Published :

Updated :

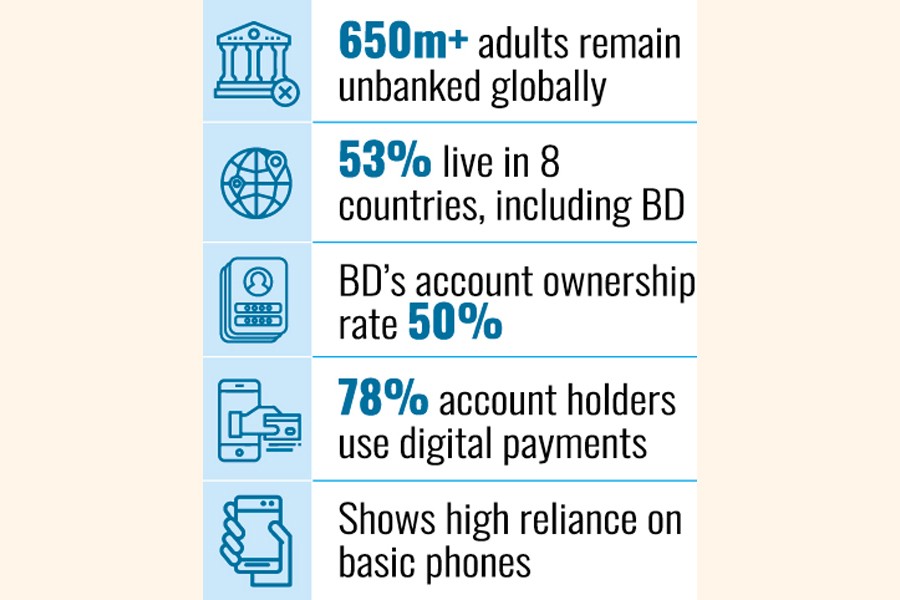

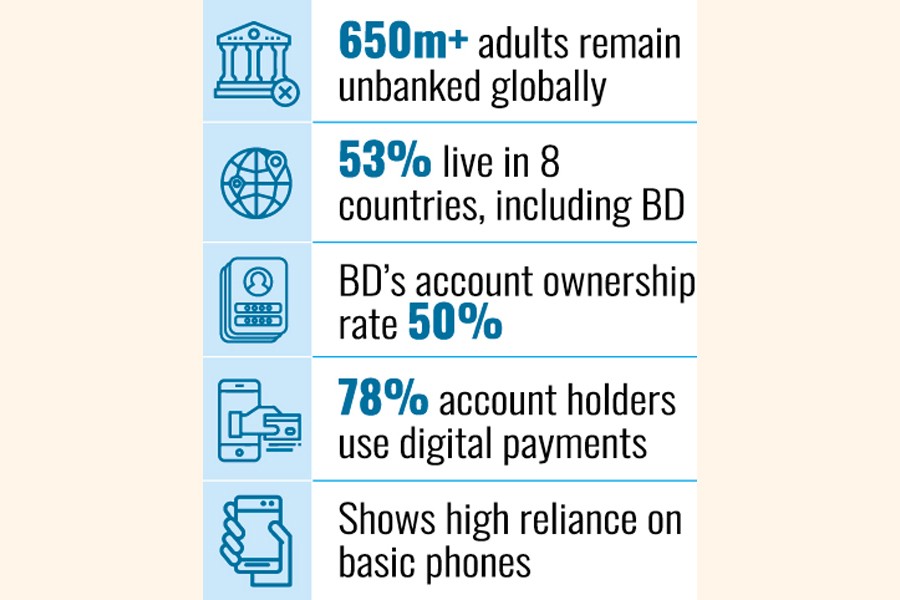

More than half of the world's adults without financial accounts live in eight countries, including Bangladesh, according to the latest Global Findex 2025 report published by the World Bank (WB).

The report reveals that over 650 million adults, or 53 per cent of the global population without financial accounts, are concentrated in eight large economies -- Bangladesh, China, Egypt, India, Indonesia, Mexico, Nigeria, and Pakistan.

These countries either have large populations, relatively low levels of financial inclusion, or both.

The report explains that a country with many people can have a high account ownership rate but still have many without accounts. For example, China and India have nearly 90% account ownership but still have the most unbanked adults because of their large populations.

In contrast, countries like Bangladesh, Egypt, and Pakistan have both large populations and low financial inclusion, with account ownership rates of around 50 per cent. This highlights a persistent challenge in expanding access to formal financial services in these regions.

The World Bank also pointed out that unbanked adults are more likely to have low incomes and are disproportionately women, indicating a clear gender gap in financial inclusion.

The report draws attention to digital connectivity as another key factor. Although some adults in every country lack access to mobile phones, a significant portion of the global unconnected population lives in South Asia and Sub-Saharan Africa.

In these regions, mobile phone account ownership rates are still below 85 per cent, especially in large-population economies such as Bangladesh, Egypt, Ethiopia, India, and Pakistan.

A significant gender gap in mobile account ownership is also evident in South Asia. In Bangladesh, the gap between men and women is 20 percentage points, while in Pakistan, it is as high as 30 percentage points -- both figures far exceeding the global average.

The report notes that in countries like India, Nepal, and Sri Lanka, the gender gap is not statistically significant, but Bangladesh and Pakistan continue to face deep inequality in digital access.

When it comes to digital payments, the disparity continues. South Asia remains the region with the lowest share of digital payment use among account holders. Only 57 per cent of account holders in the region made or received digital payments -- compared to over 80 per cent in most other regions.

Still, some variation exists within South Asia. In Bangladesh, 78 per cent of account owners made or received digital payments, while in Pakistan, the figure stands at 90 per cent. However, Pakistan's high usage rate comes from a much smaller base, as only 23 per cent of adults there have an account.

Gender-based differences in digital payment use are also notable. In South Asia, women are 15 percentage points less likely than men to use digital payments. In Bangladesh, India, and Sri Lanka, the gap is about 13 points, while Nepal and Pakistan show even larger disparities -- over 20 percentage points.

The World Bank also explored barriers to account ownership. In countries like Bangladesh, Ethiopia, Nigeria, and the Philippines, unbanked adults were surveyed about the reasons behind not having either a bank account or a mobile money account. Key barriers included lack of documentation, irregular income, and low mobile phone access.

The report further highlighted that Bangladesh is the only Asian country among the 18 with the largest number of basic mobile phone users -- the remaining 17 are in Sub-Saharan Africa. Other South Asian nations like India, Pakistan, and Sri Lanka also have a considerable share of basic phone users.

The Global Findex Database, launched in 2011, is the world's most comprehensive demand-side dataset on financial inclusion. It tracks how adults around the world access, use, and interact with financial services, from digital payments to borrowing, saving, and account ownership.

kabirhumayan10@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.