Kohinoor Chemicals rides on brand value to take the lead among peers

Published :

Updated :

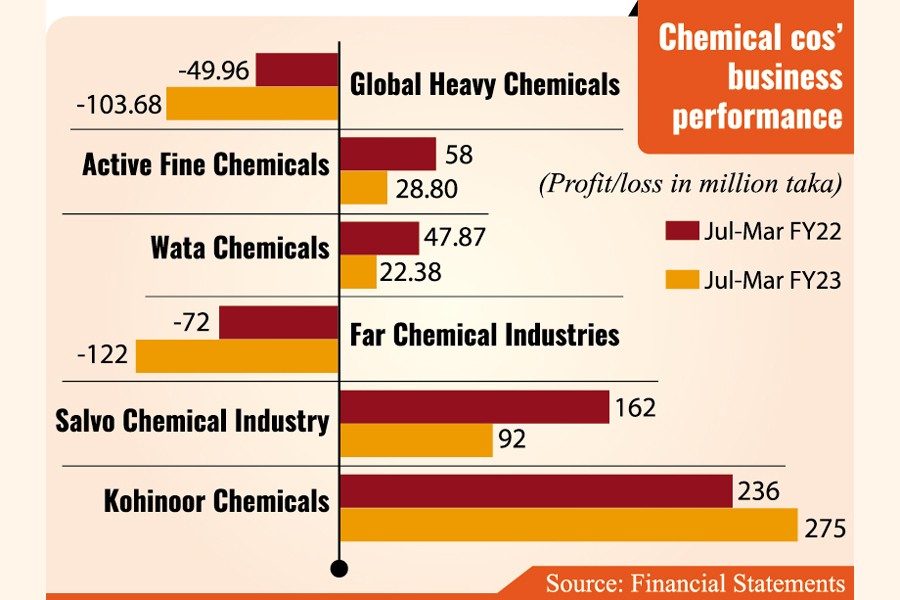

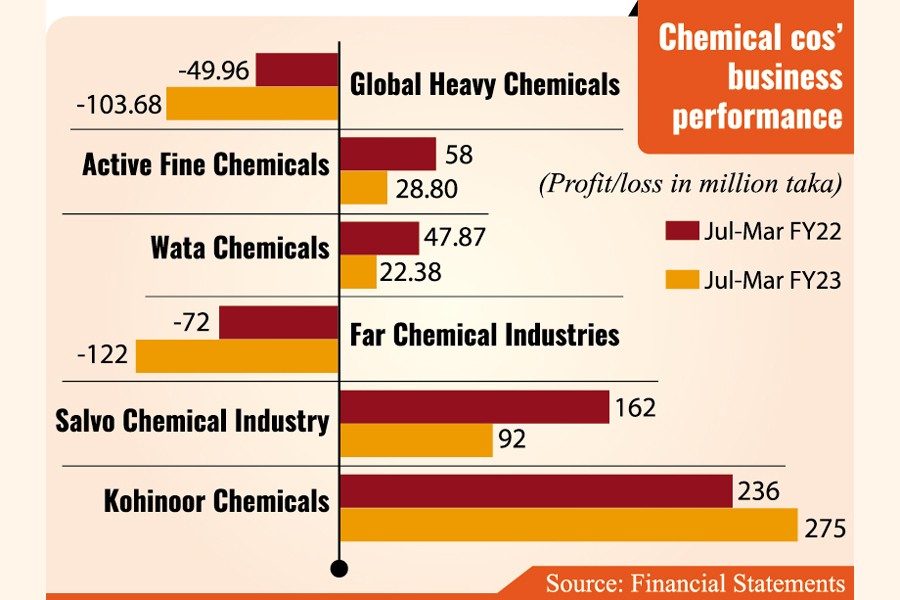

Kohinoor Chemicals stands out among six chemical manufacturers by securing a growth in profit in the nine months to March while the rest either saw profit decline or endured a loss.

The success story of Kohinoor is a very predictable one. Its brands, such as Sandalina, Ice Cool, Fast Wash, and Bactrol are popular household names among the middle class and rural people of the country. Besides, most of its products are known by the legendary brand name Tibet.

Hence, Kohinoor experienced a 16 per cent growth in sales year-on-year to Tk 1.33 billion in the January-March quarter this year when five other companies saw the demand for their products dwindle.

All businesses were hit hard during the period by costlier raw materials, the stronger dollar, and energy price hikes.

Still, Kohinoor Chemicals, one of the oldest manufacturers of soaps, cosmetics, and toiletries, gained a 3 per cent year-on-year growth in profit to Tk 102 million in the latest quarter, thanks to higher sales and increased selling prices.

The adversities affected the overall profitability of Kohinoor and other listed chemical manufacturers.

They had difficulties in opening letters of credit. In the meantime, prices of raw materials at home and abroad went up by around 30-90 percent. Then gas and electricity price hikes added to the additional cost of production.

As a result, profit of Active Fine Chemicals, Salvo Chemicals, and Wata Chemicals dropped sharply, while losses of Far Chemical and Global Heavy Chemicals more than doubled year-on-year in the three months through March this year.

Their business performance shows a similar trend in the nine months through March.

Kohinoor had the advantage of being the sole company in the group that manufactures products and sells those, instead of chemicals.

Chemical manufacturers, which mainly sell to local small and medium enterprises (SMEs), have been facing a sharp fall in sales since the beginning of the Russia-Ukraine war last year.

On top of that production was severely hampered by gas and power disruptions.

The listed companies also fell victim to an unhealthy competition created by abusive usage of the bonded warehouse facility, under which exporters import raw and packaging materials without paying any duty.

Many of these exporters sell imported chemicals at cheap prices in the local market, snatching profits from local chemical manufacturers, say industry insiders.

Salvo Chemical Industry, which produces sulphuric acid, sulphate, battery-grade water and glucose, reported a 64 per cent decline in profit to Tk 27 million in January-March this year, compared to the same period a year ago, despite higher sales revenue.

Company secretary Liton Kumar Roy said production costs had jumped due to high raw material prices at home and aboard. Moreover, devaluation of the local currency against the dollar, energy price hike and a depletion of non-operating income impacted the profit growth.

The company's sales revenue rose 41 per cent to Tk 422 million in the January-March quarter while the cost of production soared 95 per cent to Tk 358 million during the quarter.

"Raw material prices eased a bit in the recent months but we are still facing challenges in opening letters of credit for imports," Mr Roy added.

Global Heavy Chemicals, a manufacturer and distributor of sodium hydroxide (Caustic Soda) and chlorine, saw its loss double year-on-year to Tk 38 million in the latest quarter.

The company's performance is as poor in the nine months through March. It had incurred a loss of Tk 113 million in FY22.

An official preferring not to be named said the company could not come out of the red as its production had been hampered by the ongoing gas crisis.

Global Chemicals' sales dropped 6 per cent to Tk 107 million in January-March as it could not run operations properly, he said.

Debt burden has piled up while turnover decreased, which implies that the company has been struggling to continue business with the cash generated from its operation, said its auditor.

The company's loans amounted to Tk 471.72 million until the end of FY22.

"If necessary steps are not taken to improve the production efficiency, the company may struggle to continue the business profitably," said the auditor of Global Chemicals.

Far Chemical Industries, which produces textile dyeing chemical products, bled twice as much in January-March when compared to the same quarter of the previous fiscal year.

The company has shifted to its own place and it could not run the chemical unit fully after shifting, said Sudeep Banik, a manager of Far Group.

It has also been unable to open LCs to import necessary machinery due to the dollar crunch, he added.

Wata Chemicals, a producer and seller of acids, witnessed a 3 per cent profit fall to Tk 10.23 million in January-March. However, its profit plunged 54 per cent year-on-year to Tk 22 million in the nine months through March this year.

A company official said the demand for Wata Chemicals' products plummeted.

Active Fine Chemical reported a 50 per cent year-on-year drop in earnings to Tk 4.80 in January-March.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.