Bolstering Bangladesh financial safety net

WB agrees to lend $400m for bankrolling project

Published :

Updated :

A latest World Bank financing worth US$400 million is expected for strengthening financial-safety net and crisis preparedness in Bangladesh, officials said about the funding that specially focuses tidying up the banking sector.

The money will go for bankrolling the Financial Sector Support Project (FSSP) -II. Total tenure of the project will be five years.

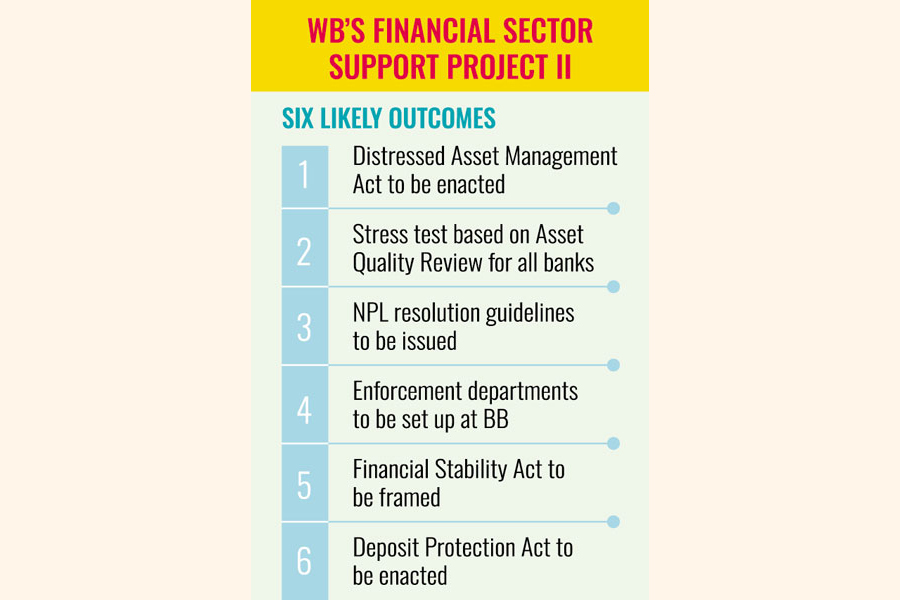

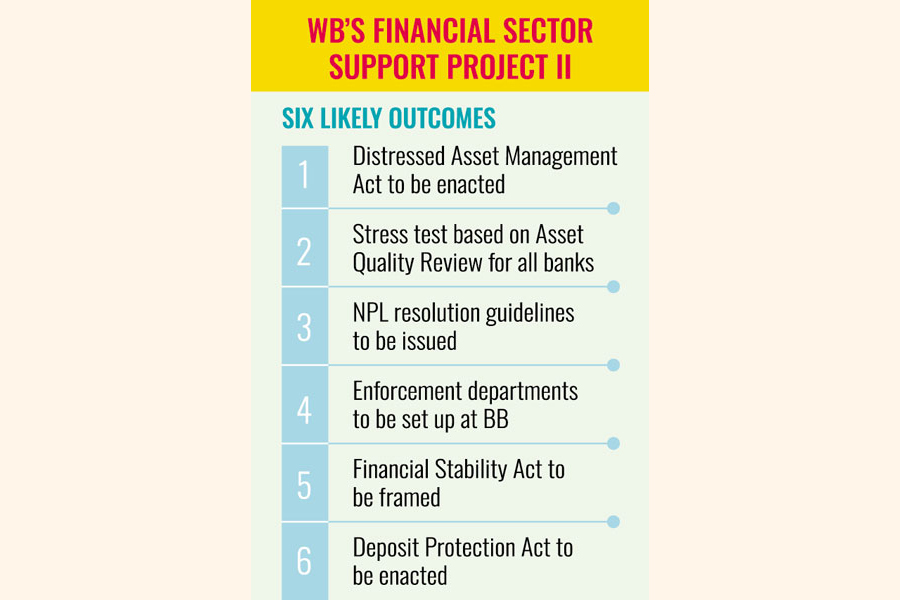

Under the proposal, Bangladesh will achieve at least six outcomes that include enacting Distressed Asset Management Act (DAMA) and stress test based on AQR (Asset Quality Review) for all the scheduled banks within the second and third years of the project.

Non-performing loans (NPL) resolution guidelines will be issued and enforcement departments will be established at the central bank during the period under the review.

Besides, two acts - Financial Stability Act and Deposit Protection Act -will be issued under the project.

However, the banking sector, particularly enhancing deposit insurance system (DIS), strengthening bank restructuring and resolution will be focused with financing worth around $300 million.

These are performance-based credits (PBCs) under a new concept introduced by the World Bank under the project, according to a central banker.

He also says an alternative to these PBCs may be inclusion of an on-lending component like previous project (FSSP) of the World Bank.

"There are also requiring enacting some new laws which will be combined efforts of the central bank and the government," the Bangladesh Bank official explains.

The DAMA will be enacted in line with the World Bank recommendations and international practices.

Another $100 million will be invested in IT, databases and systems for modernizing financial-market infrastructure of the central bank of Bangladesh along with capacity building of the BB officials for dealing with financial issues in this critical era.

"We're now working to formulate TPP (Technical Project Proforma) for the project," Spokesperson for the central bank Husne Ara Shikha told the FE.

Ms. Shikha, also an executive director of the BB, said formal discussion with the World Bank in this connection had already been completed.

"We hope that the formulation of TPP will be completed by June 2025," she said, adding that the loan proposal is expected to be submitted at the World Bank board meeting in September 2025 for approval.

siddique.islam@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.