Sagging private-sector external borrowing

Short-term debt drops to $11.97b in Nov

Industrial output, jobs squeeze feared for capital contraction

Published :

Updated :

Corporate borrowing from foreign lenders to meet funding needs slides, with the short-term debts having dropped to US$11.97 billion in November, in what economists see as signs of economic slowdown.

Corporate borrowing from foreign lenders to meet funding needs slides, with the short-term debts having dropped to US$11.97 billion in November, in what economists see as signs of economic slowdown.

Sources have said the outstanding balance of private sector's short-term external debt continues falling as entrepreneurs jettisoned their investment plans to wait and see when and how uncertainties both on domestic and global markets should dissipate.

Such continuous downturn in capital inflow triggers fear of disruptions to industrial production and jobs creation in the US$460-billion- plus economy largely dominated by the private sector.

Economists and analysts pinpoint several factors, including ongoing energy crisis in the industrial hubs, depreciation of the local currency against the greenback and repayment risks amid forex dearth, behind the ebb tide in short-term credit intake by the businesses.

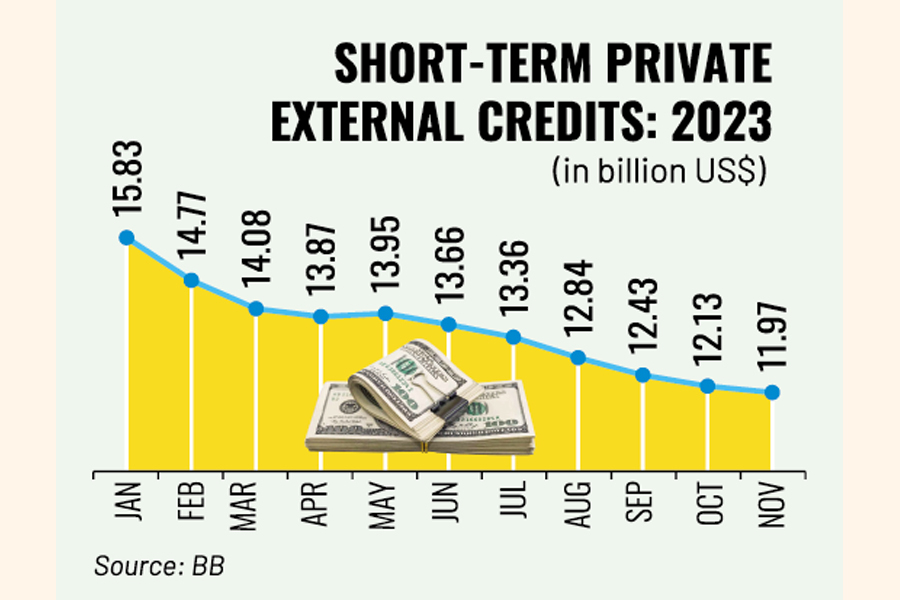

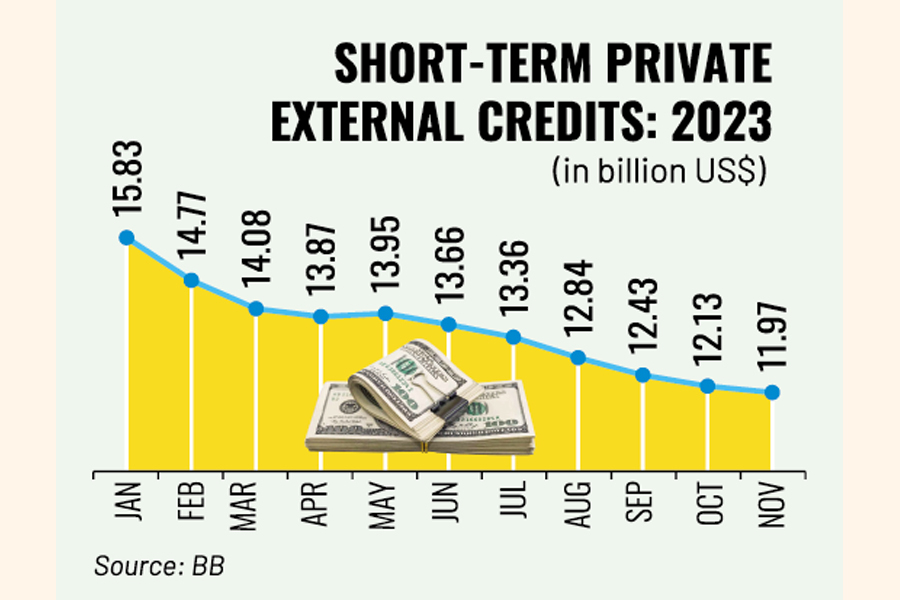

According to the latest statistics of Bangladesh Bank (BB), the outstanding balance of short-term external credits taken by the private players stood at $15.83 billion in January 2023. Then, it dropped to $14.77 billion in February, $14.08 billion in March, and $13.87 billion in April. But it made a little increase in May when the amount was $13.95 billion.

The debt curve went on a downswing again, to reach $13.66 billion in June. The downturn continued in July ($13.36 billion), August ($12.84 billion), September ($12.43 billion), October ($12.13 billion) and November ($11.97 billion).

However, the central bankers are taking the downturn in private sector's one-year-long overseas borrowing as a good sign in the current macroeconomic situation as it would lessen pressure on the country's depleting foreign-exchange reserves. But businesspeople and market analysts think completely opposite.

Seeking anonymity, a BB official says it is a good sign for the country that its overseas liabilities keep declining that would lessen pressure on the forex reserves to some extent.

Asked whether the ongoing dollar dearth poses any problem as far as repayment of the debts is concerned, the central banker said, "Things started improving as the earnings from remittance and export receivables are slowly increasing while import orders plummeted significantly."

Executive President of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Mohammad Hatem says the global market of Bangladeshi industrial products started getting volatile since the Russia-Ukraine war broke out.

On the other hand, the industrial hubs have been facing gas crisis for the last several months while the problems relating to opening LC (letter of credit) amid forex dearth keep muddling the situation, he said.

"So, these forced us to halt our investment plans in recent months and it is reflected in the data of short-term external borrowing by the private sector," the business leader says about the domino effect of capital contraction.

And such unexpected developments would certainly disrupt the growth of industrial production and employment generation, which would not be a good sign for the economy, the BKMEA executive president opines.

Contacted for his view of the situation, chairman of Policy Exchange of Bangladesh Dr M. Masrur Reaz points out that the rate of interest increases globally and it raises the cost of getting fund from external sources significantly.

"And it is probably discouraging the Bangladesh-based entrepreneurs from borrowing funds from outside," he says.

Simultaneously, the economist says, there is still tightness in opening LC as part of the government belt-tightening measures and the global orders for RMG, textile and spinning products keep dampening.

"So, the demand for trade financing and working-capital financing by the private sector from external sources has plummeted," he adds.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.