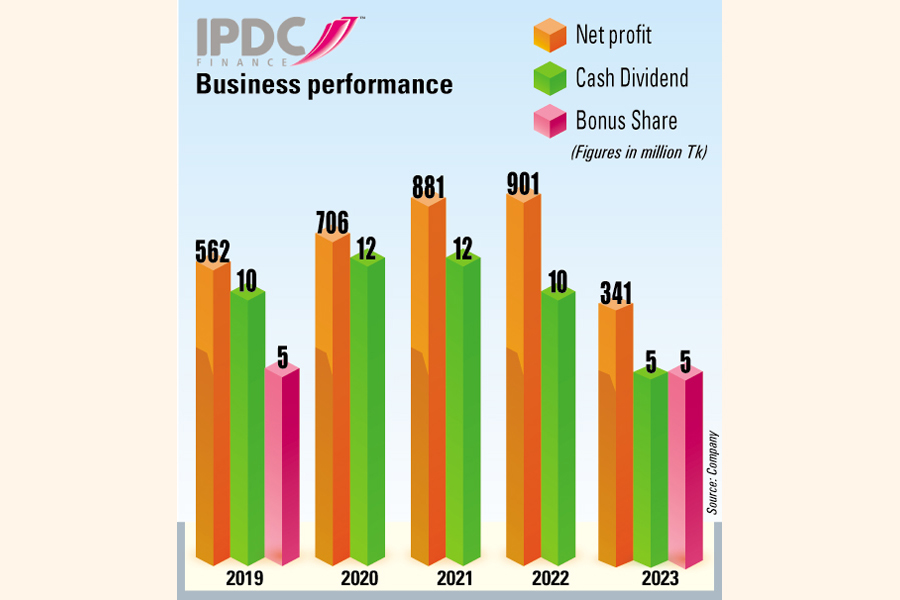

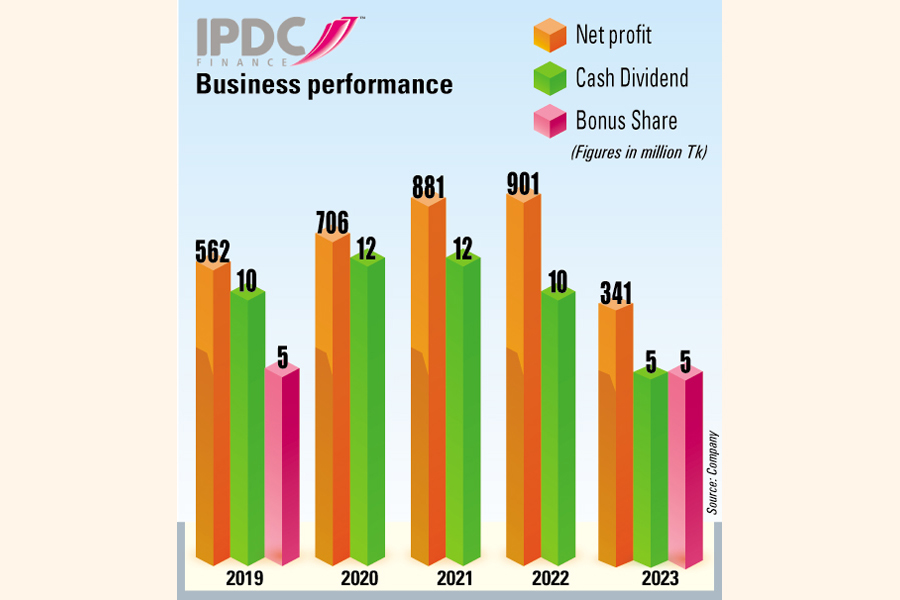

IPDC Finance's profit hits seven-year low in 2023

It declares 5pc cash, 5pc stock dividends

Published :

Updated :

IPDC Finance, a leading non-bank financial institution, has reported a net profit of Tk 346 million, the lowest in seven years, for the year 2023, largely due to higher provisions against loans and a decline in income from the stock market.

Even the non-bank financial institution (NBFI) registered a 62 per cent decrease in its net profit for 2023, compared to the previous year's profit of Tk 901 million.

As a result, the company's earnings per share (EPS) plummeted to Tk 0.92 in 2023, down from Tk 2.43 the year prior, according to its price sensitive information published on Thursday.

The company will hold its annual general meeting (AGM) on May 16 and the record date is on April 24.

IPDC Finance’s loans and advances grew by 3.6 per cent year-on-year to Tk 70.57 billion in 2023.

Company Secretary Samiul Hashim said considering the adverse market scenario characterized by higher inflationary pressure, struggling foreign exchange reserves along with lower private sector credit growth, management has prudently opted for conservative growth strategy in 2023 to minimize any potential future losses.

The company’s year-on-year revenue has dropped by 10.44 per cent and stood at Tk 2.91 billion. The operating profit dropped by 25.8 per cent to Tk 1.30 billion and net profit dropped 61.6 per cent to Tk 346 million in 2023.

“The drop in profitability is largely attributed to lower spread due to interest rate caps along with increasing non-performing loan trend,” said Mr Hashim, adding that the management has kept the NPL management among top priorities and revamped the collection process to keep the NPL at an acceptable level.

Despite these financial challenges, the board of directors has recommended a 5 per cent cash and a 5 per cent stock dividend for 2023. In 2022, the company paid out a 10 per cent cash dividend.

The stock dividend has been declared so that the retained amount can be utilised to support smooth operational cash requirement as well as portfolio growth, said the company in its earnings note.

Also, the company has declared a stock dividend out of its accumulated profit or retained earnings.

“Stock dividend has been recommended to strengthen the capital base of the company for supporting future business growth as well as higher loans portfolio growth aspirations in 2024,” said the company.

Listed in 2006, IPDC's stock price experienced a notable surge of 9.79 per cent to close at Tk 25.80 on Thursday, compared to the previous day.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.