Brokers seek deadline push for tamper-proof software rollout

BABUL BARMAN and FARHAN FARDAUS

Published :

Updated :

The DSE Brokers Association (DBA) seeks two more months to ensure the installation of tamper-proof back-office software by all brokers -- a mechanism deemed crucial to prevent digital fraud meant to embezzle investors' money.

The deadline after the third-time extension was June 30.

The DBA claimed that software vendors chosen by the securities regulator were dealing with resource limitations, which was why they could not provide enough support to brokers in the software installation and implementation drive.

Also, last month's extended Eid holidays and other public holidays have slowed down the progress in software operation, said Saiful Islam, president of the DBA, in a letter to the Dhaka Stock Exchange (DSE).

Mr Islam mentioned that all brokerage firms had already signed agreements with vendors approved by the Bangladesh Securities and Exchange Commission (BSEC).

The initial deadline for installing un-editable back-office software was April last year. It was then extended thrice on requests from the DSE and the DBA.

BSEC spokesperson Md Abul Kalam confirmed that the market watchdog received an application for time extension. The decision will be taken in the next commission meeting, he said.

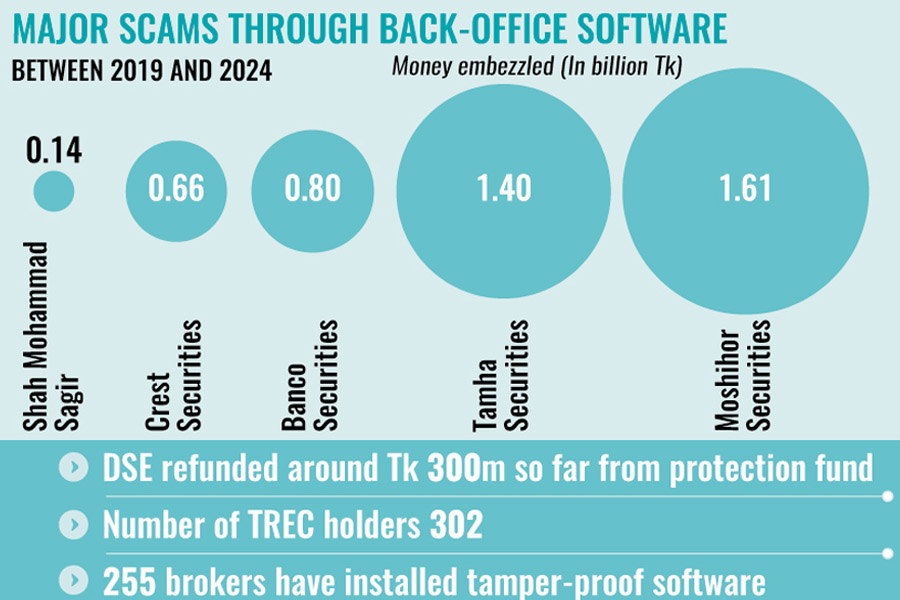

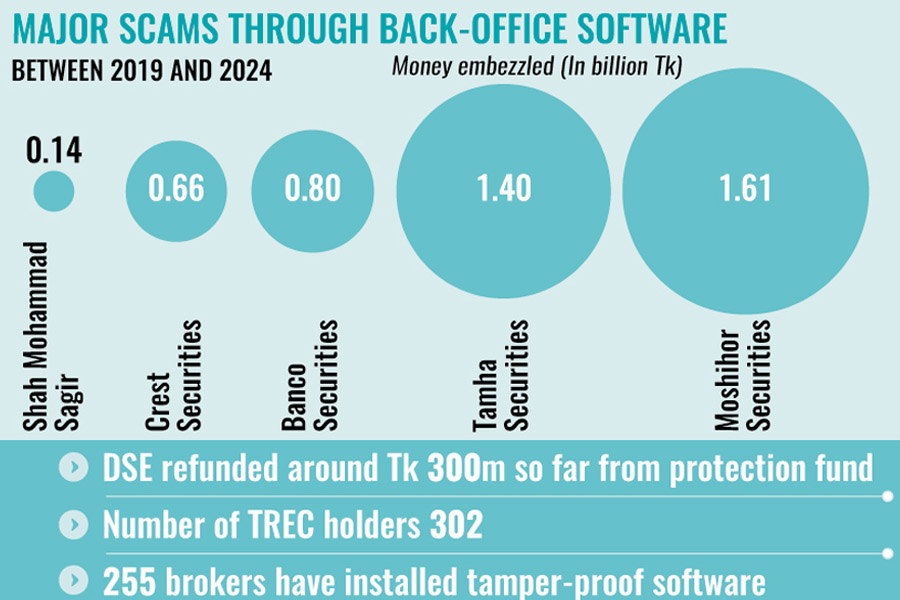

According to DSE officials, out of 302 TREC [trading rights entitlement certificate] holders, 255 have already installed the targeted back-office software, while the rest are in the process to operationalise the software.

Brokerage firms will have to ensure full operation using the software upon its installation. The securities regulator will inspect brokerage firms from time to time, as per the BSEC guidelines. The organisations, which have already been using software as suggested by the regulator, must obtain a certificate from the stock exchanges.

The back office of a stock broker keeps data stored of clients' assets, transactions, cash balance, and deposit balance.

While using in-house back office software, many unscrupulous brokers manipulated data relating to trade and transactions so that it could move away money keeping clients in oblivion.

The enlisted software vendors are expected to provide uniform services to stockbrokers to ensure security of investors' money and assets.

In February 2022, the prime bourse formulated guidelines for the installation of the software on receiving a directive from the securities regulator against the backdrop of fund embezzlement by several firms.

Embezzlement and mismanagement of clients' funds by brokers have remained long-standing unresolved problems.

Major scams so far involved Crest Securities, Dawn Securities, Tamha Securities, Banco Securities, and Shah Mohammad Sagir & Company which siphoned off as much as Tk 3 billion altogether between 2019 and 2021.

The misappropriation of funds and shares by Moshihor Securities is the latest scam exposed in August last year. Trading at the firms has remained suspended.

The brokerage firms defrauded investors by illegally using duplicate back-office software and providing fake information on their investment status.

Some other brokerage firms siphoned off huge amounts of money from the consolidated customers' accounts maintained for trading.

The financial crimes took place in the absence of strict monitoring by the prime bourse and the securities regulator, market analysts say.

No effective measure has been taken for refunding the money.

The new securities commission formed after the ouster of the previous government has been working to bring necessary reforms for the sustainable development of the capital market and punish those involved in irregularities to ensure transparency and accountability of the stakeholders.

babulfexpress@gmail.com

farhan.fardaus@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.