DSE slips back into the red as policy rate hike deflates investor enthusiasm

"If the country's macroeconomic stability returns, the stock market will be benefited in the long-term"

Published :

Updated :

Stocks ended in the red on Tuesday after rising for two consecutive days, as investors' enthusiasm was deflated by the latest policy rate hike.

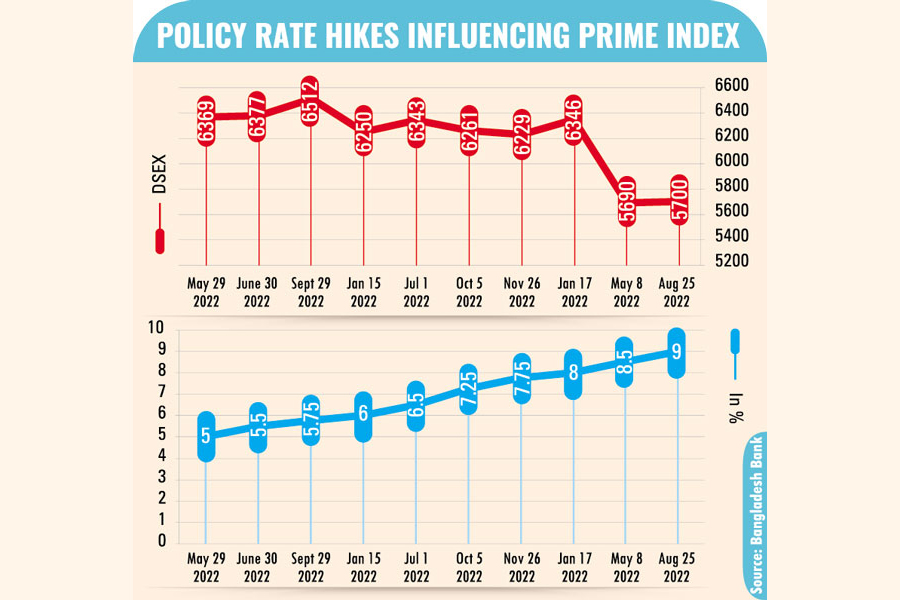

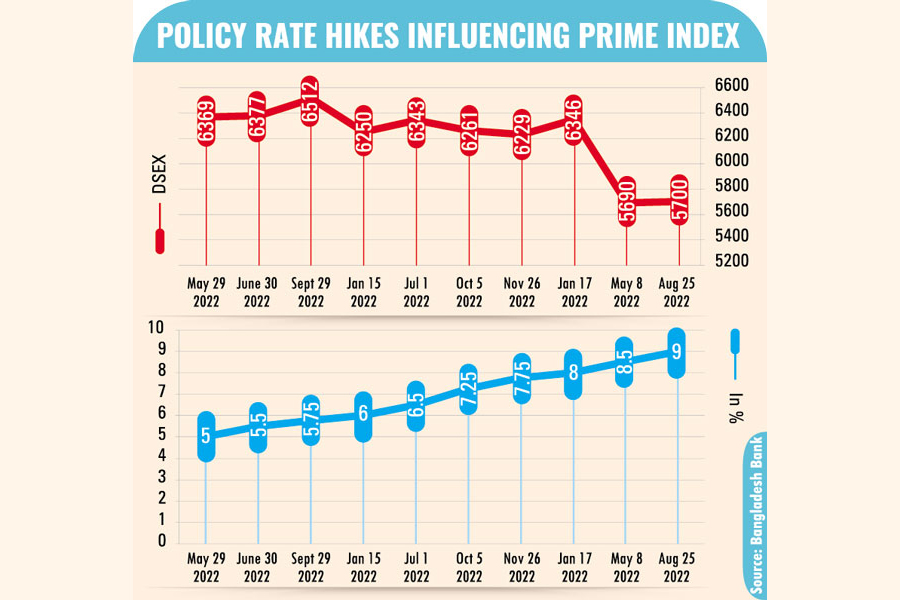

The policy rate's rise by a further 50 basis points amid a tightened monetary space heightened concerns over market outlook, market experts said.

The increase in the overnight borrowing interest rate at which the Bangladesh Bank lends money to commercial banks is feared to drive up overall borrowing costs.

Higher interest rates have already turned fixed-income instruments more lucrative compared to the stock market. So, a further rise in the rates exacerbated the situation.

The Bangladesh Bank on Sunday pushed the policy rate up to 9 per cent, in line with the interim government's commitment to curbing inflation-fuelled price rises.

Following the news, the market opened sharply lower in the morning and shed more than 56 points within the first 90 minutes of trading. However, the rest of the session recovered three-fourth of the initial losses.

The DSEX, the prime index of the Dhaka Stock Exchange, finally settled at 5,685, losing almost 15 points or 0.26 per cent on Tuesday. It had gained 94 points in the past two sessions.

The index's recovery in the latter part of the day happened after the United Kingdom showed interest in assisting in the reform process of the capital market alongside banking and revenue sectors.

"Reforms to these sectors are an immediate concern for us as our work would be more difficult unless we bring reforms," said Finance Adviser Dr Salehuddin Ahmed at a meeting.

Price fall of selective blue chip stocks, such as Islami Bank, Grameenphone, BAT Bangladesh, Square Pharmaceuticals, and National Bank contributed largely to Tuesday's market plunge.

They jointly accounted for 21-point index fall, after substantial gains in the past few sessions.

Islami Bank's share fell 3 per cent, bringing down the index by 8 points alone. It had gained 36 per cent since the ouster of the Hasina-led government on August 5.

GP, the largest stock in terms of market cap, lost 2.1 per cent, leading to 4.4-point index fall.

On the other hand, price surges of Beximco Pharma, Beacon Pharma, MJL Bangladesh, Khan Brothers, and Delta Life accounted for an 18 point-rise of the index.

The blue chip index DS30, a group of 30 prominent companies, saw a fractional loss of 0.66 point to 2,087.

Cautious investors opted to sell their shares to pocket short-term profits after the latest policy rate hike by the central bank, said Md Sajedul Islam, managing director of Shyamol Equity Management.

The policy rate hike may reduce the fund flow to the stock market for a short-term.

The lending rate may go up initially, said Mr Islam.

Market-based rates, however, are necessary to reduce inflationary pressure and restore macroeconomic stability. "If the country's macroeconomic stability returns, the stock market will also be benefited in the long-term," Mr Islam added.

According to EBL Securities, stocks failed to remain buoyant as sellers ended up on the dominant side for an uncertain market outlook amidst a weakened market momentum.

Meanwhile, the market turnover surged 34 per cent on Tuesday to Tk 7.50 billion from the previous day as investors were active on both sides of the trading fence.

The food sector dominated the turnover chart, capturing 22 per cent of the day's total turnover, followed by pharmaceuticals 21 per cent and banking 18 per cent.

Major sectors showed negative performance. The telecom sector saw the highest correction of 2.2 per cent, followed by non-bank financial institutions 1.4 per cent, food 0.4 per cent and banking 1.2 per cent.

Losers outnumbered the gainers. Out of 395 issues traded, 231 closed in the red, 131 saw price appreciation while 33 issues remained unchanged on the DSE floor.

Olympic Industries became the most-traded stocks, with shares worth Tk 371 million changing hands, closely followed by Grameenphone, Orion Pharma, BRAC Bank, and MJL Bangladesh.

National Life Insurance was the top gainer, rising almost 10 per cent, while Islami Bank the worst loser, enduring a 3 per cent correction.

The Chittagong Stock Exchange also went back into the red, with its All Shares Price Index (CASPI) shedding 107 points to 16,261 and the Selective Categories Index (CSCX) losing 64 points to 9,800.

Of the issues traded, 151 declined, 53 advanced, and 15 others remained unchanged on the CSE.

The port city bourse traded 11.4 million shares and mutual fund units, leading to a turnover of Tk 2.23 billion.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.