Published :

Updated :

Notwithstanding some infrastructural development in Bangladesh's aviation sector over the decades, local airlines have been struggling to achieve sustainability for reasons that include policy flaws and cost escalation.

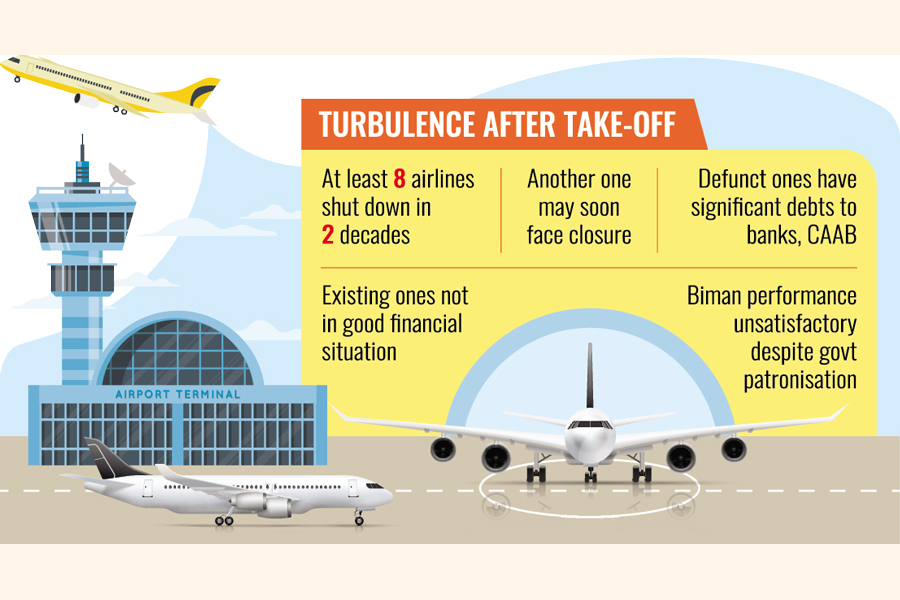

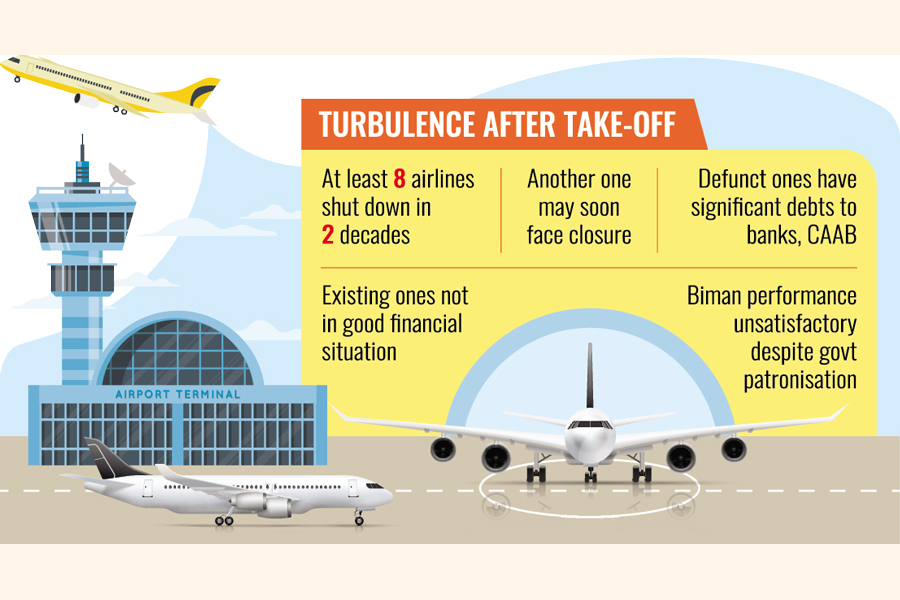

Officials say at least eight airlines that entered the market have been shut down in the last two decades. There are also rumours that another airline may soon cease operations. Moreover, those still operating are not in a sound financial situation.

Experts say Bangladesh's private aviation policy "is not business-friendly". In addition, high operating costs, jet-fuel prices and surcharges further burden the industry.

As a result, while new airlines may perform well initially, they struggle to sustain operations once the honeymoon period is over. Eventually, many reach a point of no return and are forced to fly at a loss.

Over the past two decades, several airlines have gone bust, leaving behind significant debts owed to banks and the Civil Aviation Authority of Bangladesh (CAAB).

If these structural issues are not addressed, the aviation sector will struggle to grow. Consequently, foreign carriers may dominate the market, leaving little room for local businesses to compete, according to experts.

Over the past ten years, Bangladesh has witnessed significant development in its airport infrastructure, driven by rapid growth in the aviation market, which has nearly doubled during this period.

In response to this expansion, the government has initiated several ambitious infrastructure projects aimed at modernising and expanding the country's aviation capacity.

Among the key initiatives are the construction of the third terminal at Hazrat Shahjalal International Airport (HSIA) in Dhaka and the ongoing expansion of Cox's Bazar Airport. These projects are seen as transformative steps, generating new hopes for the future of air travel and connectivity in the region.

Belying all these initiatives, the country's aviation sector witnessed the closure of several prominent airlines under the burden of huge debts.

Bangladesh's first privately owned airline, GMG Airlines, started its operations in 1997, and due to poor financial condition, it stayed operations in 2012. Regent Airways embarked upon journey in 2010 and paused in March 2020 following a financial crisis.

United Airways was founded in 2005 and began flights on July 10, 2007. The airline ceased all operations on March 6, 2016.

The three defunct airliners owed CAAB Tk 11.93 billion as of December 2024.

Now the authorities of Novoair, another private airline, are uncertain whether they will be able to continue their operations.

Apart from Novoair, there are two other private airlines in the country that frequently report various challenges in expanding their operations. Additionally, stakeholders believe the performance of the national flag-carrier Biman Bangladesh Airlines remains unsatisfactory despite full-scale government patronage.

Kazi Wahidul Alam, an aviation expert and also a former board member of Biman, says, "Local airlines have to purchase fuel at a price that is 15-percent higher than the price paid by foreign airlines. CAAB imposes a significant surcharge. Additionally, the government imposes a 30-35-percent tax on each airline ticket. These issues must be revisited for the industry to achieve meaningful growth."

He further states that the reduction in passengers on the Barishal and Jashore routes due to the Padma Bridge has also impacted local airlines' business.

CAAB Chairman Air Vice-Marshal Md Monjur Kabir Bhuiyan told The Financial Express that as a regulator, his organisation fully supports the country's airlines.

"The CAAB recently reduced hangar charges significantly," he said, adding that an airline must have good management to continue its operations spontaneously.

bikashju@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.