M AZIZUR RAHMAN AND FHM HUMAYAN KABIR

Published :

Updated :

For the first time in history, Petrobangla has sought Tk 20 billion in loans from Bangladesh Petroleum Corporation (BPC) to foot the bill for liquefied natural gas (LNG) imports, officials said on Tuesday.

The state-owned oil company BPC for the first time is going to help another government entity with its investment support to facilitate LNG procurement from the overseas market, they said.

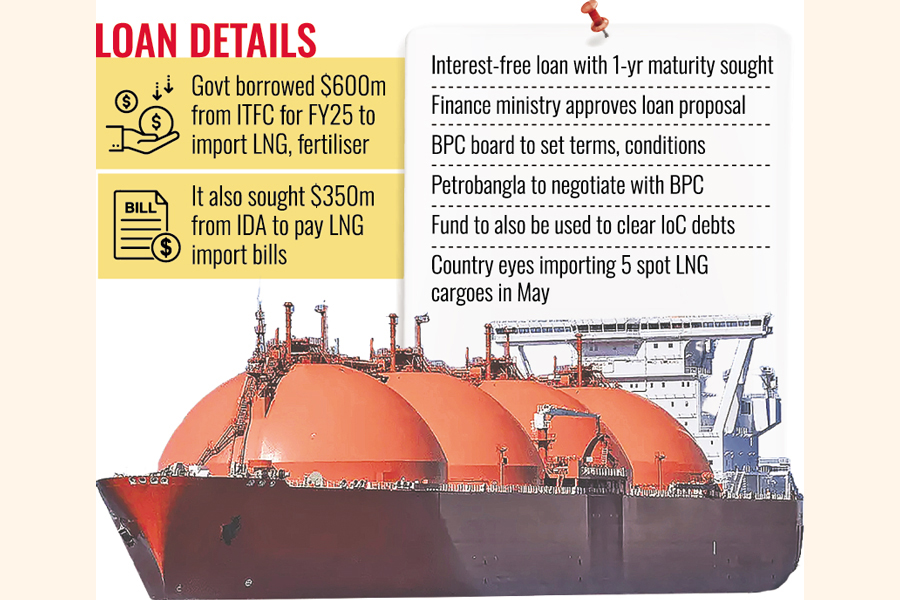

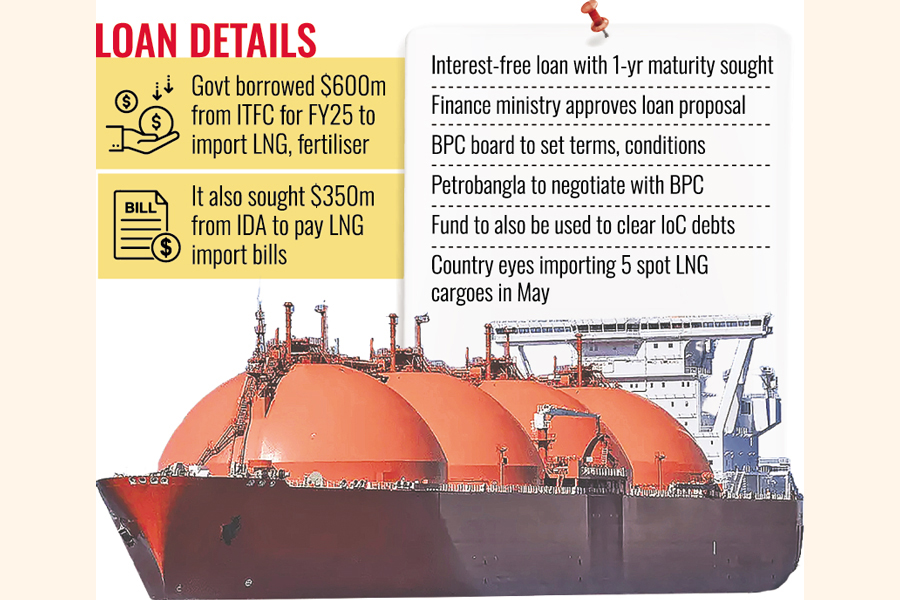

The Ministry of Finance (MoF) recently approved Petrobangla's proposal to borrow from BPC, which has excess liquidity, said a MoF official.

"We sought interest-free loans of Tk 20 billion from BPC. For that, we needed a green signal from the finance ministry, which approved our proposal recently," AKM Mizanur Rahman, director (finance) of Petrobangla, told The Financial Express.

"The finance ministry gave us some guidelines for our loan (investment) proposal. We have been informed that BPC could invest rather than providing loans. So, we will now go for a negotiation with BPC regarding the fund," he said.

The BPC board will set the terms and conditions for its investment in Petrobangla, Rahman added.

Petrobangla sought the loan from BPC with a one-year maturity period.

When asked, a finance ministry official said, "We have approved the loan proposal of Petrobangla for importing LNG and paying other bills."

He said they had suggested Petrobangla negotiate with BPC to take the loan as the ministry cannot impose terms and conditions on any state-owned company.

Petrobangla's Rahman said they have some overdue payments to the international oil companies (IoCs) operating in Bangladesh and also need to pay import bills to LNG suppliers.

The proposed fund would help Petrobangla clear the outstanding bills, he added.

An Energy and Mineral Resources Division (EMRD) official said BPC's investment is expected to be more concessional than credit from the International Islamic Trade Finance Corporation (ITFC) and other international lenders.

"So, we prefer BPC's fund to clear the overdue payments and energy import bills," he added.

Meanwhile, the government has already borrowed $600 million from ITFC, a member of the Islamic Development Bank (IsDB), for the current financial year to import LNG and fertiliser.

It has also sought $350 million in trade financing support from the International Development Association (IDA), a concessional loan providing wing of the World Bank, to pay LNG import bills, the EMRD official said.

Besides, it has sought larger funds from the finance ministry in the FY25 revised budget to pay energy import bills.

The EMRD official also said, "We have already requested the Multilateral Investment Guarantee Agency (MIGA), a member of the World Bank Group, to relax its terms and conditions as it is a bit costlier than the other loans we are getting from different sources."

As per the IDA's proposal, some local and foreign banks will arrange the loan to open letters of credit (LCs) for LNG imports. The IDA will be the guarantor on the loans from the commercial banks on behalf of the importer, which is Petrobangla.

Following Bangladesh's natural gas supply shortages from its own fields across the country, largely due to neglecting the exploration of new reserves, it has been importing liquid gas over the last few years to meet the local energy demand.

LNG imports started in 2018-19. Since then, imported LNG has played a vital role in meeting the country's growing gas demand.

In 2022, the country imported a substantial quantity of LNG, to the tune of 5.06 million metric tonnes, from QatarEnergy LNG, Oman's OQ Trading, and the spot market at a cost of $4.555 billion.

Last year, it imported a total of 86 LNG cargoes, 56 from long-term suppliers and 30 from the spot market, officials said.

Bangladesh will need to import 30 million tonnes per annum (Mtpa) LNG by 2041 to meet the growing local demand as domestic gas reserves are depleting fast, according to a report from Ramboll, a Copenhagen-based global architecture, engineering, and consultancy company.

The report was prepared in association with Geological Survey of Denmark and Greenland and Bangladesh's EQMS Consulting Limited. It said Bangladesh's existing gas reserves will run out by 2038 if no new exploration and discovery take place.

Petrobangla predicts the demand for natural gas in Bangladesh by 2041 will be around 8.0 billion cubic feet per day (Bcfd).

The country's overall gas output now hovers around 2.57 Bcfd, of which 0.50 Bcfd is regasified LNG while 2.02 Bcfd comes from local gas fields, according to the Petrobangla data on December 25 last year.

Meanwhile, Bangladesh is eyeing to import five spot LNG cargoes in May to meet the mounting demand for power in summer.

State-run Rupantarita Prakritik Gas Company Ltd (RPGCL) has already bought two spot LNG cargoes and wants to buy three more for the May delivery windows, a senior official of the company told The Financial Express Tuesday.

The tender evaluation committee is currently evaluating three tenders for the May 15-16, 22-23, and 25-26 delivery windows.

The country's energy demand has gone up from early April with the onset of summer and is expected to grow further with the rise in mercury.

Bangladesh bought four spot LNG cargoes for the delivery windows of April and March.

The bid winners will deliver the LNG cargoes at the Moheshkhali island in the Bay of Bengal, with options to discharge the cargoes at either of the country's two floating storage re-gasification units (FSRUs) located on the island.

RPGCL, a wholly-owned subsidiary of the state-run Bangladesh Oil, Gas and Mineral Corporation (Petrobangla), supervises the country's LNG trade.

The volume of each spot LNG cargo will be around 3.36 million British thermal units (MMBtu).

Bangladesh awarded its latest spot LNG cargo tender to TotalEnergies Gas and Power Ltd for the May 10-11 delivery window at $12.68 per MMBtu.

The country currently imports LNG from QatarEnergy and Oman's OQ Trading under long-term deals and also procures LNG from the spot market to re-gasify it in the two operational FSRUs having a total capacity of 1.10 billion cubic feet per day (Bcfd).

Bangladesh is reeling from an acute energy crisis as its natural gas output is depleting.

It rations gas supply to industries, power plants, and other gas-guzzling industries to cope with the mounting demand.

kabirhumayan10@gmail.com, azizjst@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.