Rules for margin loans: Regulator, lenders consider reforms

Published :

Updated :

The securities regulator and market operators have put their heads together to change rules for margin loans to stem a further rise of negative equity as they consider it crucial for market stability.

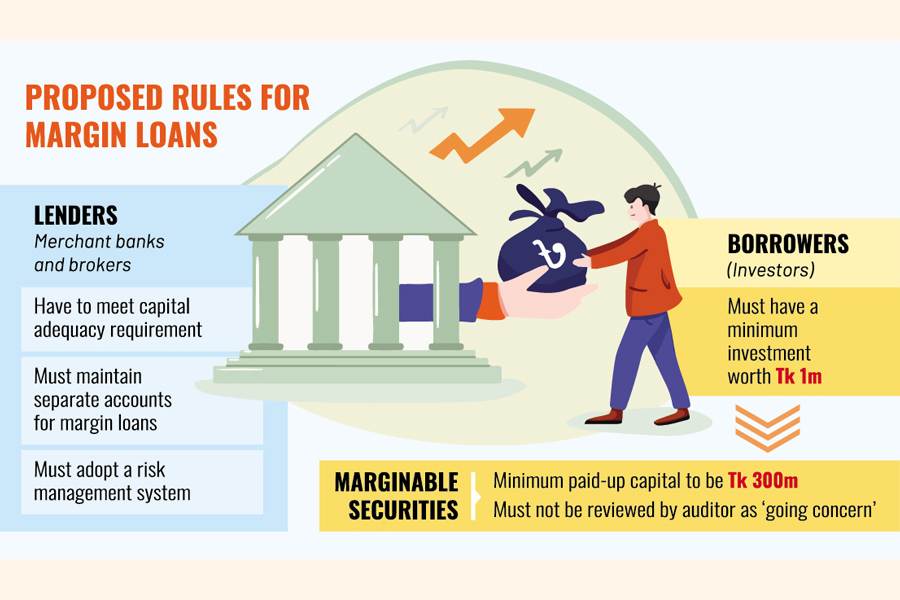

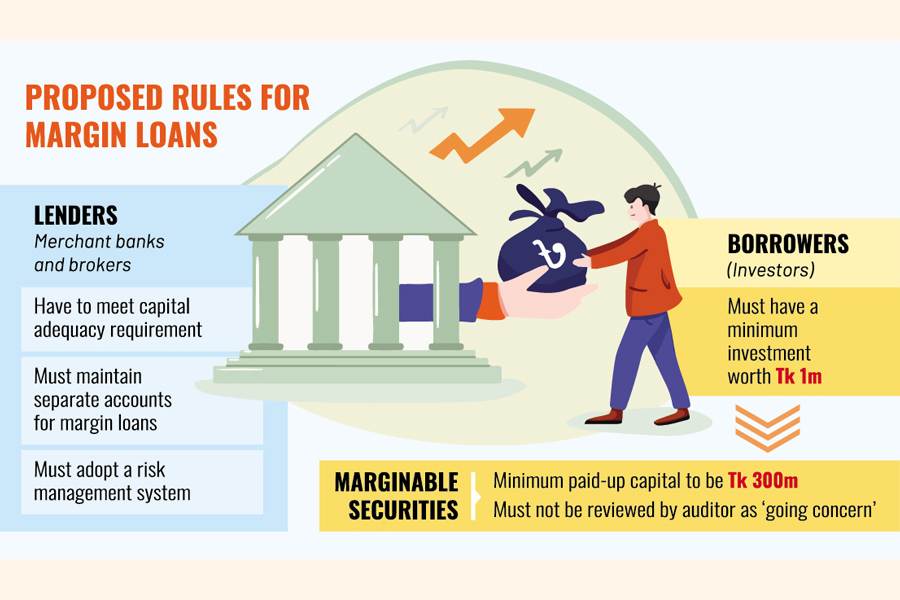

A committee comprising representatives from the Bangladesh Securities and Exchange Commission (BSEC), merchant banks, and stock brokers has prepared draft rules that they said should be equally applicable to merchant banks and stock brokers. Merchant bankers have agreed on most of the proposed rules and communicated their opinions to the BSEC. Stock brokers are yet to submit their review of the draft rules.

Currently, merchant banks and stock brokers have separate rules (Margin rules 1999 meant for merchant banks and Margin rules 1996 for brokerage firms) to follow when it comes to disbursing margin loans to their clients.

However, the rules do not have any eligibility criteria to be met by lenders and borrowers and do not discriminate against securities based on their fundamental strength.

Under the proposed rules, investors will not be allowed to avail of the credit facility if they have investments worth less than Tk 1 million in stocks in the preceding year.

On the other hand, lenders will not be able to give margin loans to anyone associated with them. It has been observed that many organisations tend to lend money to their owners, holding companies, their executives and family members.

The proposed draft said investment safety, financial strength of the companies to be invested in, stocks' liquidity, capital appreciation, risk factors, the impact of taxation, and price trend should be taken into consideration before the disbursement of margin loans.

Mazeda Khatun, president of the Bangladesh Merchant Bankers Association (BMBA), said the regulator and market operators had emphasized the need for uniform rules to plug the loopholes for misuse of the credit facility.

Apart from setting specific criteria for lenders and borrowers, risk management guidelines have also been incorporated in the proposed rules.

"The proposed rules, if brought into effect, will ensure the safety of both lenders and borrowers," she said.

At present, risk assessment is not legally binding.

An investor now is not allowed to get credit against their assets in a 'Z' category company. But they can access a margin loan against their holdings in a 'B' category stock having P/E (price-to-earnings) ratio within 40. In that case, the lender does not consider the company's paid-up capital, fundamental robustness, depth of market liquidity and risk factors.

A similar practice is in place for putting borrowed money in stocks.

This is the backdrop to margin loans being used to artificially increase prices of weak stocks. Subsequently, lenders and borrowers get into a trap, giving rise to negative equity.

As negative equity has ballooned since the 2010 stock market debacle, lenders time and again exert selling pressure to adjust margin accounts, a factor responsible for unexpected index corrections.

The outstanding negative equity amounted to more than Tk 66 billion as of September 2023. The amount is now assumed to be higher following the market volatility.

In such a situation, market operators feel a dire need for reforms to rules meant for margin loans.

The draft rules put an embargo on giving margin loans for and against investments in a company that the auditor described as "not going concern". Also, a company must have a minimum paid-up capital of Tk 300 million to be considered as marginable stock.

Stock brokers and merchant banks will have to meet risk-based capital adequacy ratio for giving loans. Lenders will also have to maintain separate bank accounts for transactions of margin loans.

The association of merchant bankers BMBA has already conveyed their opinions on the draft rules to the committee.

It has laid importance on forming a risk management committee by each lender alongside analyzing clients' credibility before giving loans to them.

Saiful Islam, president of the DSE Brokers Association of Bangladesh, said the market would not gain stability if the burden of the accumulated negative equity were not removed.

"We are working to make time-befitting rules for margin loans," he added.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.