Published :

Updated :

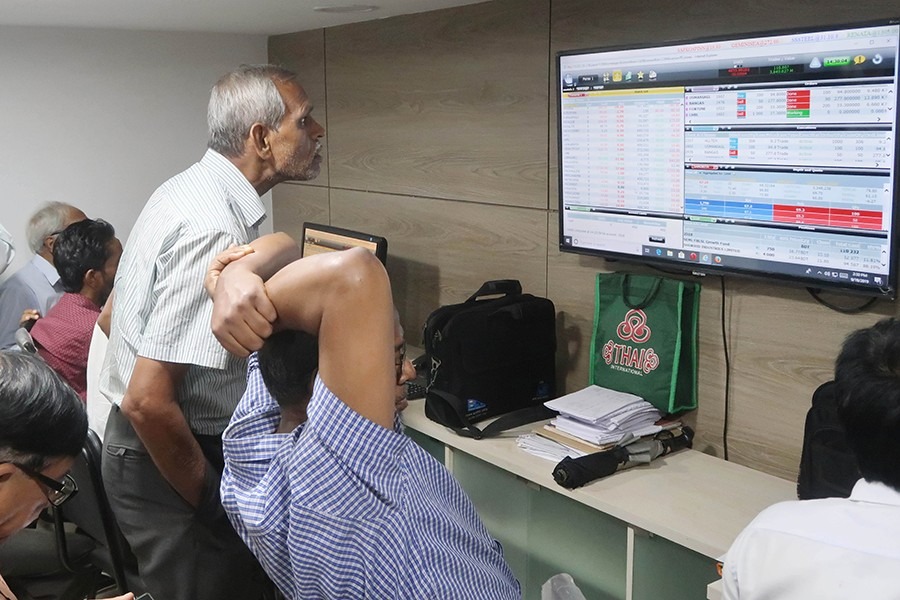

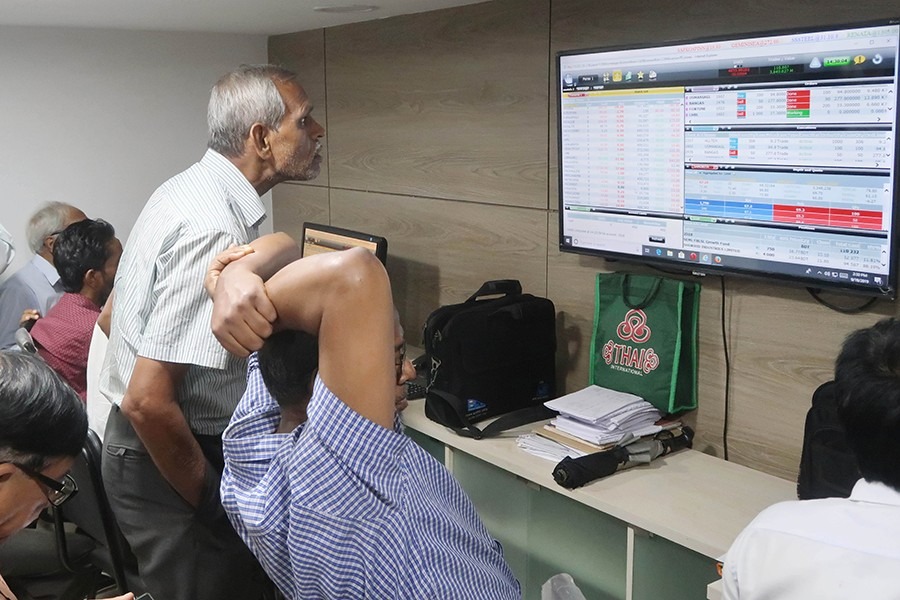

The country's stock market is not showing any sign of vibrancy. Occasional attempts to breathe life into it aimed at bringing new firms to get listed have fallen flat. Also, there is no encouragement for small investors to gain from the market. This has been glaringly reflected in a recent finding that Bangladesh's stock market was the second worst performer among its Asian counterparts in the first half of 2025, with the benchmark index sliding and no new listing recorded. In contrast, Sri Lanka emerged topper with an impressive 13.9 per cent gain in its equity index, while Thailand fared the worst with a loss exceeding 22 per cent.

Bangladesh's poor performance stems from a combination of high interest rates, weakening corporate profitability, ongoing political and economic uncertainties and a legacy of negative equity-all of which have severely eroded investor confidence. By June 30, the Dhaka Stock Exchange's DSEX index had shed 378 points, or 7.25 per cent, to settle at 4,838. During this period, market capitalisation fell by 8.1 per cent. The blue-chip DS30 index, tracking 30 prominent companies, plunged by 124 points to 1,816. Even more concerning is the fact that the average daily turnover at the prime bourse dropped to Tk 3.84 billion, a steep 39 per cent decline year-on-year. In this depressing market scene, investors have found no opportunities for gains through initial public offerings (IPOs), as there were no IPOs launched over the past year-a situation not seen in decades.

According to many market observers, the failure to adopt transparent and proactive policies for years has left both the Dhaka and Chattogram stock exchanges largely dormant. Continued political interference and manipulation by those close to power have only made matters worse, compounding investor distrust and discouraging genuine market-based activity. The new Commission formed by the interim government has reportedly begun efforts in this regard, setting up a committee and holding discussions with major domestic and multinational firms to encourage listings. But the fact remains that unless these companies see the market as credible, transparent and profitable, they will remain reluctant to participate.

Restoring investor confidence is indeed at the heart of any serious capital market reform. Achieving this requires strong regulatory enforcement, a robust legal framework and a commitment to shielding the market from manipulation and political pressure. Without these fundamental reforms, stagnation in the capital market is unlikely to be reversed, leaving investors wary and companies unwilling to seek listing. Policymakers must also focus on investor education and technological upgrade to enhance trading transparency and efficiency. Modern, automated trading systems, fair disclosure practices, and a vibrant bond market can help diversify investment options and reduce risks for retail investors. Rebuilding trust through sound governance, accountability and developing a long-term strategic vision are thus indispensable, if Bangladesh is to energise its capital market and unlock its full potential for supporting sustainable economic growth.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.