Special facility for legalising illicit money likely to continue

Published :

Updated :

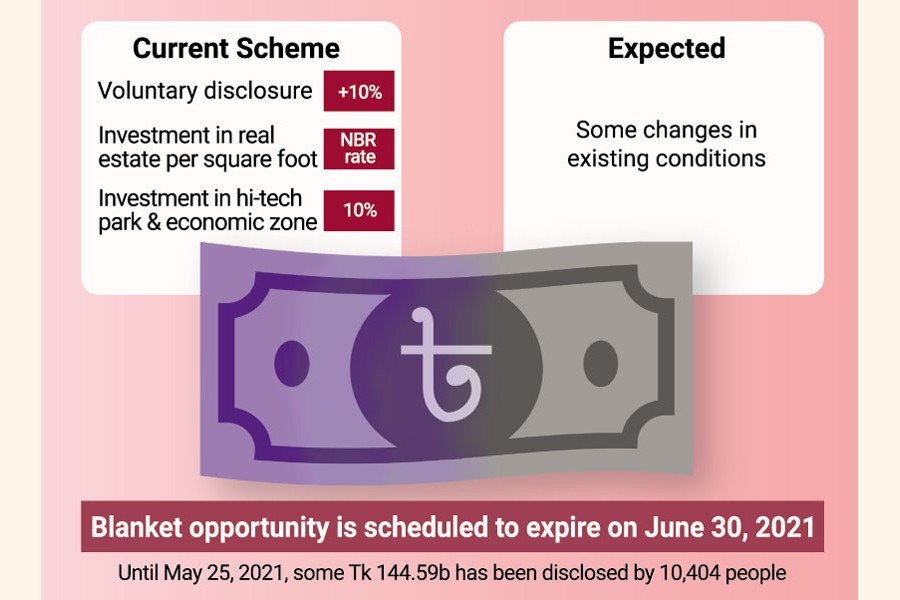

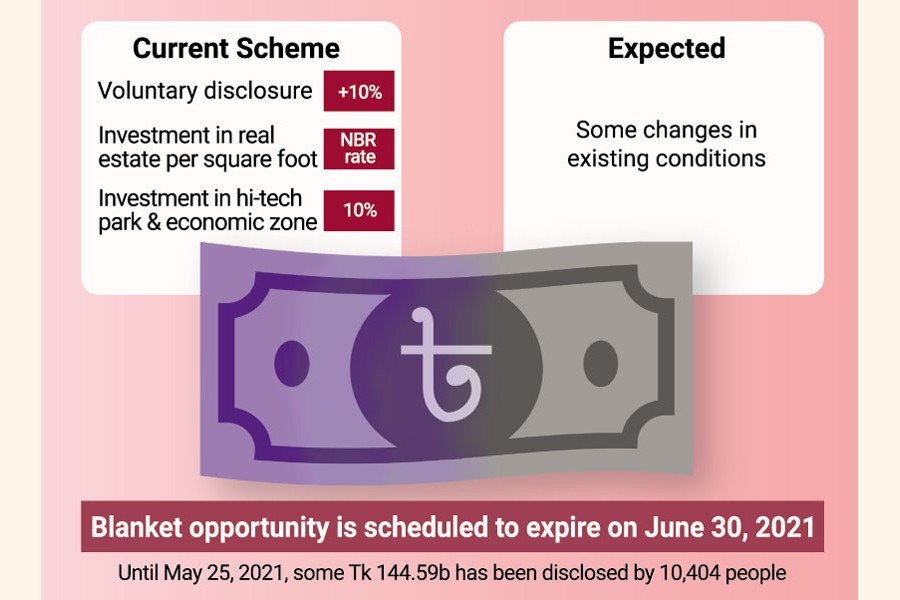

The special facility given to legalise undeclared income is likely to continue in the upcoming fiscal year (FY) 2021-22 with some amendments.

The government offered the opportunity for the outgoing FY only in a bid to 'check capital flight and bring undisclosed money into the formal channels of the economy'.

Officials concerned said there could be some changes in the conditions attached to theopportunity in the upcoming fiscal year (FY), 2021-22 with a view to ensuring justice for the regular taxpayers.

The existing provision of declaring undisclosed money as cash, share, debenture, in real estate and other areas is scheduled to expire on June 30 next. One can legalise funds paying tax at a nominal rate of 10 per cent and any relevant government agency is barred from asking any question about the source/s of such tainted money.

Sources said the provision relating to the continuation of the illegal fund whitening opportunity is likely to be incorporated in the Finance Bill-2021 before its adoption.

The finance bill, which was placed in parliament on June 03, does not have any such provision of extending or continuing the opportunity through paying the flat rate of tax.

The government high-ups are yet to decide whether it will bring any change in the flat rate of tax for FY22.

Final decision on the areas that would be opened for investment of undisclosed income and applicable rate of taxes will be finalised shortly, according to the sources.

In the budget speech, finance minister AHM Mustafa Kamal did not mention anything about the continuation of the opportunity.

However, in the post-budget press conference, he sounded positive about its continuation only if he finds any encouraging response.

People concerned have formalised this year a record amount of undisclosed income, almost equivalent to the total amount whitened in the past 15 years, according to the National Board of Revenue (NBR).

Until May 25, some 10,404 people legalised undisclosed funds availing the blanket opportunity offered on July 01, 2020.

An estimated Tk 144.59 billion has been formalised under the opportunity, contributing Tk 14.45 billion in taxes to the public exchequer.

The taxpayers' response is impressive this year than that from 2005-06 to 2019-20 when a total of Tk 145.95-billion undisclosed income was shown in tax returns.

Currently, three forms of money-whitening provision are available in the Income Tax Ordinance-1984.

They are voluntary disclosure of income by paying 10-per cent tax in addition to normal tax rate, investment in real estate by paying tax at an NBR-prescribed rate based on per-square foot and investment in hi-tech park and economic zones until June 30, 2024, by paying 10-per cent tax.

Officials said almost none of the taxpayers show their interest to formalise money under those schemes, forcing the government to offer blanket opportunity at a flat tax rate and without asking any question.

After the budget speech, economists and think-tanks appreciated the government's move to discontinue the blanket opportunity having a lower rate of taxes compared to that paid by honest taxpayers.

Businesses said regular taxpayers are paying tax at a rate of 25 per cent while people with undisclosed money are getting the opportunity to pay tax at 10 per cent on their income.

doulot_ater@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.