Published :

Updated :

Six priority areas are up for reforms under conditions binding a World Bank-offered budget-support credit, including an overhaul in fiscal, revenue, and public-welfare arenas, officials said.

The World Bank is providing the development-policy credit under its Building Economic and Institutional Resilience programme for tidying these areas of finance.

The Ministry of Finance has formed a policy actions-implementation committee headed by an additional secretary of the finance division to push through the reforms.

As part of the spadework for such major changes, policy matrix has already been prepared in consultation with the ministries and divisions concerned, the officials said.

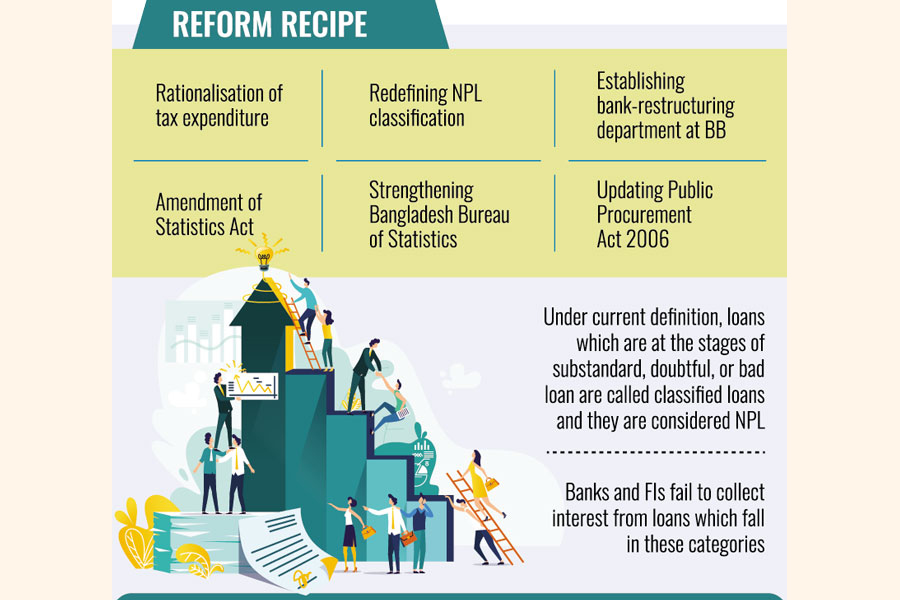

In the six-point reform recipe are rationalisation of tax expenditure, a new definition of non-performing loan (NPL) classification, establishment of bank-restructuring department in Bangladesh Bank, amendment of the statistics act, and the strengthening of Bangladesh Bureau of Statistics (BBS).

Officials concerned say Bangladesh's tax-to-GDP (gross domestic product) ratio is one of the lowest in the world and so needs a gradual raise. They see such low tax-revenue collection as a "big barrier facing economic development of the country",

Under this reform programme, the committee will work on implementation of policy actions aimed at finding potentials for broadening tax base, ways for additional revenue collection, and elimination of less-effective tax exemptions.

They say an updated definition of classified loans will also be prepared under this reform drive. Under the current definition loans which are at the stages of substandard, doubtful, or bad loan are called classified loans and they are considered NPL.

The banks and financial institutions fail to collect interest from the loans which fall in these categories. Recovery of both the interest and principal amount becomes uncertain when a loan is classified as bad loans.

Officials concerned have said the restructuring of some banks "has become very necessary as financial health of many public-and private-sector lenders has deteriorated following wanton plunder in the recent past".

The central bank, they say, will soon begin assessment of the asset quality of the banks before restructuring. Under the budget-support credit of the World Bank a bank-restructuring department is going to open in the Bangladesh Bank.

The central bank governor few weeks back sought some $270 million from the World Bank under Financial-Sector Support Project II from where some $70 million will be spent on strengthening Bangladesh Bank's technical capability and capacity for effective regulation and supervision.

Officials say the Statistics Act 2013 will also be amended under the budget-support programme of the World Bank. Also, the Public Procurement Act 2006 will be amended to make it more time-befitting.

The strengthening of the Bangladesh Bureau of Statistics (BBS) is also in the ambit of reforms under the Word Bank's budget-support credit to make statistics produced by the state agency more authentic and credible to remove a credibility gap.

Officials say in the past, the statistics produced by the BBS "used to be called in question home and abroad for a lack of accuracy".

Dr Zahid Hussain, a former lead economist at the World Bank's Dhaka office, earlier told the FE that reform is necessary in various public institutions and acts in Bangladesh to make them fit in international best practices.

On a question over data accuracy, he said, "There is a common perception in Bangladesh for many years that the GDP data produced by the BBS are inflated. Also, the accuracy of many social-indicator data remained under question for years which the government did not pay heed too."

He underscored the need for strengthening the BBS and for generating accurate data for their well acceptance.

syful-islam@outlook.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.