Published :

Updated :

Islamic banks in Bangladesh are gradually losing their stronghold in the remittance market, mainly due to the weak financial health of some lenders, with their share slipping significantly over 16 months.

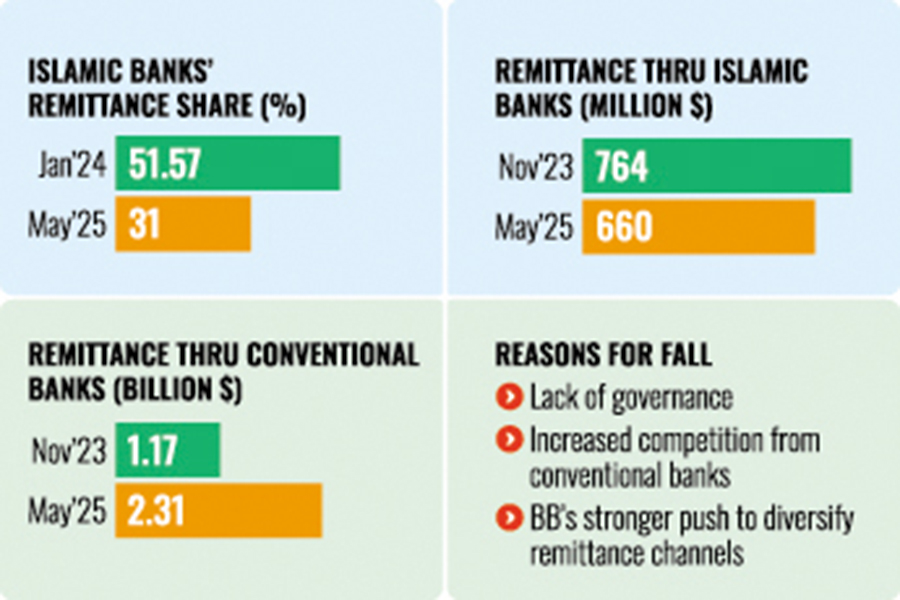

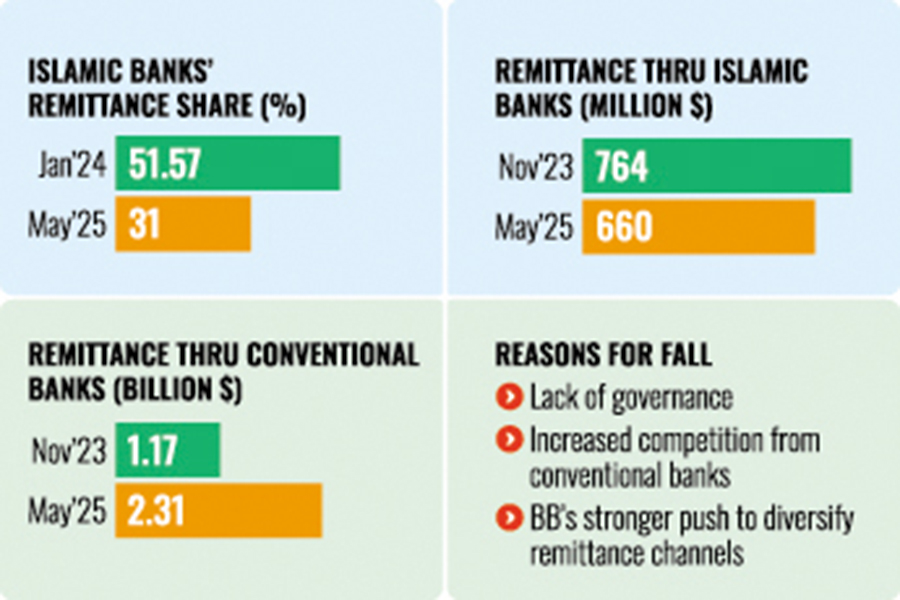

Their share fell from 51.57 per cent in January 2024 to nearly 31 per cent in May 2025, the Bangladesh Bank (BB) data shows.

Stakeholders opine that migrants and exchange houses are increasingly routing remittances through conventional banks, likely due to liquidity concerns and trust issues surrounding some Islamic lenders.

Full-fledged Islamic banks, as well as Islamic bank branches and windows, received $1.09 billion in remittances in January 2024, which was 51.57 per cent of the total remittances collected through the entire banking sector.

Such banks accounted for 47.92 per cent of the total remittance inflows in December 2023, channelling Tk 105.10 billion during the month.

However, their dominance began to fade in February 2024, and the downward trend continued till May 2025.

The data revealed in terms of remittances, Islamic Banks started from $764 million in November 2023 and decreased to $660 million at the end of May 2025.

On the other hand, conventional banks started from $1.17 billion in November 2023, and their share increased substantially to $2.31 billion in May 2025.

Banking insiders attribute the decline to a mix of factors, including a lack of governance, increased competition from conventional banks, and a stronger push by the central bank to diversify remittance channels.

Despite the fall, Islamic banks still handle a sizable portion of remittance inflows, reflecting their long-standing appeal among migrants.

Remittances coming through Islamic banking showed mixed behaviour from November 2023 to June 2024.

It drastically started falling after June 2024 and reached its minimum in August 2024, according to the Bangladesh Bank.

Generally, the growth of remittance depends on several factors, such as the number of expatriates, festivals, occasions, incentives, bank locations, easy access to banking services, political stability, and last but not the least, clients' bank preferences.

Experts warn that without renewed focus on service quality, digital innovations, and compliance readiness, their role in the remittance business could shrink further.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, says conventional banks are now far ahead of Islamic ones in handling remittances.

"Some Islamic banks are almost non-functional in this area. They have either shut down their remittance operations or significantly reduced their role. In some cases, they even lack the liquidity needed to settle remittance inflows," he notes.

He adds that gaps in trust and reliability have also contributed to the sharp decline in Islamic banks' share of the remittance market.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.