Sales decline drove profit of automobile industry down in nine months

Aftab Automobiles sole co that made profit as Padma Bridge opening helped boost demand for buses

Published :

Updated :

Sales of commercial vehicles almost halved in the nine months through March, compared to the same period a year ago amid runaway inflation.

The country's automobile sector took a fresh blow following the pandemic as Russian troops invaded Ukraine in February last year sending a jolt through the global economy.

Import costs shot up by around 25 per cent since then, owing to the devaluation of the local currency against the dollar, making consumer goods costlier.

An even greater problem that the industry has been facing is the restriction on opening letters of credit (LCs) for not-so-necessary imports against the backdrop of an acute shortage of the greenback, industry insiders say.

According to Abdul Matlub Ahmad, president of the Bangladesh Automobile Assemblers and Manufacturers Association, the sector suffered most due to the higher cost of production, import restriction and the overall economic slowdown.

While the sales dropped, the companies could not transfer the additional cost burden to consumers who had already been bearing high living costs, said Mr Ahmad, also chairman of Nitol Niloy Group that markets vehicles of TATA brand in Bangladesh.

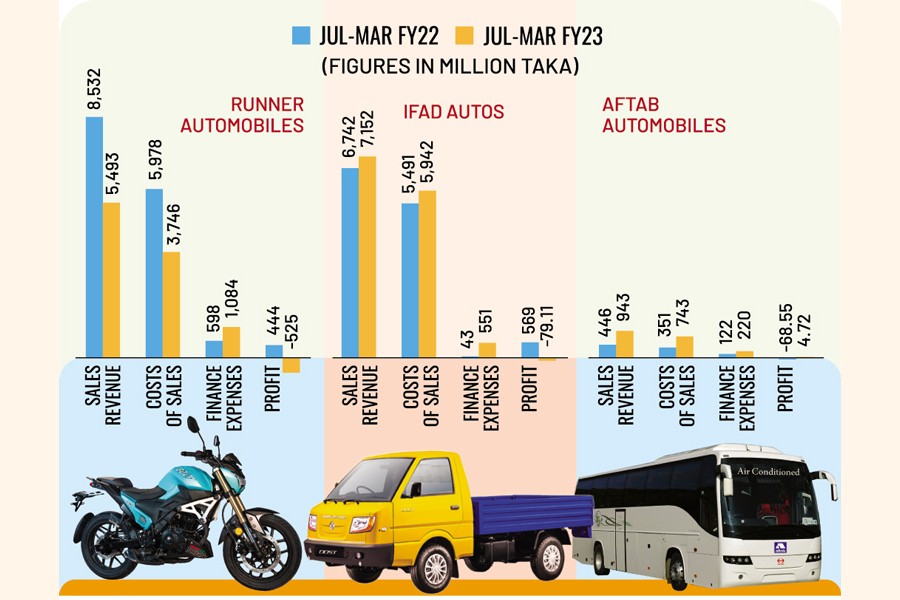

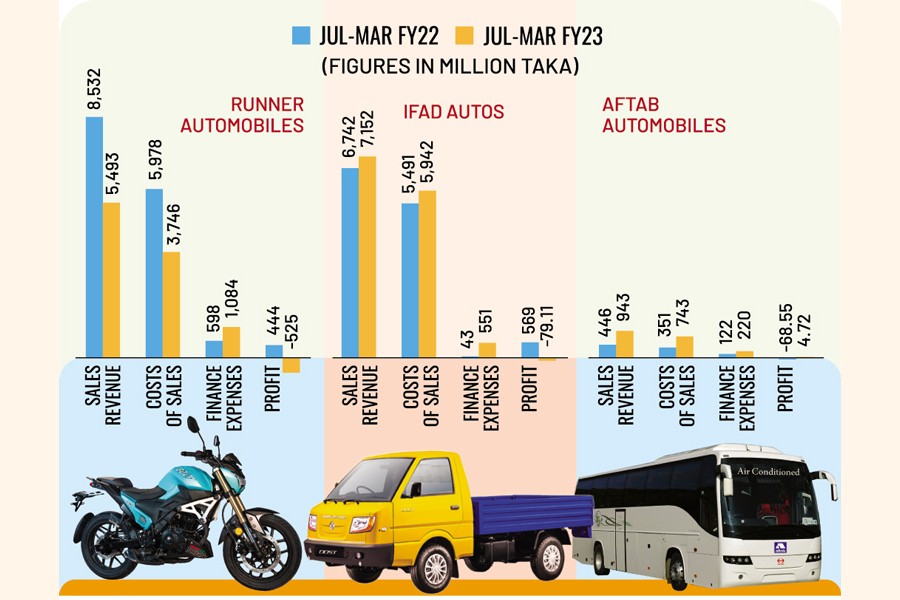

Battered by the economic challenges, Runner Automobiles and IFAD Autos suffered losses for the three consecutive quarters ended in March while Aftab Automobiles somehow managed to keep itself out of the red.

Runner Automobile PLC

Runner Automobiles, the country's pioneer bike manufacturer, counted losses in Q1, Q2, and Q3 of FY23 for a sharp, persistent decline in sales in its two major segments -- two-wheelers and trucks.

Its consolidated revenue dropped 36 per cent year-on-year to Tk 5.49 billion in the three quarters.

Losses amounted to Tk 525 million for the first nine months of the current fiscal year while the company made a profit of Tk 444 million in the same period the year before.

The figures include data of the subsidiary company, Runner Motors that sells Eicher trucks.

The motorcycle market fell following its record high sales in January-July 2022, on the back of a pre-inflation rush, before companies raised unit prices and consumers tightened their belts for inflation and a rise in fuel cost.

Runner gained share in the slowed-down motorcycle market slightly because of its affordable models preferred by inflation-hit customers.

Still, motorcycle sales were 30 per cent lower in Jan-March, FY23 compared to the same period a year ago.

On the other hand, truck sales in the Jan-March quarter took a big hit as revenue tumbled almost 57 per cent year-on-year to Tk 866 million in the period.

"The latest quarter was a tough period for truck business," said Shanat Datta, chief financial officer (CFO) of Runner.

Truck owners have seen their business slow down with imports gone down for the crisis over the foreign currency reserves since the middle of 2022. Hence, purchasing new vehicles was beyond consideration.

Overall sales of bikes declined 36 per cent and trucks 45 per cent year-on-year in the nine months through March, according to the company's financial statement.

For higher product prices and fuel costs, many buyers shelved their purchase plan, said Mr Datta.

Runner's three-wheeler manufacturing plant, which went into operation in February this year, helped it increase sales as Bajaj-branded three wheelers attracted customers with price benefits, he said.

However, almost 70 per cent of the equipment is imported. The company was met with an unfavourable policy in L/C opening, which was why it could not cater to the full demand.

Moreover, the three-wheeler segment alone was far from offsetting the losses in the segments of bikes and trucks. It could reduce loss in the latest quarter though compared to the previous quarter.

FY23 is unlikely to be a profitable one for Runner. The company eyes a better business in the next fiscal year with the help of electric bikes and three-wheelers.

The stock has been languishing at the floor price of Tk 48.40 since October last year.

IFAD Autos

IFAD Autos, the sole distributor of Indian Ashok Leyland, also suffered losses of Tk 79.11 million in the nine months through March despite higher revenue.

The company's revenue from vehicle assembling and body building soared, but the sales of imported vehicles plunged 40 per cent to Tk 1.84 billion in the nine months through March, which affected the overall earnings.

Company secretary Md. Sazzad Hossain Talukder could not be reached for comments.

An official of the company on condition of anonymity said the foreign exchange loss multiplied by 13 times in the period compared to the previous fiscal year eroded profit. The unprecedented devaluation of the taka against the dollar was behind the surge in loss.

Profit in truck assembling and sales of other vehicles also slumped 71 per cent year-on-year to Tk 93.64 million in January-March for the same reason.

The share price of IFAD Autos has remained stuck at Tk 44.10 since mid-November last year.

Aftab Automobiles

Aftab Automobiles, the lone largest assembler-cum-manufacturer of Toyota & Hino vehicles, narrowly escaped loss in the nine months through March riding on higher revenue.

It secured a net income of Tk 4.72 million during the period while it had a loss of Tk 68.55 million in the same period the year before.

The company that assembles vehicles and makes bodies of buses saw its revenue more than doubled to Tk 943 million in the nine months to March. The market leader in the bus segment got the advantage of continued demand for buses after the Padma Bridge opened new routes connecting south-western Bangladesh with the capital in June last year.

The growth in revenue, however, could not boost profit because of a steep rise in the cost of sales and operating expenses.

Having been stuck at Tk 24.50 since November last year, the stock started climbing in the third week of April this year following the disclosure of earnings.

The share price surged 4.69 per cent to close at Tk 26.80 each on Sunday.

Atlas Bangladesh

The state-owned company which is engaged in assembling and marketing TVS brand Motorcycles and ZONGSHEN-Atlas brand, is yet to publish January-March quarter financial statements.

However, it has been reporting losses for seven years since 2016 after its business deal with Hero Honda Motors ended.

The company's cumulative losses stood at Tk 370 million in the seven years through FY22. It reported a loss of Tk 49 million in the six months through December last year.

The company said in its earnings note that the government had suspended purchasing vehicles from governmental, semi-government, autonomous and other organisations.

"This explains the decrease in sales from the previous period. Due to fixed salary and wages, cost of sales increased and gross profit margin decreased in comparison to the previous period."

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.