Published :

Updated :

A much-cherished rise in Bangladesh's tax-GDP ratio gets a mild push as the annual submission of income-tax returns by individual taxpayers increased 17 per cent to 3.5 million till an extended timeline.

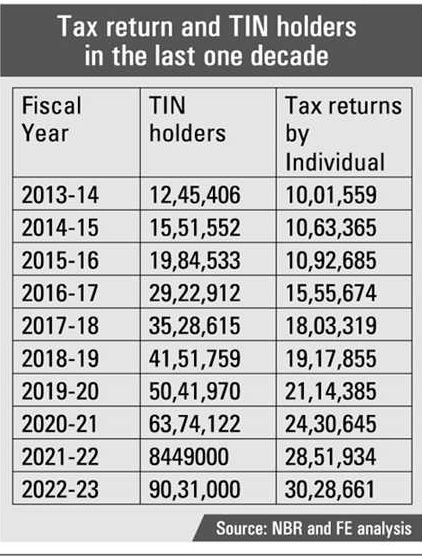

Official statistics show the government's tax collection from individuals and their return submissions yet account for one-third of the total registered taxpayers.

As the return-submission deadline expired on January 31, 2024, the National Board of Revenue (NBR) had received taxes worth Tk 57.99 billion from the 3.5 million filings.

In the last financial year, the revenue board had received 30,28,661 tax returns with Tk 48.98 billion taxes until January 31, 2023.

Currently, there are some 9.8 million taxpayer-identification numbers (TIN) or registered taxpayers under the NBR, which is also seen far below par in proportion to the size of the country's economy.

Member (income tax policy) of the revenue board AKM Badiul Alam says the number of tax-return submissions would increase further, hopefully above 4.0 million, by June 30, 2024 as its still open for the new taxpayers submitting their returns for the first time.

As per new income-tax law, new taxpayers are allowed to submit tax returns until the last day of the current FY without having to pay the penalty.

The income-tax wing of the NBR has formed two taskforces to intensify enforcement and verify compliance with the mandatory submission of Proof of Submission of Tax Returns (PSR), he adds.

"Our expansion plan would pay off soon to mobilize more revenue and increase the number of tax returns," he says.

He feels there are no alternatives to enforcement and abiding by the tax laws strictly by withdrawing benefits or services where PSR is mandatory.

In the new Income Tax Law 2023, the NBR has widened the area to increase its tax base by adding up many sectors under mandatory tax-return submission.

With the individual taxpayers, different approved funds, including provident fund, of the government are required to follow the deadline till January 31, 2024.

Snehasish Barua, Partner at Snehasish Mahmud & Co, in his Linkdin post wrote the reduced tax rate at 15 per cent may not be applicable to those who fail to submit tax returns within the timeline.

The NBR has reduced tax rate for provident fund, gratuity fund and other funds managed by private sector to 15 per cent which was as high as 27.5 to 30 per cent in the new Income tax law.

"….tax will be payable at 27.5 or 30 per cent if tax return is filed after January 31, 2024 along with 4.0- percent interest on gross payable," he wrote. A senior tax official has said similar penalty would be imposed on individual taxpayers who missed the deadline as there is no scope to submit time petitions seeking additional time from the taxmen this year.

"Even, taxpayers who missed the deadline last FY, too, would have to pay manifold higher taxes as their exempted incomes, tax rebates and other tax incentives would be withdrawn," he adds.

Considering the stern action on failing deadline, the NBR extended the deadline for tax-return submission by two months until January 31, 2024 to facilitate taxpayers, he mentions. Officials have said the gap between the number of TIN-holders and taxpayers would be minimized soon as taxmen geared up their effort to verify PSR.

As of now, Bangladesh has a tax-GDP ratio of 8.0 per cent, ranking the second-lowest in South Asia and lagging behind most lower-middle-income countries. The International Monetary Fund (IMF) in its lending package has set targets for the country to raise the ratio by 8.3% by the end of FY24 and 9.5 per cent by the end of FY26.

doulotakter11@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.