Published :

Updated :

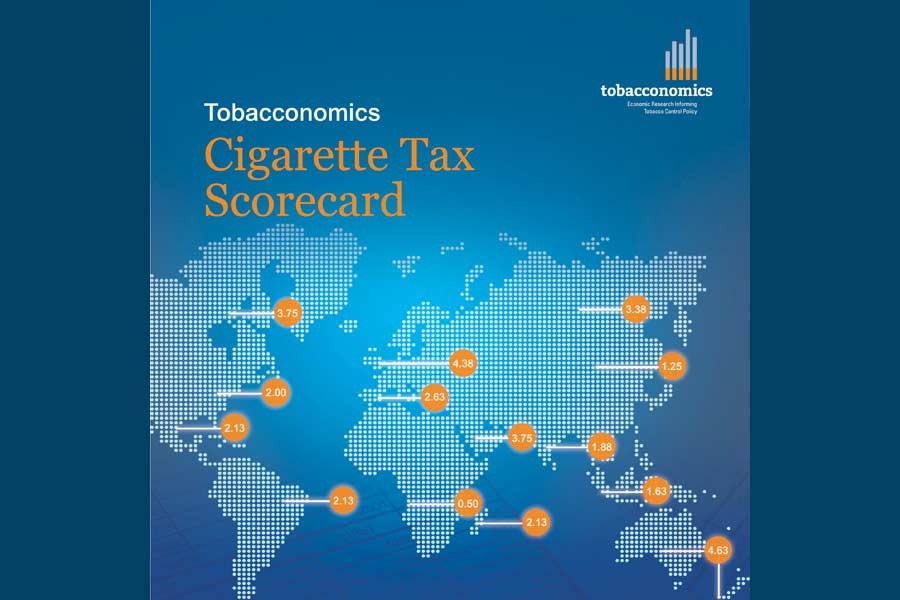

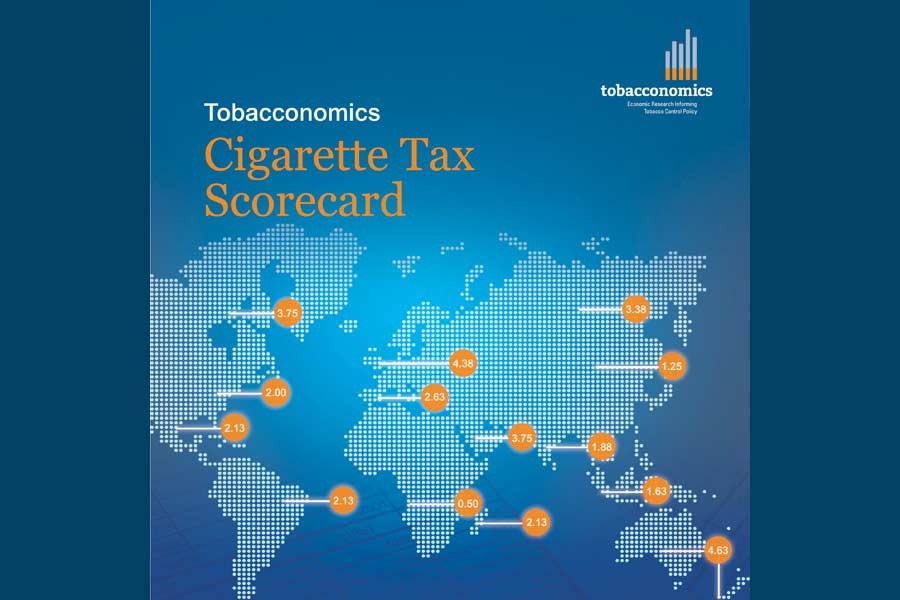

A significant improvement in Bangladesh's Cigarette Tax Scorecard produced and released by the Tobacconomics, a US-based research initiative, is certainly salubrious. An improvement from a score of 0.87 in 2014 to 2.38 in 2018 shows that the country is on the right course but admittedly there is more to be done. This latest score available is only slightly higher than the global average of 2.07 but way behind the highest score of 4.63 jointly achieved by two neighbours across the Tasman Sea, Australia and New Zealand in the tobacco tax index. Created by the University of Illinois Chicago's Institute for Health Research and Policy, the index took into account cigarette tax policies in more than 170 countries on the basis of international best practices using data (2014-18) from the World Health Organisation to make a comparative assessment of performance.

Since then two years have almost passed. By this time further improvement may have been achieved in terms of tobacco consumption but this cannot be said in terms of taxation on the substance. Tobacco companies have been smarter enough to appease the authorities concerned by taking up environmental programmes in order to get the administrative pressure off. So the prices of cigarettes could not be raised as much as would have been appropriate. Taxation also stayed far below the international level, particularly those imposed by countries achieving higher scores of 4.0 and above out of 5.0. The ploy used by the tobacco companies ---both national and international --- to skirt around a stricter legal taxation regime is not unknown. What is needed is a steely resolve to get rid of such tentative approach to fight the danger of tobacco use. The country's health concern alone should aim at achieving a scorecard comparable to the world's top nations.

True, nearly half of the 170 or so countries assessed scored less than 2.0 but this should not hold this country on the threshold of a developing country back. Its human resource is the best one that has so long been the engine of its growth often seen by international development practitioners as enigmatic. When 37.8 million adults in the country use tobacco and 41 million citizens suffer passive smoke in their own homes let alone others in offices and public places, any delay to address the problem will be suicidal. According to an anti-tobacco group in the country, Knowledge for Progress (Progga), 0.126 million people die every year in Bangladesh and in the year 2017-18 alone the economic burden from tobacco use was estimated at Tk 305 billion.

Evidently, the unhealthy practice of smoking is a total waste of money and human health. As long as people cannot totally give up tobacco use, the rationality of making the practice as costly as possible is indisputable. The director of Tobacconomics has argued in favour of making the most of the 'untapped potential for cigarette tax increase to raise revenue for Covid-19 recovery'. This is equally true for Bangladesh in order to avoid tobacco-related deaths and 'promote a healthy and productive workforce.'

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.