NBFIs show signs of distress, only four keeping up growth

BABUL BARMAN and FARHAN FARDAUS

Published :

Updated :

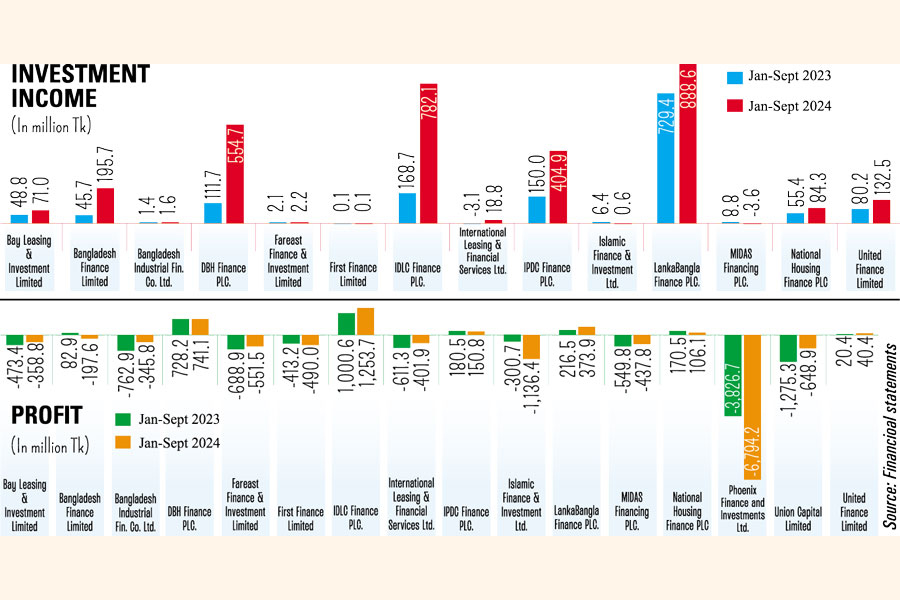

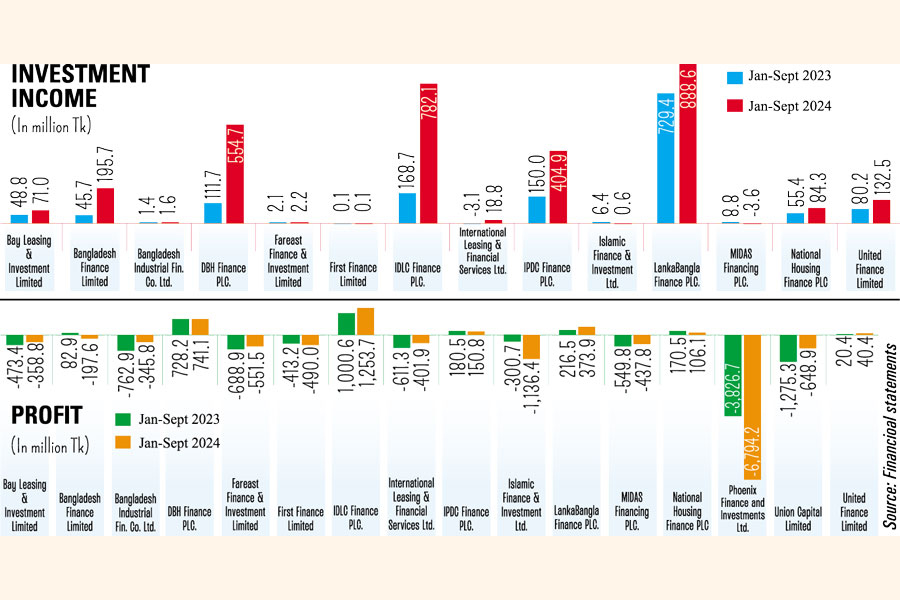

Only four non-bank financial institutions (NBFIs) out of 16 secured a higher profit year-on-year in January-September this year, driven by an increase in return from government securities.

IDLC Finance, DBH Finance, United Finance, and LankaBangla Finance stand out in the industry for their consistently good financial performance. Their operating efficiency, low amounts of non-performing loans (NPLs), and higher investment income helped them stay on the path of growth trajectory even in an adverse business climate.

Of the remaining NBFIs, ten have remained in the red for years mainly for high NPLs and scams.

The good performers reaped handsome profits from investments in government securities apart from securing high interest income in the nine months to September, say market insiders. Interest expenses on deposits also went up during the time, compared to the same period a year ago.

Market-based interest rates drove interest income up. Yields of Treasury bills and bonds also were on the rise during the nine-month period.

Of the 23 NBFIs listed on the Dhaka Stock Exchange, 16 have so far published financial reports for January-September this year. The FE analysed the financial results.

Shahidul Islam, chief executive officer (CEO) and managing director of VIPB Asset Management, said the NBFIs, which had managed to keep their non-performing loans low and could mobilize funds at relatively lower costs, leveraging their operating efficiency, were to see profits going up.

IDLC Finance's profit grew 25 per cent year-on-year to Tk 1.25 billion in January-September this year although its net finance income dropped slightly. Its income from government securities soared 364 per cent year-on-year to Tk 782 million in the nine months through September.

While interest income escalated due to the removal of the lending rate cap in July last year and the introduction of market-based interest rate in May this year, interest payment to depositors and lenders rose simultaneously. As a result, net interest income of some NBFIs fell year-on-year.

DBH Finance's profit grew 1.80 per cent year-on-year to Tk 741 million in January-September year, riding on higher investment income. Its interest payment to depositors and against debts jumped 39 per cent year-on-year to Tk 4.24 billion during the time.

DBH has always been able to keep operating costs down and mobilize funds at relatively low costs due to its excellent market reputation, which enabled the company to remain competitive in the market.

United Finance's profit more than doubled to Tk 40.4 million in the nine months through September this year, as the company's net interest income and investment income jumped 29 per cent and 65 per cent respectively.

LankaBangla Finance's profit soared 72 per cent year-on-year to Tk 374 million in January-September this year, as net interest income rose 21 per cent.

"The net profit surged mainly from an increase in net interest income, income from investment and exchange & brokerage commission," said the company in its earnings notes.

The company had increased investment in government securities to take advantage of the rising interest rates.

The yield rates of T-bonds ranged between 12 per cent and 14.80 per cent, with maturity periods of 2-20 years, while T-bills' yields varied between 15 and 15.2 percent during the time.

Poor performers

Most NBFIs have been struggling with a huge amount of non-performing loans, liquidity crisis, and shrinking interest margin.

Due to widespread scams in some NBFIs, the volume of non-performing loans in the industry soared to as high as 30 per cent of the total loans disbursed as of June this year. So, they had to keep huge provisions against those loans and investments.

Interest incomes against bad loans, which accrue on paper but are not earned in reality, need to be excluded from the profit and loss accounts.

According to the rules, every lender has to set aside a certain amount of its income proportionately with the non-performing loans and the amount is called provision.

Among the loss-making NBFIs, Phoenix Finance suffered the highest loss of Tk 6.79 billion in January-September this year, 78 per cent up year-on-year.

Although Bangladesh Finance’s investment income increased significantly, it endured losses in January-September due to an increase in provisions and suspense allocations for loans, leases, and investments compared to the same period last year.

Alongside the pile-up of NPLs, asset quality of scam-hit NBFIs has deteriorated drastically leaving a huge impact on the overall sector.

The financial health of the NBFIs has not worsened abruptly. Rather, they have been in a dire strait for many years.

According to the Bangladesh Bank, PK Halder, former managing director of NRB Global Bank (later renamed Global Islami Bank), alone swindled at least Tk 35 billion from four NBFIs - People's Leasing, International Leasing, FAS Finance, and BIFC. More than 90 per cent of their loans turned sour. People's Leasing, International Leasing, BIFC, and FAS Finance are now facing hurdles to pay back depositors.

Of the listed NBFIs, 14 have been trading at prices below the face value of Tk 10 each on the Dhaka Stock Exchange.

babulfexpress@gmail.com

farhan.fardaus@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.