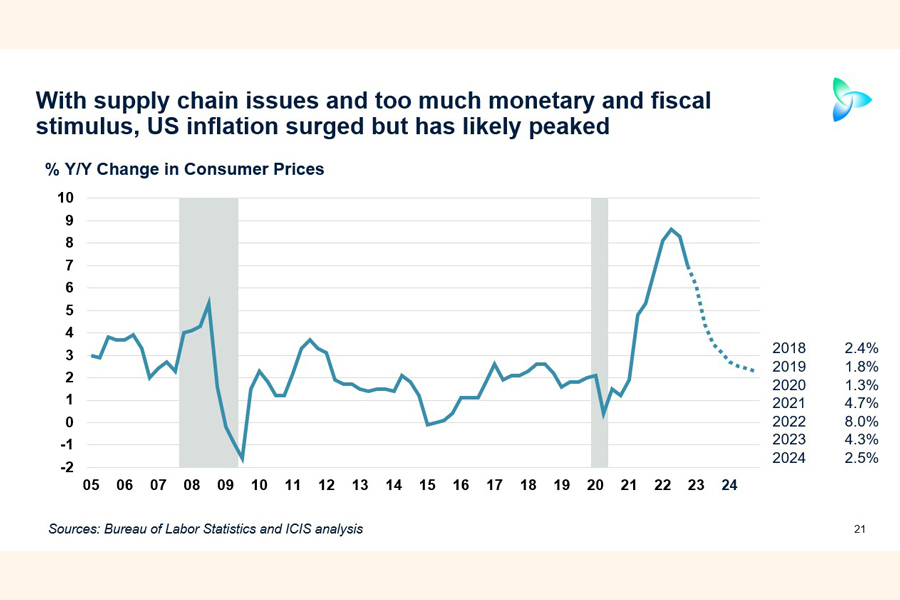

The topics of inflation and interest rates have dominated recent discussions within the world of finance and economics. In the past two years, we have witnessed a significant surge in the prices of everyday goods, while wage increases have failed to keep up with the pace of inflation. This has resulted in a decline in people’s purchasing power. In response, the Federal Reserve and other central banks have decided to increase interest rates to mitigate the effects of inflation and stabilise the economy.

In the field of macroeconomics, the correlation between inflation and interest rates is a crucial aspect that significantly impacts the economy. Inflation pertains to the general rise in the costs of goods and services over a certain period, while interest rates refer to the expense of borrowing money or the yield on lending it. When inflation is high, it causes purchasing power of money to decrease as prices escalate faster than people’s income and savings. To address this concern, central banks may opt to increase interest rates, resulting in higher borrowing costs that eventually curb spending and contribute to reducing inflation. Conversely, in times of low inflation, central banks may choose to decrease interest rates to incentivise borrowing and stimulate economic growth. This approach encourages individuals to obtain loans for investing in businesses, acquiring homes, or making other purchases that boost economic activity. Hence, inflation and interest rates serve as significant tools that central banks utilise to maintain price stability and promote economic growth.

The surge in inflation witnessed today can be attributed to the outbreak of the COVID-19 pandemic in 2020. Governments worldwide implemented stringent lockdown measures, causing the closure of numerous businesses and loss of jobs for millions of individuals. To address this issue, the US government distributed over $800 billion in stimulus payments. The Federal Reserve also reduced the federal funds rate by 1.5 per cent in March 2020 to boost spending and reduce borrowing expenses. These actions injected more money into the economy, but the pandemic restrictions meant that many services were unavailable, causing a surplus funds that people couldn’t spend. As a result, by the beginning of 2022, many individuals had extra cash, and some even chose not to work.

The COVID-19 pandemic had also a profound impact on the complex and multifaceted global supply chains, highlighting the dangers of intricate production processes and disrupting the smooth flow of goods and services worldwide. In modern times, the production process has become more intricate and fragmented, with many goods manufactured through complex supply chains that span across several countries. The pandemic led to significant disruptions in the supply chain, causing unexpected delays for both businesses and consumers. The worldwide lockdowns implemented to curb the virus’s spread had adverse effects on supply chains, leading to bottlenecks, delivery delays, worker shortages, and other issues. Additionally, people’s buying habits changed during the pandemic, with more individuals purchasing durable goods as they spent more time at home. However, the production of these goods was slow to adapt to, leading to a disparity between supply and demand, aggravating inflationary pressures.

Another significant contributor to inflation is the invasion of Ukraine by Russia on February 24, 2022, which had far-reaching implications for the global economy. As the 11th largest economy and a substantial producer of commodities such as gas, oil, industrial metals, wheat, and potash, Russia’s actions resulted in a huge surge in gas prices, which is a critical determinant of inflation. With globalisation, goods are now transported across borders, and many companies opt to manufacture their products in countries with low labour costs like China, India, and Vietnam. However, the increase in gas prices has led to a rise in transportation costs, forcing companies to increase prices to maintain their profit margins, further aggravating inflation.

On March 16, 2022, the Federal Reserve responded to the rising inflation by taking a decisive step of increasing interest rates by 0.25 per cent. With the goal of preventing a recession while also controlling inflation, the Fed aimed for a gentle landing, as Chair Jerome Powell repeatedly emphasised in several meetings. Initially, the Fed was not overly concerned about inflation, citing it as temporary. However, as inflation persisted at high levels and businesses faced difficulties in finding labour, the Fed had no option but to take more aggressive measures by raising interest rates. This trend of rate increases persisted throughout 2022 and into 2023, with rates climbing up to 5 per cent. The future course of action by the Fed remains unclear at this juncture.

Despite the Federal Reserve’s decision to raise interest rates to combat inflation, it appears that the rate hikes have had little effect. The surge in consumer demand, fueled by government relief savings and increased wages, combined with supply chain disruptions caused by the pandemic, has been the main driver of inflation. Additionally, the shift in spending from goods to services has led to rising prices in the service sectors. While the Fed’s intention was to curb inflation by making borrowing more expensive, this approach comes with the risk of a sharp economic slowdown. Many economists believe that a recession is likely in 2023, as indicated by a survey of 70 per cent of US macroeconomic experts conducted in June 2022. Some experts argue that raising interest rates may not be the most effective solution to address supply shortages, such as those in gasoline or housing, and may lead to unnecessary pressure on the economy.

As concerns mounted about the uncontrollable inflation, there was also growing apprehension that the country might be heading towards stagflation— a situation characterised by high inflation, weak growth, and unemployment. In a recent report by the World Bank, President David Malpass highlighted that subdued growth is likely to continue throughout the decade due to weak global investment. He also warned that if inflation remains high and supply growth slows, the situation could continue for longer than anticipated. Nonetheless, the current situation in the US differs from that of the 1970s, with the financial markets signaling that inflation is temporary. Additionally, the former Federal Reserve Chairman, Ben Bernanke, is of the opinion that the Fed’s greater independence and understanding of inflation make it unlikely for the US to experience a recurrence of the Great Inflation.

The state of the US economy has left economists with divergent opinions, creating uncertainty about what the future may hold. The latest figures indicate a flourishing economy, characterised by robust employment rates, higher wages, and reduced economic disparities among different groups. While the inflation rate as a persistent concern seems to be decelerating, some economists are uneasy about a probable recession that may be triggered by the Federal Reserve’s efforts to manage inflation. In addition, the impact of Silicon Valley Bank’s failure on the economy is unknown, contributing to the current uncertainty.

As interest rates continue to rise, consumers are starting to feel the impact, and there are varying opinions on the Federal Reserve’s approach. While some economists argue that the Fed should persist in increasing rates until inflation subsides, others worry that this strategy, coupled with a possible shortage in bank lending, could result in job losses and an economic downturn. Given that policymakers must make decisions based on incomplete information, achieving a balance between controlling inflation and maintaining employment is a challenging task.

The US job market has made a remarkable comeback, but there is a concern that the Federal Reserve’s attempt to curb inflation could jeopardise the progress. The job market has bounced back to its pre-pandemic level, with all the jobs that were lost added back, giving workers an uncommon bargaining power and helping marginalised groups. However, not taking enough measures to control inflation could lead to higher rates, which in turn may prompt more aggressive actions and a deeper recession. Currently, the debate is not over whether inflation and unemployment are good or bad, but rather whether to prioritise current unemployment or the possibility of even higher unemployment later. Recent data suggest a slowdown in the labour market, but the balance between increased supply and reduced demand may be achieved without significant job cuts.

As inflation rates begin to decrease, the Federal Reserve appears to be effectively using interest rates as a tool to control the economy. However, their job is far from over. Precise timing is crucial as the Fed determines when to halt the interest rate hikes and start lowering them again. A key factor in this decision will be how the job market reacts in relation to inflation. While unemployment may continue to rise, inflation is likely to keep decreasing. But if unemployment rises, while inflation remains high, the consequences could be dire, potentially leading to a recession. The recent collapse of important banks such as Silicon Valley Bank has only added to the uncertainty of the future. The possibility of a domino effect reminiscent of the 2008 recession looms. As the ball remains in the Fed’s court, only time will tell what lies ahead for the economy.

M Kabir Hassan is a Professor of Finance at the University of New Orleans, USA. KabirHassan63@gmail.com

José Antonio Pérez Amuedo is a Ph.D. doctoral Student at the University of New Orleans, USA

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.