Published :

Updated :

Bangladesh's two major remittance corridors -- the United States and the United Arab Emirates -- witnessed significant year-on-year (YoY) declines in inflows during the last two quarters, raising concerns over the sustainability of the growth momentum.

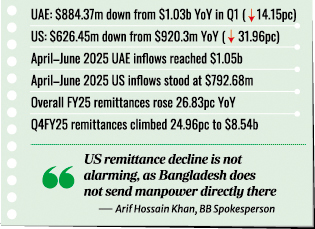

According to the latest Bangladesh Bank (BB) report, remittances from the UAE dropped to $884.37 million in July-September 2025, down sharply from over $1.03 billion in the same quarter of 2024, a decline of 14.15 per cent.

The downturn was even more pronounced in the US corridor, where inflows fell to $626.45 million in July-September 2025, compared with $920.3 million a year earlier, marking a steep 31.96 per cent decline.

The BB's April-June quarterly report also reveals emerging weaknesses. Despite the US remaining the top source of remittances in FY25, inflows from this corridor declined by 21.8 per cent (YoY) in Q4FY25, reflecting uncertainty over proposed US remittance tax legislation and stricter regulatory oversight.

Similarly, inflows from the UAE, one of the key contributors to total remittance receipts, fell by 22.15 per cent (YoY) in Q4FY25, partly linked to the gradual decline in overseas employment since 2023, the BB report said.

Remittance inflows from the UAE stood at $1.05 billion in April-June 2025, while inflows from the US reached $792.68 million during the same period, according to central bank data.

The BB April-June quarterly report also shows that the US, Saudi Arabia, the UK, and Malaysia were the main contributors to the FY25 remittance growth, posting annual growth rates of 59.8 per cent, 55.55 per cent, 13.44 per cent, and 60.78 per cent, respectively.

The Gulf region continued to dominate overall flows, accounting for 45.03 per cent of total remittance receipts.

Despite the recent decline in major corridors, Bangladesh recorded a robust surge in remittance inflows in fiscal year 2024-25 (FY25). Remittance receipts rose by 26.83 per cent year-on-year, reaching $30.33 billion in FY25, compared with $23.91 billion in the previous fiscal year.

The rise was underpinned by a competitive exchange rate and tighter surveillance of unofficial transfer channels, encouraging migrant workers to use formal remittance routes.

The upward trend was particularly evident in the final quarter of FY25, with inflows climbing 24.96 per cent to $8.54 billion in Q4FY25, up from $6.83 billion in Q4FY24.

With global economic headwinds and evolving migration patterns, the next fiscal year will test whether Bangladesh can maintain its remittance momentum or whether FY25's record inflows mark the peak of a temporary upswing. Bangladesh Bank spokesperson Arif Hossain Khan said there is no alarming issue behind the decline in US remittance inflows, as Bangladesh does not send manpower directly to that market.

However, he added that the drop in UAE remittances during the June quarter of 2025 might be partly linked to declining overseas employment since 2023 and rising living costs driven by high prices of essentials.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank (MTB), said the recent remittance trend reflects both structural and behavioural shifts across major corridors.

He pointed out that inflows from the US and UAE declined noticeably due to several external and regulatory factors.

"In the US, many non-resident Bangladeshis (NRBs) face uncertainty due to recent policy stances toward immigrants and tax measures on remittance companies.

At the same time, people are spending less, and some of the money that used to come through formal banking routes after being laundered abroad has now almost stopped," he explained.

He further observed that similar patterns are visible in the UAE. "Fintech platforms are expanding rapidly in the Middle East, but a large portion of cover funds for UAE transactions is now being routed from countries like Singapore, Malaysia, the UK, and even South Africa.

Alongside that, declining overseas employment, tighter visa policies, and a slowdown in construction and real estate sectors have all contributed to weaker inflows," Mr Rahman added.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.