Published :

Updated :

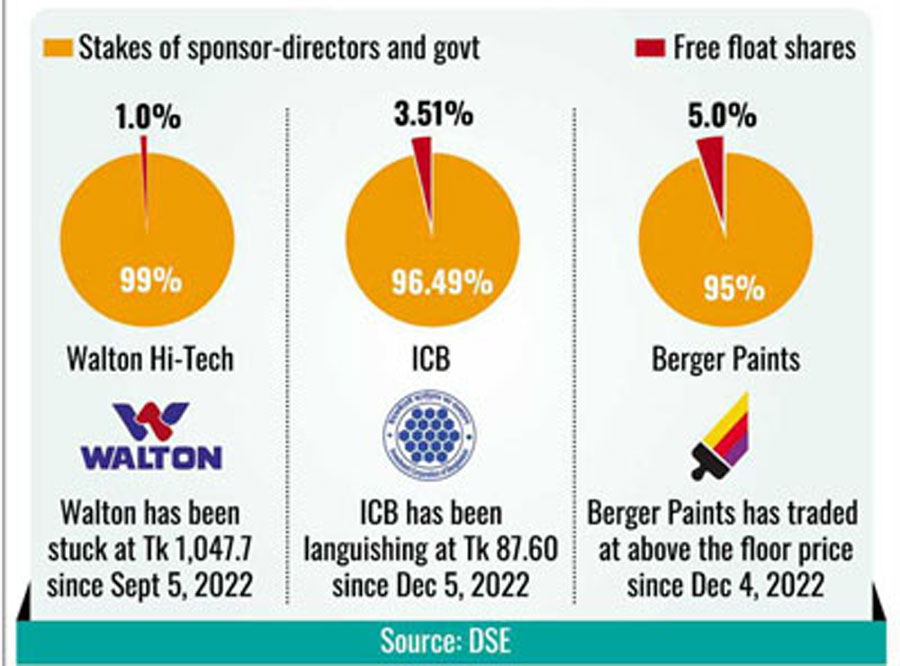

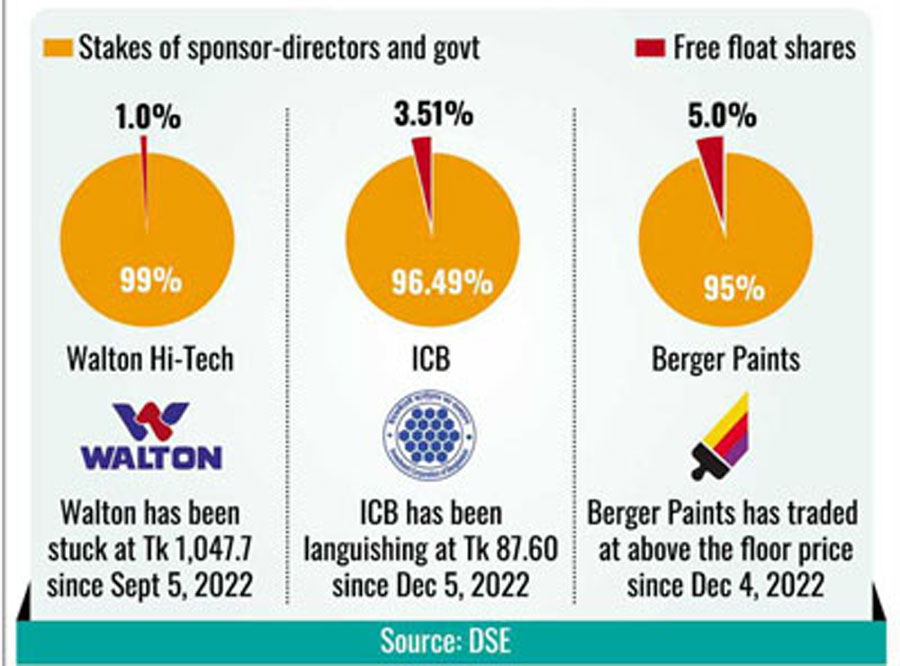

Walton Hi-Tech Industries offered only 0.97 per cent shares to the public in the process of listing in September 2020.

Later on, the Bangladesh Securities and Exchange Commission (BSEC) amended the public issue rules, making it mandatory to offload 10 per cent of the outstanding shares by listed companies.

As in the case of Walton, the state-run Investment Corporation of Bangladesh (ICB) and Berger Paints (Bangladesh) fell short of free float shares to meet the requirement.

The provision should have been complied with by now but representatives of the companies say the persistent bearish market has been unfavourable for that.

"We want to execute the regulatory order. But attempts to offload more shares have stumbled upon a lack of buyers in the market," said Md. Rafiqul Islam, company secretary of Walton.

The securities regulator had asked the three companies to increase their free float shares up to 10 per cent by offloading 1 per cent of the required amount of shares every month.

Free float are shares of a listed company available in the stock market for public trading; outstanding shares minus locked-in shares held by sponsor-directors, controlling-interest investors, government and other private parties.

As per the regulatory requirement, Walton had to float 9.03 per cent more shares, ICB 6.81 per cent and Berger 5 per cent.

Walton was able to offload only 0.03 per cent or 0.15 million shares between June 2022 and July 2023. Presently, the company's free float shares amount to 1 per cent of its outstanding shares.

The share price of Walton has been stuck at the floor price of Tk 1047.7 since September 5, 2022.

In April, the ICB finalised a deal to increase its free float shares up to 10 per cent by offloading shares held by Pubali Bank, a sponsor shareholder.

As per a decision at a meeting with the finance ministry, Pubali bank had to offload 0.5 million shares per month at the prevailing market prices.

The managing director of Pubali Bank, Mohammad Ali said the company would incur a loss if shares were sold in the current market situation.

"The market will also face pressure if we execute sales of a large volume of shares. That's why we have held back offloading of more shares," Mr. Ali said.

The ICB too has been confined to the floor -- at Tk 87.6 -- since December 5, 2022.

The managing director of Berger Paints, Rupali Chowdhury said the company was striving to increase free float shares but the present market situation was not conducive.

Unlike the two other companies, Berger has remained above the floor on the Dhaka Stock Exchange for most of the time since the price restriction was re-imposed in July last year.

Recently, the company has exhibited a steady upward trend and peaked at Tk 1879.30 on Thursday.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.