Published :

Updated :

Stocks rebounded in the week to Thursday, paring half of the steep losses from the previous week despite the announcement of tight monetary policy.

The Bangladesh Bank unveiled the monetary policy for the first half of the next fiscal year on Sunday, removing the lending rate cap and introducing the market-driven reference rate instead.

A contractionary monetary policy generally tends to intimidate stock investors as it makes stocks less lucrative compared to other risk-free assets, while higher interest expenses drag down the profitability of leveraged firms.

However, the monetary policy statement was hailed by market analysts, who believe it corrected the central bank's previous mistakes of artificially holding interest rates.

The impact of the monetary policy would be little on the stock market as investors knew about the central bank move on the six-month Moving Average Rate of Treasury bills (MART), which will be used to fix the lending rate from the coming fiscal year, they said.

Analysts believe the higher interest rate generally helps increase the cash-surplus insurance companies' income.

Accordingly, insurance sector stocks returned to the positive territory after a sharp correction in the week before, leading the market to end higher.

Investors were mostly active in the life insurance sector, capturing 20 per cent of the week's total turnover, with the sector gaining 2.25 per cent after previous week's correction.

Also, the profitability of banks and financial institutions will increase under the new monetary policy.

As a result, the banking and non-bank financial institutions drew the investors' attention again and many found oversold stocks lucrative for capital gain.

This week, buyers dominated the trading floor throughout the week, taking the prime index higher.

Of the five trading days this week, four sessions ended higher while one session suffered losses marginally.

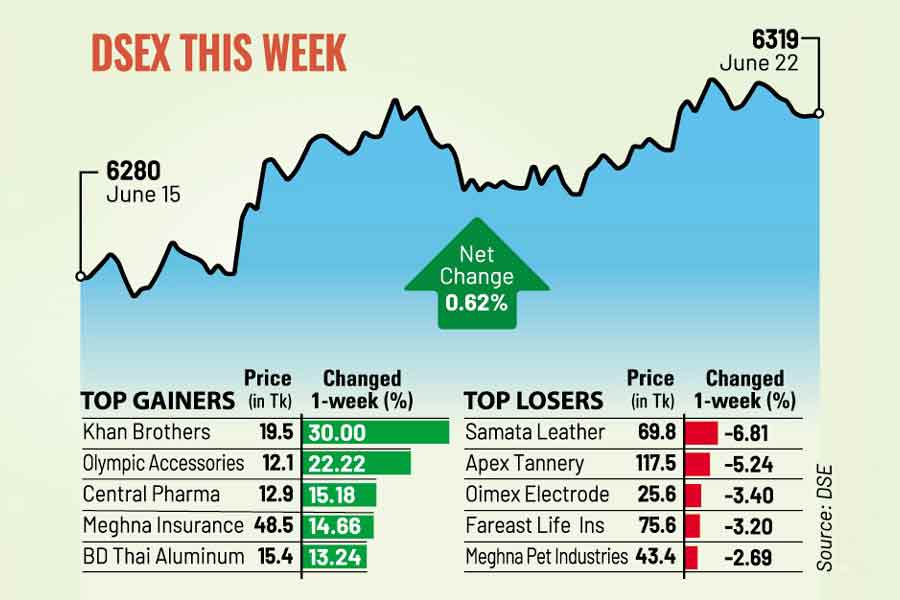

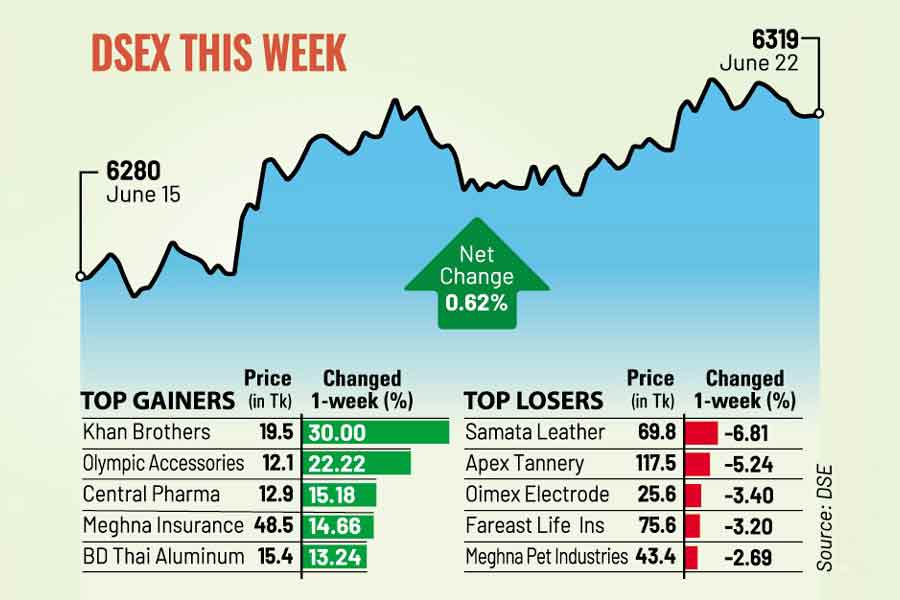

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), finally settled the week 39.23 points or 0.62 per cent higher at 6,319.25, after losing 72.82 points in the previous week.

According to the EBL Securities, stocks ended higher as smart investors sought bargain hunting opportunities in sector-specific stocks, as concern over monetary policy somewhat eased.

While investor sentiment improved to some extent, the market movement was led by particular small-cap and junk stocks as investors sought to take positions in the quick rallies in anticipation of quick gains, said the stockbroker.

The DS30 Index, which consists of blue-chip companies, also gained 5.24 points to close at 2,187 and the DSES index, which represents Shariah-based companies, rose 7.55 points to 1,372.

According to International Leasing Securities, the market showed bullish performance after the announcement of the monetary policy following a major correction in the previous week.

But, the investor confidence is yet to rebound across the trading floor owing to the prevailing concerns regarding the market outlook due to various macroeconomic factors, it added.

As a result, turnover kept falling and amounted to Tk 29.58 billion in total, down from Tk 38.70 billion in the week before.

The average daily turnover stood at Tk 5.92 billion, down 23 per cent from the previous week's daily average turnover of Tk 7.74 billion.

Majority of the traded issues saw price appreciation, as out of 393 issues traded, 162 saw price surge, 23 witnessed price fall while 208 issues remained unchanged.

Meghna Life Insurance became the most-traded stocks for the second straight week, with shares worth Tk 1.05 billion changing hands, followed by Gemini Sea Food, Navana Pharma, Bangladesh Shipping Corporation and Eastern Housing.

The Chittagong Stock Exchange (CSE) also returned to the green with its All Share Price Index (CASPI) rising 97 points to settle at 18,657 and the Selective Categories Index (CSCX) climbing 52 points to close at 11,154.

The port city's bourse traded 211 million shares and mutual fund units with turnover value recorded Tk 8.98 billion during the week, riding on huge block trade.

In the block market, buyers and sellers meet at a negotiated price to trade bulk numbers of shares without disrupting the regular public market.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.