Published :

Updated :

The equity market has recently been receiving fresh inflows of investment from foreign investors as macroeconomic indicators started showing signs of economic recovery and the forex market attained stability.

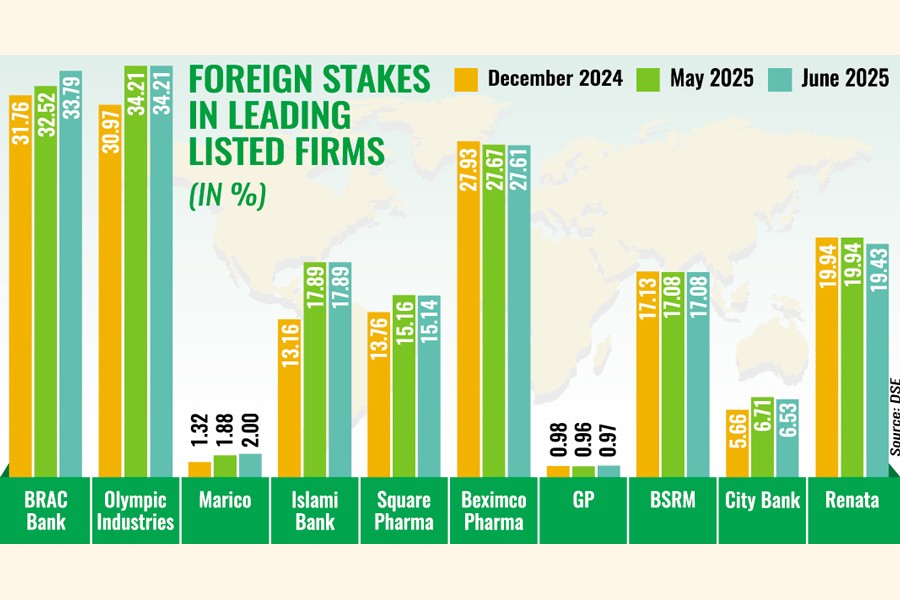

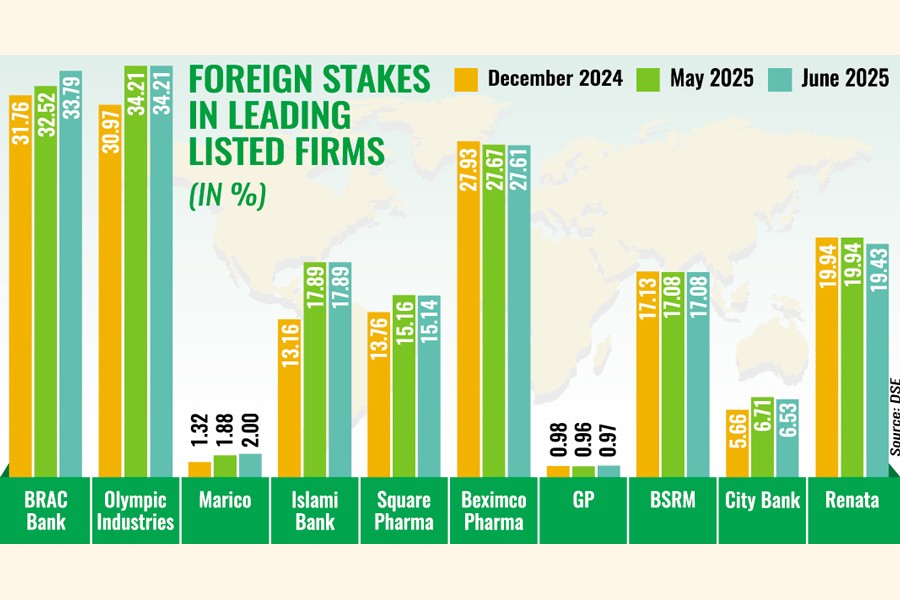

Stocks, which are lucrative to overseas investors, saw foreign stakes go up by June this year from the holdings six months back.

Foreign equity investments more than doubled year-on-year to $304 million in the January-March quarter this year, according to data from the central bank.

Fund managers expect the exchange rate to remain stable, supported by interventions from the central bank, and the forex market stability, according to them, will in turn draw further foreign investments into equities.

"The renewed interest in the securities is largely driven by stability in the forex market, supported by healthy foreign exchange reserves and ongoing reforms across the economy," said Akramul Alam, head of research at Royal Capital.

When the exchange rate is volatile, there is a risk of unexpected decline in the value of assets of foreign investors even if stocks remain unmoved on the bourses.

Mr Alam also pointed out that attractive valuation of blue-chip stocks after prolonged correction inspired fresh fund injection in the equity market.

The central bank has been allowing a fully-flexible exchange rate since May this year, with limited interventions to mitigate excessive volatility and reinforce stability. Under the new regime, the interbank taka-dollar rate settled at Tk 122.77 in June, with depreciation moderating to 3.89 per cent in FY25 from 8.17 per cent in FY24.

That means if a foreign investor invested $1 in a stock a year back, he/she witnessed a 3.89 per cent reduction in the value of the asset by the end of the year in June.

Mir Ariful Islam, managing director & CEO of Sandhani Asset Management, said the foreign exchange market had been gaining strength, with a rise in inbound remittance and stronger export earnings.

The central bank has also made a move to align the local currency with market fundamentals, inspiring foreign fund managers to put fresh funds in stocks.

If the local currency strengthens further against the US dollar and equity prices go up, foreign investors will benefit in both ways --- capital gain and exchange gain, Mr Islam explained.

Meanwhile, higher remittance inflow over the last few months provided a breather for the country. On the other hand, the availability of dollars allowed foreign investors to repatriate profits more smoothly than before.

Remittances hit a record high of $30.3 billion, growing 26.8 per cent year-on-year in FY25, supported by a competitive market-driven exchange rate, tighter controls on unofficial channels, and better access to agent banking and mobile financial services.

Exports expanded 8.6 per cent year-on-year to $48.3 billion in FY25, aided by strong RMG demand and solid growths in exports of leather, footwear, and plastic products.

The regulatory actions to establish good governance are also thought to have played a role in boosting confidence of foreign investors in growth companies, according to Mr Alam of Royal Capital.

The central bank's ongoing efforts to clean up the banking sector through asset quality reviews, resolution frameworks, and governance overhauls, aimed at bringing down non-performing loans, have helped regain trust, he added.

When it comes to investing in stocks of Bangladesh, foreigners are mostly interested in well-governed companies that have successfully secured a profit growth even in an adverse business climate.

BRAC Bank, the largest private commercial bank in terms of profitability, witnessed its foreign stake increase from 31.76 per cent in December last year to 33.79 per cent in June this year.

BRAC Bank earned a record consolidated profit of Tk 14.32 billion in 2024, securing a significant 73 per cent year-on-year growth driven by substantial income from investments in government securities.

Foreign shareholdings in Islami Bank rose to 17.89 per cent in June this year from 13.16 per cent six months back. After the political changeover in August last year, the bank's board has been restructured, removing representatives of S Alam Group responsible for high default loans of the bank. There is optimism about the recovery of the lender's financial health.

Olympic Industries experienced a similar trend. Its foreign stake moved up to 34.21 per cent in June from 23.97 per cent in December last year.

Meanwhile, BB Governor Ahsan H Mansur kept the policy rate unchanged at 10 per cent for the first half of FY26, aiming to curb inflation, stabilize the exchange rate, and strengthen financial stability.

"We anticipate a better trade situation over export and remittance growth over a flexible exchange rate. As economic activities rebound, import could also pick up pace going forward," said BRAC-EPL Stock Brokerage in a recent market analysis.

Meanwhile, the equity market gained momentum, with the benchmark index hitting 10-month-high last week. Market turnover also surpassed Tk 11 billion after a year.

However, prevailing political uncertainty may continue to weigh on investor sentiment, prompting a cautious approach.

Good governance and listing of reputable companies are a must to attract more foreign funds into the equity market, said Mr Islam.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.