Natural disasters cause colossal farming losses

Subsidised crop insurance seen as an effective tool to help affected farmers

Published :

Updated :

A lack of insurance protection costs Bangladesh farmers hundreds of millions of dollars in colossal crop losses perennially in onslaughts of climate-related calamities, according to independent findings.

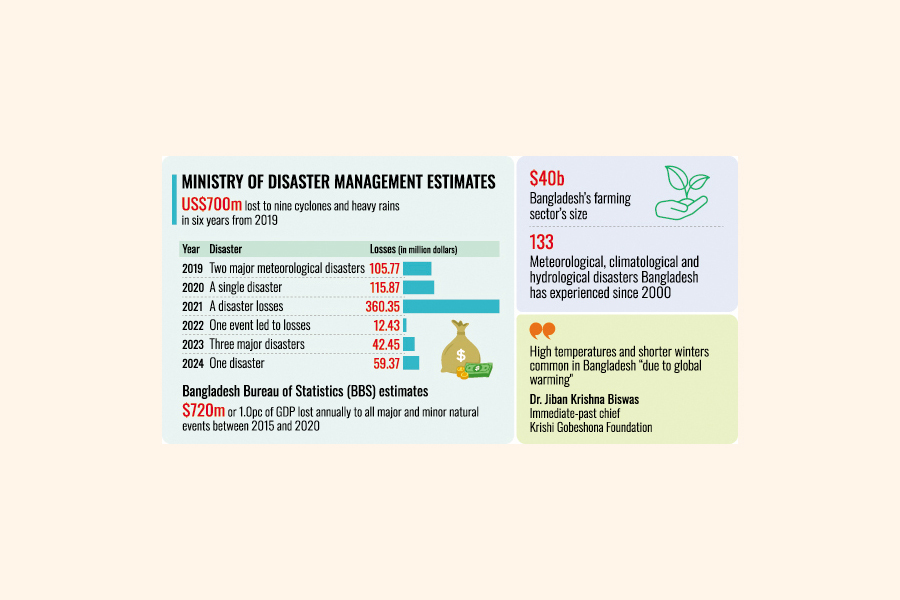

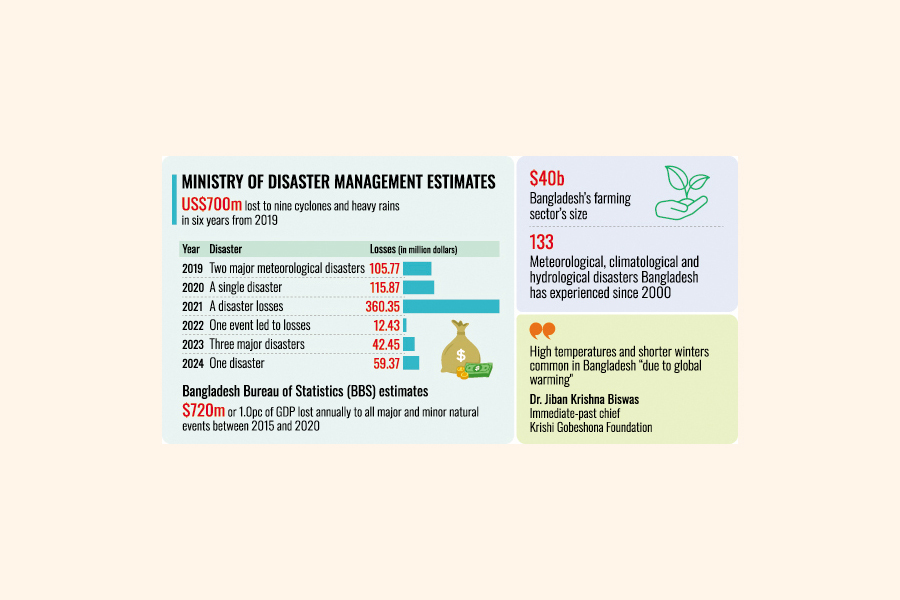

Agricultural losses have amounted to an estimated US$700 million over the past six years since 2019 due only to nine cyclones and heavy rains, according to data collated by the Ministry of Disaster Management through assessments conducted by officials at all administrative levels-- from the lowest to the highest tiers.

While considering all types of climate-related disasters, they have found agricultural damages significantly higher, with estimates from the Bangladesh Bureau of Statistics (BBS), the country's national statistical organisation, showing average annual losses of nearly $720 million between 2015 and 2020 or around 1.0 per cent of GDP.

These figures underscore severe threat that climate change poses to Bangladesh's agricultural sector, as crop insurance is not widely available for farmers at present.

In 2019, two major meteorological disasters caused agricultural losses amounting to $105.77 million. In 2020, a single disaster resulted in losses of $115.87 million, followed by a disaster in 2021 in sync that caused damages worth $360.35 million. In 2022, one event led to losses of $12.43 million, while in 2023, three major disasters caused damages of $42.45 million. As of 2024, one disaster has inflicted losses totaling $59.37 million.

A significant flood event in several southern districts in August and September 2024 is not included in those numbers.

The disaster ministry does not account for agricultural losses caused by minor events as they assess losses only for major disasters, according to officials familiar with the situation.

However, the estimates from the BBS for 2015-2020, published in May 2022, include losses from not only major disasters like cyclones and floods but also factors such as heavy rainfall, droughts, waterlogging, tidal surges, thunderstorms, landslides, and river erosion.

According to the EM-DAT database, a global disaster database, Bangladesh has experienced 133 meteorological, climatological, and hydrological disasters since 2000. More than half (70) were storms, especially tropical cyclones, followed by floods (41).

Climate experts note that increasingly frequent high temperatures and shorter winters are creating a gap in assessing the full impact of climate-related losses on the country's agriculture employing more than 40 per cent of total workforce.

Dr. Jiban Krishna Biswas, the immediate -past chief of Krishi Gobeshona Foundation, a non-profit organisation supporting sustainable agricultural research and development, told The Financial Express that high temperatures and shorter winters have become common phenomena in Bangladesh.

"Of course, this is due to global warming," the climate researcher, also former director -general of Bangladesh Rice Research Institute (BRRI), stated.

Dr Fazle Rabbi Sadek Ahmed, a climate scientist and Deputy Managing Director of Palli Karma-Sahayak Foundation (PKSF), says: "Farmers are losing out each year due to floods, droughts, short-lived winters, excessive rainfall, and insufficient rain."

PKSF, which finances NGOs providing credits and non-financial services at the grassroots level, is on the front lines of this development, as the country's agricultural loans amounting to Tk 350 billion annually are primarily disbursed through NGOs.

Dr Ahmed also notes with concern that the increasing frequency of heatwaves is reducing farmers' work capacity and degrading soil fertility, further inflating the already-substantial losses.

The 2024 Bangladesh heatwave, a significant climatic event that began on April 1, saw temperatures soar up to 42°C (108°F). This extreme heat had forced nationwide school closures, according to Meteorological department.

He mentions that Bangladesh lacks the technical capacity to collect and process data on agricultural losses due to heatwaves and short-lived winters from weather stations.

Despite the frequency of climate-related disasters, the country's total 16.88 million farm holdings in accordance with agricultural census remain unprotected, lacking the safety nets necessary to recover from losses and continue farming.

"Crops insurance remains neglected, keeping the entire agricultural sector uninsurable, as no government has seriously addressed the issue," he says in his Dhaka office, his frustration evident.

Farmers like Md Sabiar Rahman from Godagari in Rajshahi, a five-hour journey from Dhaka, are bearing the brunt of these disasters.

In November 2023, incessant rain turned his paddy fields into a soggy, inharvestable mess, costing him Tk 100,000 or $ 834, he shared with this correspondent recently during a visit.

Forced to take a Tk 50,000 or $417 loan from an NGO to cover his losses, Rahman struggles with the mandatory monthly deposits called DPS (a monthly deposit pension scheme)required by the loan, further straining his fragile finances.

Sitting under the tin roof of his modest home in Dewapara in Godagari, Rahman recalls the brief respite that a climate-related crop -insurance project offered him in 2018 when a similar disaster struck.

"We need financial help after disasters that affect our crops, but there's no insurance protection now," he says, his voice tinged with frustration and desperation.

Rahman's concerns are a common topic at local NGO meetings as he frequently advocates for the reinstatement of crop insurance.

Ekramul Hoque of Dhuroil in Mohanpur, another area in Rajshahi, has similar tales to tell.

Hoque, who now relies entirely on agriculture after leaving his job as a madrasa teacher (religious school), cultivates paddy and potatoes on his five bighas (approximately 135,000 square feet) of land.

"We are often victims of nature-whether it's floodwater, heavy rain, or no rain at all-it all affects our crops," he says.

The short-lived winters also impacts his potato cultivation, leading to poor yields.

"We need financial support after losing our crops, but there is no insurance now," Hoque laments, recalling the one time he insured his paddy in 2018, a decision he wishes he could make again.

The lack of widespread crop insurance in Bangladesh is rooted in a complex web of issues, including opposition reportedly from the ministry of agriculture.

Former Agriculture Secretary Md Nasiruzzaman told the FE that the then Agriculture Minister, Ms. Motia Chowdhury, opposed the introduction of widespread crop insurance, arguing that poor farmers would be unable to afford the premiums. As a result, the burden would fall on the government. He had worked with Ms. Chowdhury for a long time.

This correspondent had tried to contact the former agriculture minister, Ms Motia Chowdhury, but she could not be found through mobile phone.

A former senior official of the Ministry of Finance, while explaining the Agriculture Ministry's lack of cooperation on the issue of crop insurance, mentions that he faced significant opposition. "I encountered many challenges, even when launching an ADB-funded crop-insurance project in 2014," Mr. Arijit Chowdhury recalls.

Industry experts say that Bangladesh does not have crop insurance in the true sense. Very few non-life insurers out of 81 provide it as part of their "CSR (Corporate Social Responsibility)" activities, but these efforts are not impactful for the entire agriculture sector or cannot be called widespread.

They have emphasised that subsidies are essential to make crop insurance viable, as insurers will only enter the market if such support is provided.

"I can say with certainty that there is no real crop insurance in Bangladesh. We only provide small-scale coverage, which can be seen as CSR because, without subsidies, offering crop insurance commercially across the agriculture sector is not feasible," says Md Khaled Mamun, Chief Executive Officer of Reliance Insurance Company, a leading privately-owned non-life insurer in Bangladesh.

"Subsidies are crucial, along with strong government commitment to protect farmers. In India, the government covers up to 80 per cent of premiums, which is why their system is successful," he adds.

The Manila-based Asian Development Bank (ADB) funded a weather-index-based crop -insurance project, implemented by the state-owned Sadharan Bima Corporation (SBC).

The project, which ran from 2014 to 2018, covered farmers in Rajshahi, Sirajganj, and Noakhali due to their exposure to droughts, floods, and cyclones respectively.

Despite insuring 10,000 farmers and collecting Tk 5.2 million in premiums, the project paid out Tk 6.5 million in compensation during its four-year run, along with additional administrative costs.

The ADB-funded pilot project on weather-index-based crop insurance concluded in 2018.

The ADB- financed pilot project used the NGOs' network to collect the farmers interested in the crop insurance.

Md Wasiuful Hoq, Project Director and now a general manager at SBC in Dhaka, suggests forming a national agriculture- insurance corporation to address these issues and ensure wider coverage.

He points to India's Agriculture Insurance Company as a successful model, where crop insurance is widely available with substantial government subsidies.

Mr. Hoq also states that this is feasible in Bangladesh, too, and insurers will not incur losses if reinsurance is secured, along with government subsidies.

Arup Kumar Chatterjee, an ADB financial specialist who worked on the project, emphasises that crop insurance is vital for any South Asian country's agricultural sector, including Bangladesh.

"It serves as a financial safety net, protecting farmers against losses caused by various climate and weather-related threats that can adversely affect crops," he notes.

He notes that premium subsidies are a sensitive issue. "Governments can use premium subsidies to promote private-sector agricultural insurance to replace ad hoc disaster relief."

In India's main crop- insurance scheme, the Pradhan Mantri Fasal Bima Yojana (PMFBY), the subsidy, is the central element of the insurance system.

Most of the PMFBY premiums are subsidised by central and state government payments to insurers, ensuring affordable premium rates for farmers.

The Insurance Development and Regulatory Authority (IDRA), the insurance regulator of Bangladesh, believes that agricultural insurance should be a primary tool for mitigating agricultural risks, says Mohammed Jainul Bari, who was Chairman of the IDRA until recently, but has now resigned as he was appointed by recently ousted Sheikh Hasina government.

However, he has now been appointed chairman of the largest state-owned non-life insurer, SBC, which conducted the crop -insurance pilot project.

Mr. Bari says that the IDRA is always ready to approve such products promptly, and parametric insurance products are seen as suitable for dealing with climate-related risks by providing prompt loss funding, which is crucial for maintaining crop cycles.

Parametric (or index- based) solutions are a type of insurance that covers the probability (or likelihood) of a loss-causing event happening (like an earthquake) instead of indemnifying the actual loss incurred from the event, according to Swiss Re.

"Developing countries with widespread agricultural insurance generally rely on government subsidies to make it affordable," says Mr Bari.

He notes that India has the largest number of farmers covered by agricultural insurance, with private insurers participating under government-subsidized schemes.

However, IDRA does not have the authority to decide on subsidies, which is the purview of relevant ministries.

Ekramul Hoque from Dhuroil in Mohanpur told this writer recently that after the ADB project ended, they even seiged the SBC office in Rajshahi in frustration. This is also confirmed by Mr. Mohammed Ali, the manager of SBC Rajshahi.

"We are desperately waiting for such insurance to return so we can maintain our crops without interruption and secure our livelihoods," he said, expressing the deep uncertainty farmers face without this type of protection.

The story calculates the exchange rate at Tk 120 per $1.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.