Fallout from repo squeeze from April

Yield rise may make govt bank borrowing costlier

Predicted cost rise already casts its shadow before

Published :

Updated :

Government bank borrowings may be costlier from this fiscal year's last quarter for growing yields on sovereign securities, as rate rises already cast their shadows before.

Economists and bankers believe the yield pressures may be zooming despite the borrowing target for the April-June period is not set to increase significantly.

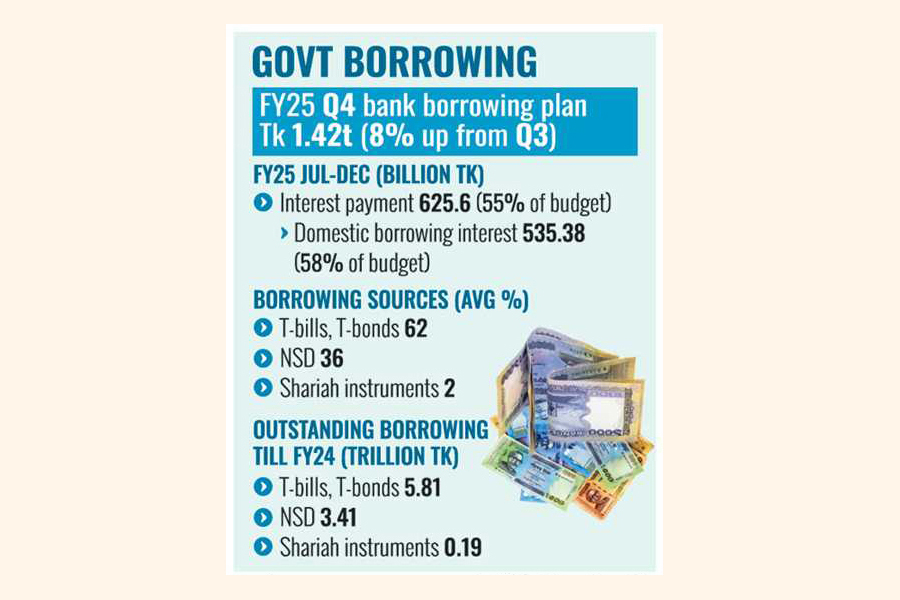

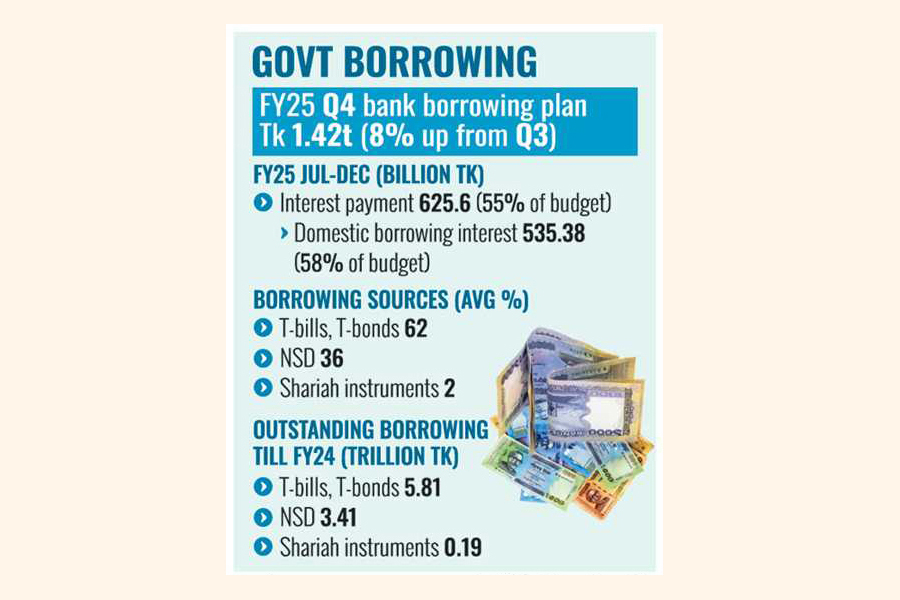

On Tuesday, the government released its auction calendar for the fourth quarter of the fiscal year 2024-25 with a plan to borrow Tk 1.42 trillion through the banking system -- an increase of nearly 8.0 per cent.

The country's banks typically rely on repo borrowing to meet urgent liquidity needs and fund their investments in government securities. But, the central bank has announced discontinuation of the 28-day repo facility from April 10.

Bankers argue that soon after issuance of the circular, yields on both treasury bills and bonds reflected an uptrend in last auctions held Sunday and Tuesday this week.

The cut-off yield on the 15-year Bangladesh Government Treasury Bond (BGTB) rose to 12.28 per cent from 11.36 percent, while on the 20-year BGTB increased to 12.54 per cent from 12.05 per cent, according to auction results.

Similarly, the auction results also show that the cut-off yield on the 91-day T-bill rose to 10.90 per cent from 10.75 per cent and that on the 182-day T-bill increased to 11.25 per cent from 10.90 per cent.

Syed Mahbubur Rahman, Managing Director and CEO of Mutual Trust Bank, told the FE that yields might surge due to liquidity stress on the market.

However, he notes that "banks with strong liquidity positions would not face major difficulties and would invest accordingly".

Md. Shaheen Iqbal, deputy managing director of SME-focused BRAC Bank, told FE that the relationship between repo discontinuation and investment in government securities is direct.

"This may push treasury yields higher, ultimately increasing government borrowing costs," he predicts.

During July-December of the current fiscal year, interest payments from the exchequer amounted to Tk 625.6 billion, accounting for more than 55 per cent of the allocated budget. Of the total, Tk 535.38 billion was paid for domestic borrowing, representing approximately 58 percent of the budget estimate.

Mr. Iqbal alerts that if the central bank discontinues another repo facility in July, market liquidity could tighten further. The central bank is also mulling over phasing out another repo from July in order to strengthen the interbank transactions.

He mentions that the outstanding amount under the repo facility in the banking system currently stands at around Tk 700 billion.

Discontinuing one of the instruments could significantly reduce this amount, potentially cutting it down by 50 per cent to Tk 350 billion.

Currently, three repo tenures are available: 7-day, 14-day, and 28-day ones. The 28-day repo ceases from April 10.

Domestic borrowing consists of three main components: National Savings Directorate (NSD) instruments, treasury bills and bonds, and Sukuk (Islamic bonds).

The government borrows 62 per cent of necessary funds from the banking system through treasury bills and bonds, 36 per cent from NSD instruments, and the remaining 2.0 percent from Sukuk or shariah-based instruments. Prize bonds, which are lottery bonds issued by the government, do not carry any interest payments.

According to central bank data, as of the end of fiscal year 2023-24, the outstanding government borrowing stood at Tk 5.81 trillion through treasury bills and bonds, Tk 3.41 trillion from NSD instruments, and Tk 190 billion from Sukuk.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.