Published :

Updated :

Brokerage firms have been given two more months until August 31 to install uniform, tamper-proof back-office software -- a mechanism deemed crucial to prevent digital fraud meant to embezzle investors' money.

The stock market regulator at a meeting on Thursday extended the time following requests from the Dhaka Stock Exchange and the Chittagong Stock Exchange.

The Bangladesh Securities and Exchange Commission (BSEC), however, set different deadlines within the extended timeframe for brokers to complete the installation of the intended software.

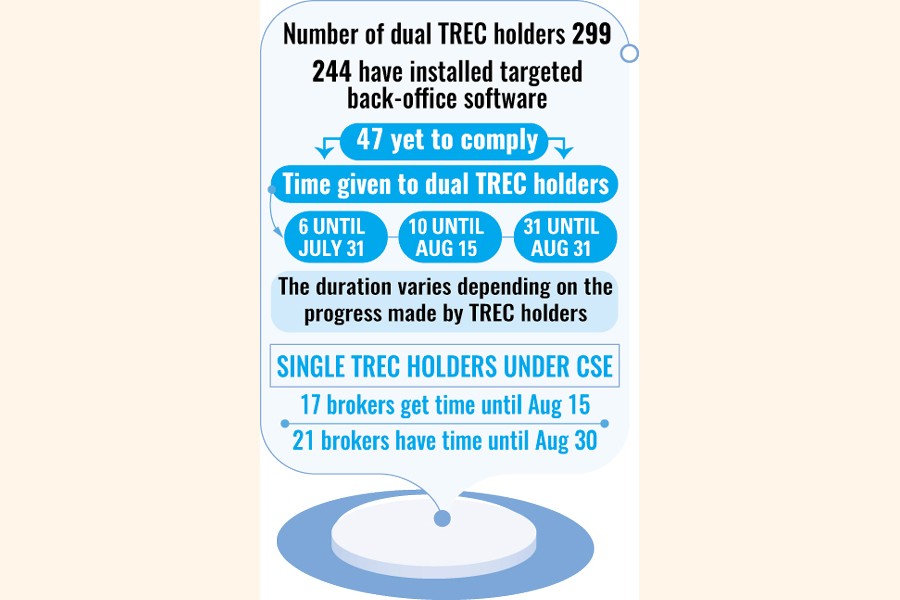

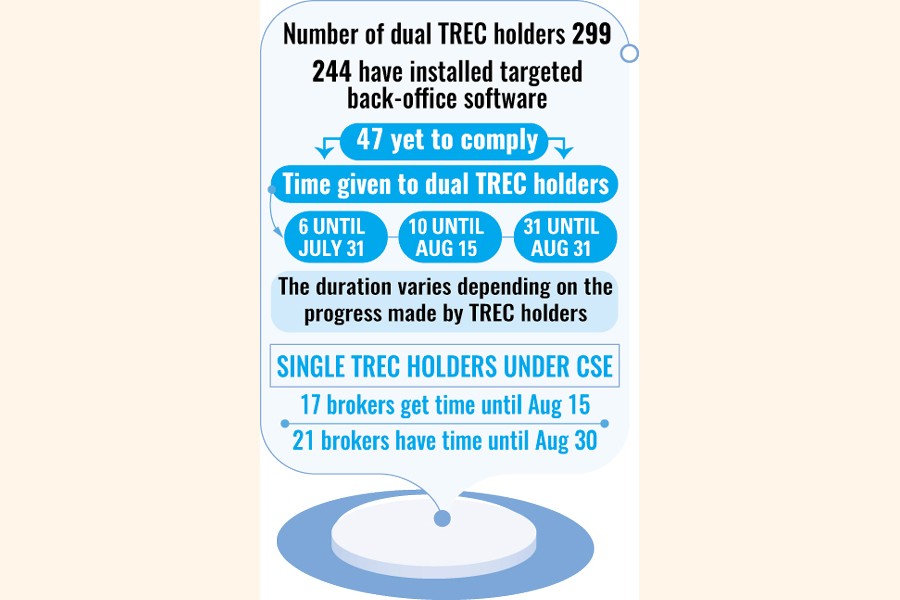

According to the BSEC statement, out of 299 dual TREC [trading rights entitlement certificate] holders, 244 have already installed the targeted back-office software, while 47 are in the process to comply with the requirement.

Of the 47 dual TREC holders, 6 TREC holders have time until the end of this month to install the uniform software, 10 others have to install the software by August 15, while the remaining 31 will have more time -- until August 31 -- to ensure their full operation using the software upon installation.

In the port city bourse, out of 82 single TREC holders, 42 have already installed the software. Of the remaining TREC holders, 17 brokers have time until August 15 while 21 brokers have time until August 31 to become fully operational with tamper-proof software.

The separate deadlines have been recommended by the DSE and the CSE, according to the BSEC statement.

This is the fourth-time extension as the previous deadline expired on June 30. The initial deadline for installing un-editable back-office software was April last year. It was then extended thrice on requests from the bourses.

In February 2022, the prime bourse formulated guidelines for the installation of the software on receiving a directive from the securities regulator against the backdrop of fund embezzlement by several firms.

Embezzlement and mismanagement of clients' funds by brokers have remained long-standing unresolved problems.

While using in-house back office software, many unscrupulous brokers manipulated data relating to trade and transactions so that it could move away money keeping clients in oblivion.

Major scams so far involved Crest Securities, Dawn Securities, Tamha Securities, Banco Securities, and Shah Mohammad Sagir & Company which siphoned off as much as Tk 3 billion altogether between 2019 and 2021.

The misappropriation of funds and shares by Moshihor Securities is the latest scam exposed in August last year. Trading at the firms has remained suspended.

The brokerage firms defrauded investors by illegally using duplicate back-office software and providing fake information on their investment status.

No effective measure has been taken for refunding the money.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.