Published :

Updated :

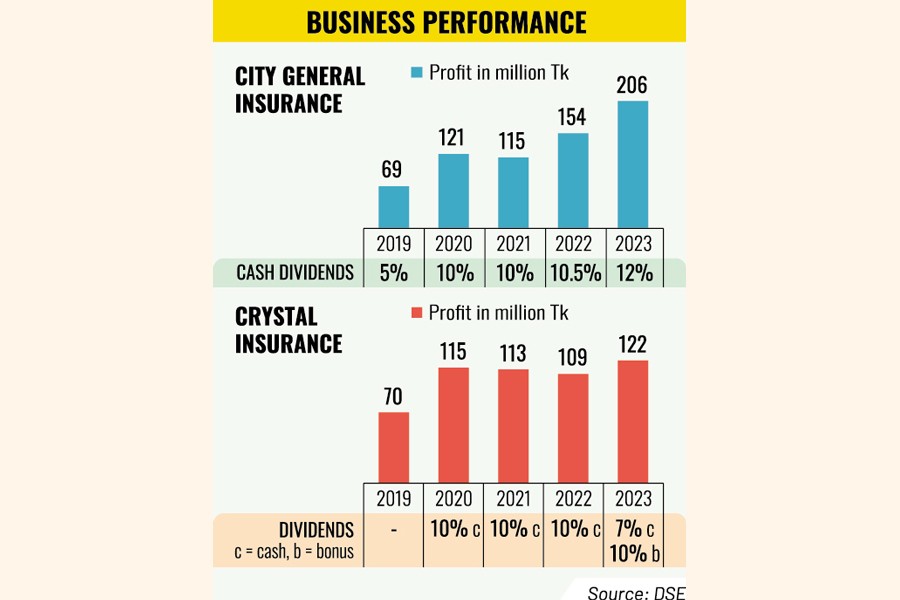

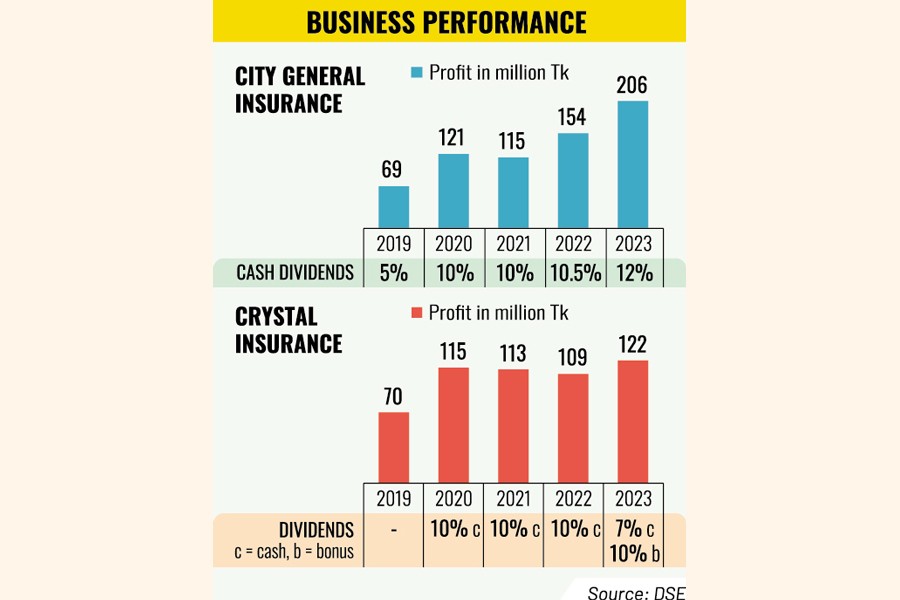

Two general insurers -- City General Insurance and Crystal Insurance -- have recorded significant profit growth in 2023, buoyed by improved underwriting performance and higher interest income.

The City General Insurance witnessed a 34 per cent surge in profit year-on-year to Tk 206 million in 2023, up from Tk 153 million a year before. Similarly, Crystal Insurance's profit jumped 12 per cent to Tk 122 million in 2023, according to separate disclosures on Monday.

The City General Insurance saw a profit surge as its underwriting profit and other income rose significantly, said its acting company secretary Mohammed Ashaduzzaman Sarkar.

In Bangladesh, general insurance companies do business mainly in three segments -- fire, transport and marine.

Persistent macroeconomic challenges, strong dollar, and runaway inflation hit the general insurers business, but higher interest income might have helped their profit grow, according to industry insiders.

As the bank interest rate is rising, the income of cash-surplus insurance companies is also growing, said a leading broker.

The Bangladesh Bank (BB) removed the interest rate cap and replaced it with a market-driven reference rate, which is regulated by the six-month average treasury bills rate, effective from July 1 last year.

"The higher interest generally helps increase the cash-surplus insurance industry's financial income," the broker added.

City General Insurance

Based on the profit growth, the board of directors of City General Insurance declared a 12 per cent cash dividend for the year ended on December 31, 2023.

The general insurer will hold its annual general meeting on March 28 and the record date for entitlement of dividend is on March 12.

The insurer's earnings per share (EPS) reached Tk 3.02 in 2023 as against Tk 2.25 in the year before, according to its audited financial statements.

Its net asset value per share stood at Tk 20.40 and net operating cash flow per share at Tk 2.53 for the year ended December 31, 2023 as against Tk 18.57 and Tk 5.59 respectively for 2022.

However, the company is yet to disclose the details of audited financial statements for 2023.

Listed in 2007, its stock price rose 1.74 per cent to close at Tk 69.80 on Monday.

In 2022, the company paid 10.50 per cent cash dividend.

Crystal Insurance

The Crystal Insurance Company recorded a 12 per cent increase in profit year-on-year to Tk 122 million in 2023, up from 109 million a year before.

Thus, earnings per share rose to Tk 3.05 from Tk 2.72.

The insurer, however, saw a 71.38 per cent fall in net operating cash flow per share to Tk 1.74 in 2023 from Tk 6.08 in 2022.

The company attributed a decrease in premium collections and a rise in claim payment to the cash flow slide.

On Monday, its board meeting recommended a 7 per cent cash and 10 per cent stock dividend for 2023.

The company declared a stock dividend along with cash dividend for the purpose of the company's modernisation and expansion and utilization of such retained amount as capital, the company said in its earnings note.

The company declared such stock dividend out of the retained earnings.

The final approval of the dividend will come at the annual general meeting scheduled for March 31 and the record date is set on March 12.

In 2022, the company paid a 10 per cent cash dividend.

Its stock price, however, plunged 4.87 per cent to Tk 111.30 on Monday.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.