Published :

Updated :

Most of the listed banks registered hefty growth in EPS for January-June, 2021 compared to same period of the previous year mainly because of suspension of loan classification.

Experts and the officials of the central bank have said the EPS (Earnings per share) of banks rose significantly as they were not required to keep provision amid the ongoing suspension of loan classification.

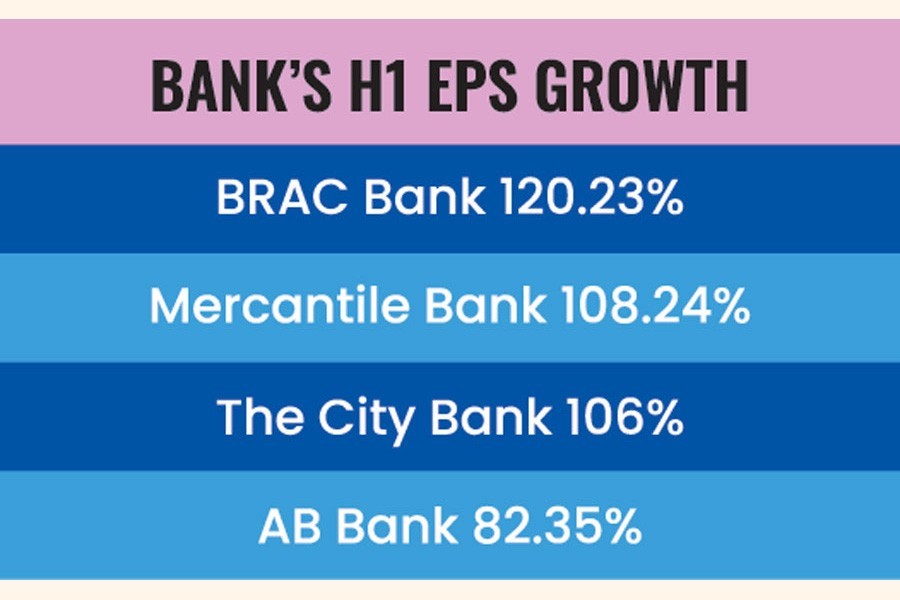

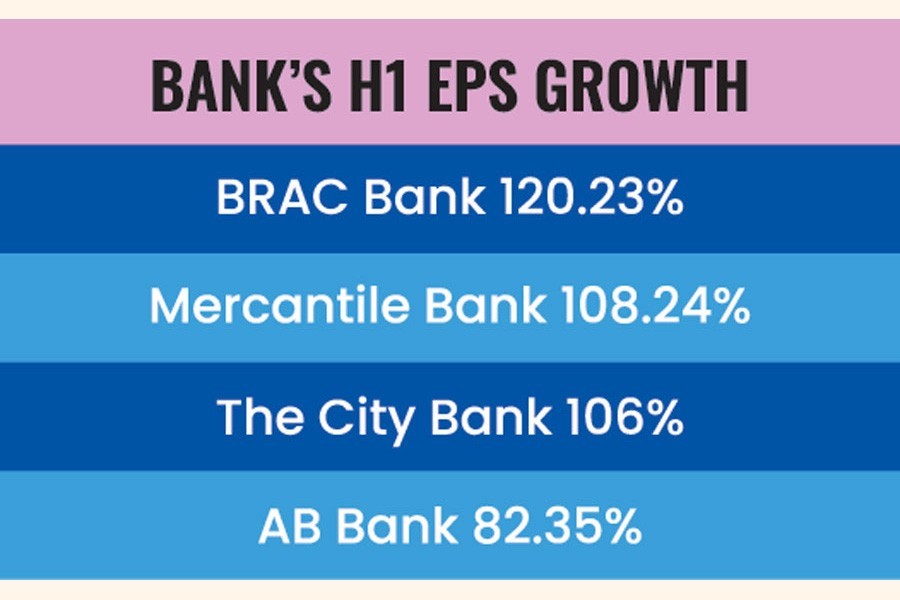

Most of 31 banks have reported growth up to above 120 per cent in consolidated EPS for January-June, 2021 compared to same period of the previous year.

Of the banks, BRAC Bank posted 120.23 per cent growth, Mercantile Bank 108.24 per cent, The City Bank rose 106 per cent and AB Bank 82.35 per cent.

Many other banks have also witnessed significant growth in EPS for January-June, 2021 compared to same period of the previous year.

The chairman of BRAC Bank Ahsan H Mansur said the banks' EPS, the accrued interest is being treated as the banks' income following the waiver from provisioning.

"In many cases, the rise observed in income is artificial. The banks will have to bear the load in future. So, it could be better for the banks if they kept provision," said Mr. Ahmed.

Presently, the scheduled banks are not required to make provisioning of loans as the central bank earlier suspended loan classification to facilitate business activities amid the ongoing Covid-19 pandemics.

The tenure of suspension of loan classification was extended till September of this year.

As a result, interests of the troubled loans are directly being added to the banks' earnings which inflated their EPS reported for April-June and January-June, 2021, insiders said.

Asked, a senior official of Bangladesh Bank (BB) said on anonymity that there is nothing to be happy with growth in EPS as they banks have not said that their earnings were reported based on performances.

"The banks' EPS rose significantly as the interests of troublesome loans have been added to profits directly due to waiver from loan classification," said the BB official.

He said the banks' actual performances will be visible when at the time of excess provisioning to be required to mitigate risks.

In his reply to a question, the BB official said risks are increasing due to waiver from loan provisioning. "The solution lies with the policies to be adopted to mitigate the risks."

For January-June, 2021 the EBL has reported 55 per cent growth in EPS against January-June, 2020 while the IFIC Bank posted 78.43 per cent growth, Islami Bank 7.21 per cent, Jamuna Bank 27.53 per cent, Southeast Bank 61 per cent, UCB 41.66 per cent, and Pubali Bank 25 per cent from January-June, 2020

Of other banks, the consolidated EPS of Al Arafah Islami Bank rose to Tk. 1.16 for January-June 2021 from Tk 0.84 reported for January-June 2020.

Bank Asia has reported a consolidated EPS of Tk 1.75 for January-June 2021 against Tk. 1.37 for January-June 2020.

Dhaka Bank has reported EPS of Tk 3.57 for January-June 2021 as against Tk. 3.42 for January-June 2020.

The EPS of some banks, however, declined for January-June, 2021 compared to same period of the previous year.

The banks include EXIM Bank and the First Security Islami Bank.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.