Weekly market review

Stocks end flat as investors remain wary

Average daily turnover drops 18pc on prime bourse

Published :

Updated :

The benchmark equity index ended nearly flat this week as investors took to the sidelines following last week's sharp fall, which dampened market sentiment.

The market volatility persisted throughout the week as cautious investors adopt 'wait and see' approach amid uncertainties over the market outlook.

However, selling pressure somewhat eased this week, while subtle price appreciation of sector-specific issues provided cushion to the ailing market.

Of the five trading days, three sessions saw the market close lower and two others managed to eke out gains with low turnover.

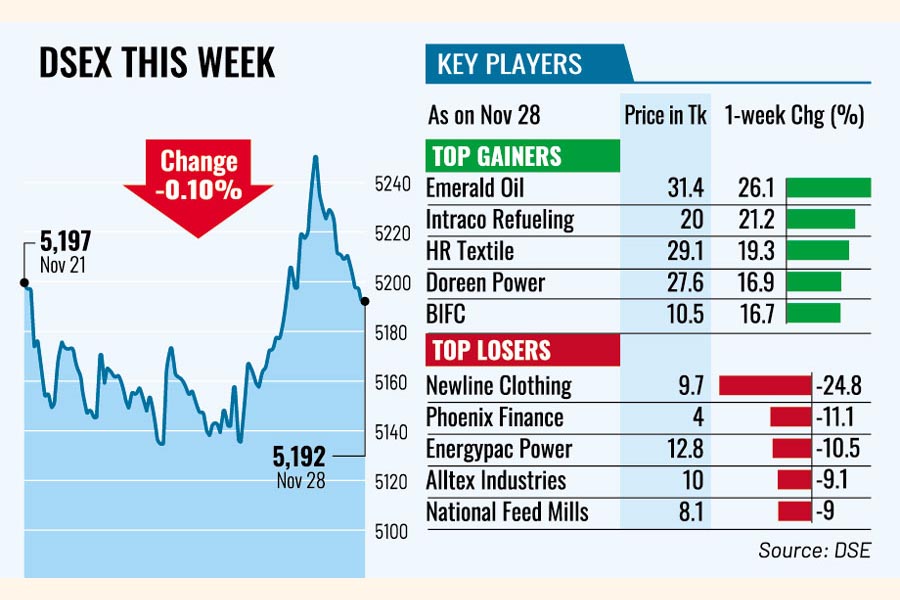

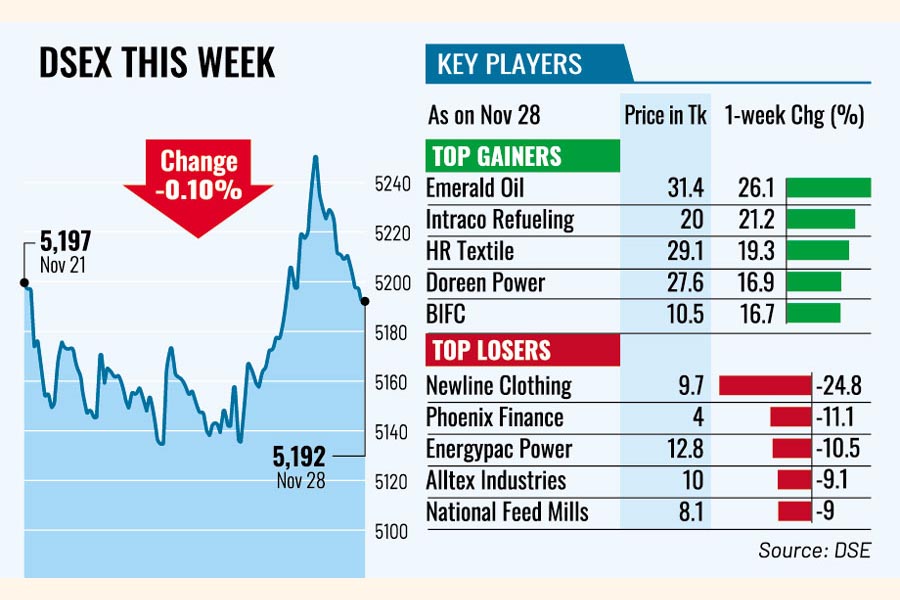

The benchmark DSEX index of the Dhaka Stock Exchange (DSE) settled the week 5 points or 0.10 percent lower at 5,192. The DSEX lost 163 points in the past two consecutive weeks.

In its weekly analysis, EBL Securities said market volatility persisted throughout the week as sellers maintained their dominance while opportunistic investors preferred to observe the market's trend and sit on cash to look for lucrative investment opportunities following the corrections.

The central bank's approval of the anticipated Tk 30 billion sovereign-guaranteed loan to Investment Corporation of Bangladesh, somewhat improved investors sentiment, said the stockbroker.

Nevertheless, profit-booking by jittery investors soon eroded most of the gains in the final session amidst the waning market momentum, it added.

The post-record date adjustment for the top index contributor Square Pharma exerted a significant downward impact on the market indices during the week.

The leading drug maker accounted for 33.8-point index fall alone in the week. Other index draggers are Brac Bank, Islami Bank, BAT Bangladesh and Khan Brothers.

Investors remained mostly cautious in the prevailing economic and political uncertainties and the profit-booking spree dragged down the indices, said a leading stockbroker.

Besides, the news of a record amount of non-performing loans (NPLs) in the banking sector, coupled with the downgrading of sovereign ratings of the country by Moody's heightened worries surrounding the equity market, he said.

NPLs in the banking sector soared to a record Tk 2.85 trillion in September, accounting for around 17 per cent of total outstanding loans. The real financial conditions of banks have been exposed by the interim government.

Of two other DSE indices, the DS30 index, a group of 30 prominent companies, dropped around 3 points to 1,916, but the DSES index, which represents Shariah-based companies, bucked the trend, rising 15 points to 1,167.

Turnover, a crucial indicator of the market, stood at Tk 19.06 billion this week, down from Tk 23.30 billion in the week before.

Accordingly, the average daily turnover dropped to Tk 3.81 billion, a 18 per cent down from the previous week's average of Tk 4.66 billion.

Investors were mostly active in the banking sector, which accounted for 18 per cent of the week's total turnover, followed by pharma (12.3 per cent) and food sector (10.7 per cent).

Most of the traded stocks, however, saw price appreciation, as out of 390 issues traded, 213 closed higher, 126 lower, and 51 remained unchanged.

Most sectors posted gains. The power sector saw the highest gain of 1.8 per cent, followed by engineering with 1.2 per cent, pharma (1.20 per cent), telecom (0.7 per cent) and banking (0.10 per cent).

On the other hand, the food sector endured the highest decline of 0.9 per cent, followed by general insurance (0.50 per cent) and cement (0.1 per cent).

NRB Bank was the most-traded stock with shares worth Tk 655 million changing hands, followed by Bangladesh Spinning Corporation, Midland Bank, Lovello Ice-cream and Agni Systems.

The Chittagong Stock Exchange (CSE) also ended lower, with CSE All Share Price Index (CASPI) shedding 52 points to settle at 14,532 and its Selective Categories Index (CSCX) losing 29 points to 8,851.

The port-city bourse traded 11.66 million shares and mutual fund units with a turnover value of Tk 304 million.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.