Published :

Updated :

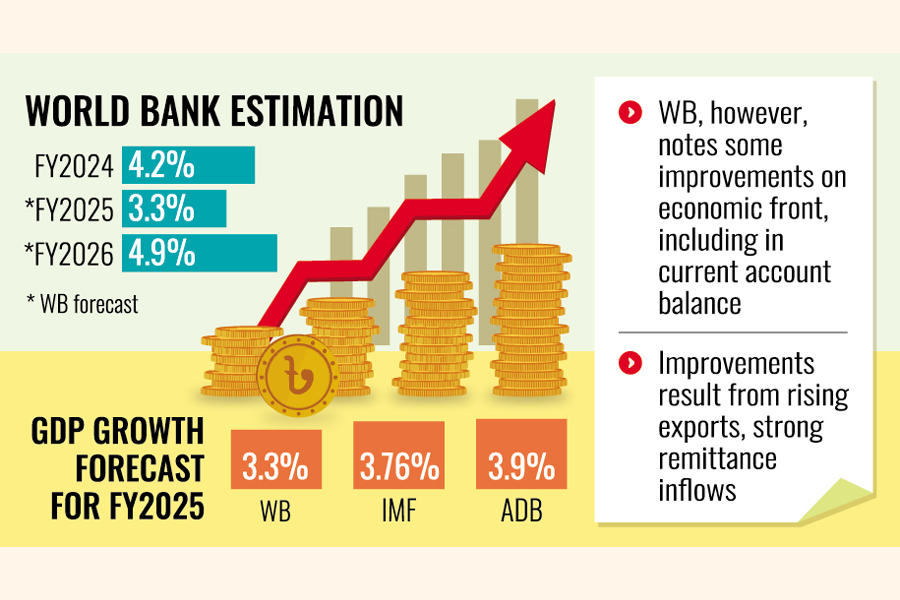

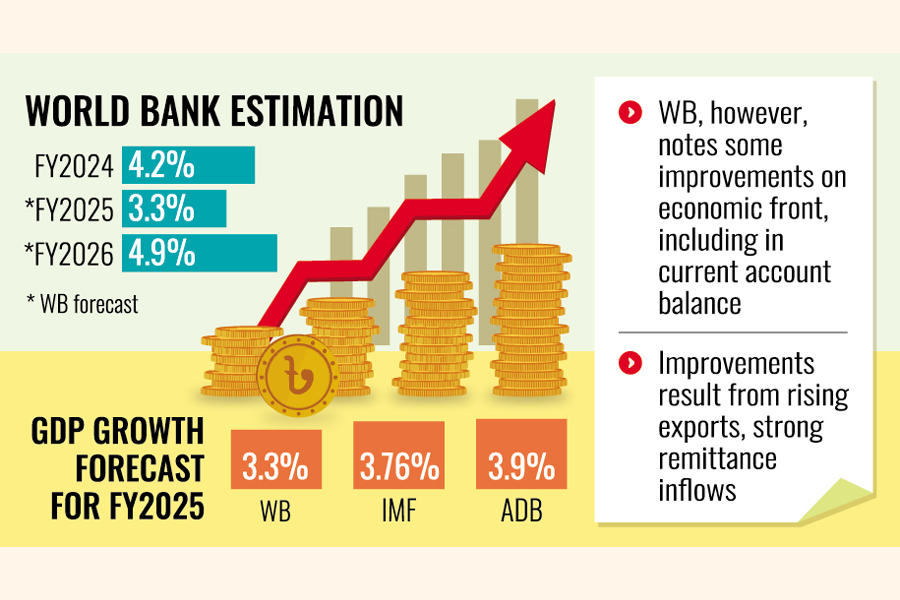

Now the World Bank also downgrades Bangladesh's economic growth, to 3.3 per cent this fiscal year, in conservative forecasts twice as the lender cites domestic disruptions and global headwinds.

Although the Washington-based lender cuts its gross domestic product (GDP)-growth prediction for Bangladesh by 0.7-percentage points in its latest report for the current fiscal year (FY) 2024-25 from its October report, the Bank paints a better economic picture for the next financial year (FY2026).

Bangladesh's GDP is expected to grow at a 4.9-percent rate in the next FY2026, the WB says in its South Asia Development Update unveiled Wednesday-a day after its twin, the IMF, also trimmed the growth rate down for this and lifted for the upcoming fiscal.

The growth forecast by the WB is much lower than its fellow lenders, including the International Monetary Fund (IMF) and the Asian Development Bank (ADP), predicted.

Just a day before, the IMF forecast 3.76-percent GDP growth for the current FY2025 for Bangladesh while the ADB early this month projected the rate to be 3.9 per cent.

Meanwhile, Bangladesh government has the target to achieve 6.75-percent GDP growth in the outgoing FY2025.

In Bangladesh, growth is expected to slow from 4.2 per cent in FY2024 to 3.3 percent in FY2025 before rebounding to 4.9 percent in FY2026, says the WB in its South Asia Development Update report -- twice-a-year regional economic outlook.

"The projections have been downgraded since October for both years. This primarily reflects the disruptions arising from last summer's social unrest and political tensions."

It also reflects the trade disruptions, the persistence of inflation, worsening bank health, governance challenges, and general uncertainty about the country's political future, all of which will contribute to an expected decline in investment, it says to substantiate the downgrades.

In Bangladesh, real GDP growth moderated to 4.2 per cent in FY2024 from 5.8 per cent in FY2023, primarily driven by a sharp decline in exports, the WB notes.

Supply-chain disruptions, combined with currency depreciation and rising domestic energy prices, added to inflationary pressures in 2024, reads the SADU report.

Consumer price inflation peaked to 11.7 per cent in July and remained elevated at 9.3 per cent in February 2025.

The WB expects the high inflation to moderate in countries where it is currently unusually high (Bangladesh) as the impact of temporary factors such as tax-rate changes or currency depreciations fades.

The current account balance has improved as a result of rising exports and strong remittance inflows, which have increasingly been channeled through the formal financial system as the kerb-market premium has narrowed, the World Bank notes about the improvements.

About South Asia the WB says amid increasing uncertainty in the global economy, South Asia's growth prospects have weakened, with projections downgraded in most countries in the region.

The latest Development Update has projected the SA regional growth to slow to 5.8 per cent in 2025- 0.4-percentage points below October projections-before ticking up to 6.1 per cent in 2026.

This outlook is subject to heightened risks, including from a highly uncertain global landscape, combined with domestic vulnerabilities, including constrained fiscal space.

"Multiple shocks over the past decade have left South Asian countries with limited buffers to withstand an increasingly challenging global environment," says Martin Raiser, World Bank Vice President for South Asia.

"The region needs targeted reforms to address vulnerabilities such as fragile fiscal positions, backward agricultural sectors, and the impact of climate-related shocks."

kabirhumayan10@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.