More cos issuing cash div than bonus shares

'It's good for market, shareholders'

Published :

Updated :

The number of dividend recommendations in the form of cash has been on rise in recent years against the declining trend of issuing bonus shares by the listed companies.

Experts and stakeholders said the number of companies issuing bonus shares is gradually declining because of multiple reasons, including their lack of further business expansion plan and lock-in on bonus shares held by sponsor-directors.

Some of them said the increasing trend of issuing cash dividend is good for both the market and shareholders as well.

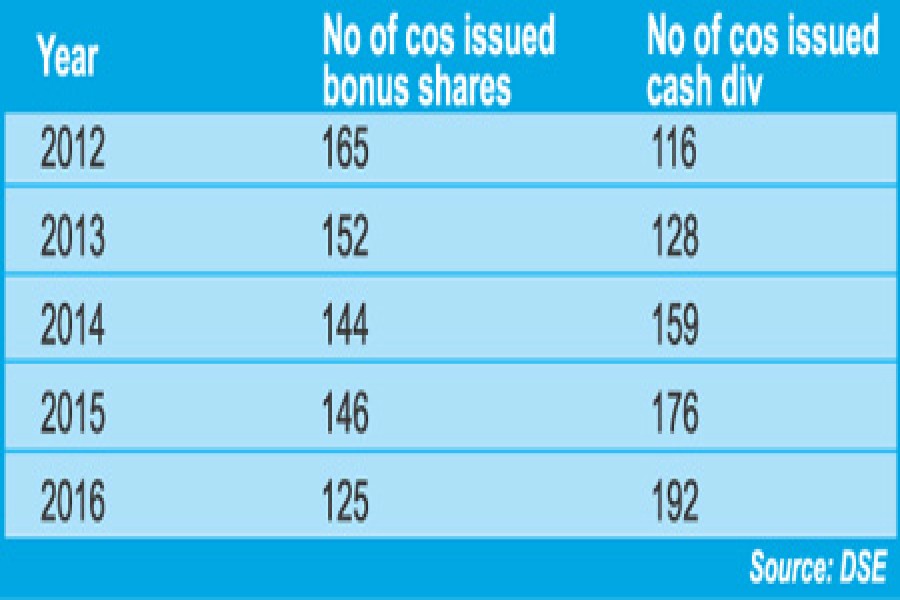

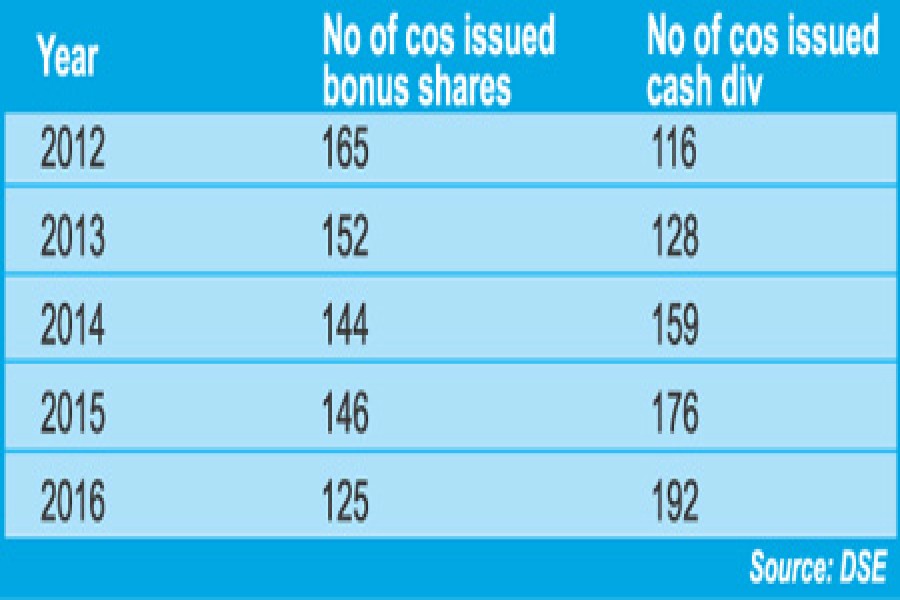

A total of 165 companies issued stock dividend in 2012, 152 companies in 2013, 144 companies in 2014, 146 companies in 2015 and 125 companies in 2016, according to the information of Dhaka Stock Exchange (DSE).

The number of listed companies rose gradually from 2012 to 2016. But the number of companies, which issued bonus shares, declined gradually during this period, snapping the declining trend of issuing bonus shares.

The DSE data also showed that the number of listed companies issuing cash dividend increased from 2012 to 2016.

A total of 116 companies issued cash dividend in 2012, 128 companies in 2013, 159 companies in 2014, 176 companies in 2015 and 192 companies in 2016.

Bonus shares are shares distributed by a company to its current shareholders as fully-paid shares free of charge to increase capital to implement new business plan.

Anis A Khan, vice president of Bangladesh Association of Publicly Listed Companies (BAPLC), said the companies increase their capital through bonus issues in accordance with their necessity.

"I do not think that the number of companies issuing bonus shares has declined because of reasons such as lock-in on sponsor-directors' bonus shares. The number of companies willing to issue bonus shares will depend on capital requirement," he added.

According to DSE information, the number of companies that issued bonus shares rose from 2009 to 2012.

Above 328.34 million bonus shares were issued by different companies in 2009, above 753.01 million in 2010, above 3.36 billion in 2011 and above 4.71 billion in 2012. Later, the amount of bonus shares declined gradually until 2016.

Former chairman of the securities regulator Dr A B Mirza Azizul Islam said the investors' preference to cash dividend may be a reason behind the reduction in the number of stock dividend declaration.

"Many companies may have no further expansion plan, and it can be a reason behind the fall in the number of companies issuing stock dividend," he noted.

Previously, the sponsor-directors had no legal bar to sell bonus shares, other than the shares held at the time of approving IPO (initial public offering) proposals, issued after the companies' listing with the stock exchanges.

On November 30, 2015 the securities regulator imposed two-year lock-in on the bonus shares, owned by the directors and individuals having at least 5.0 per cent shares of the newly-listed companies.

The regulatory measure came following the allegation that the sponsor-directors have a tendency to take profits by offloading bonus shares just after listing of the companies.

A DSE official said the mandatory lock-in on bonus shares, held by sponsor-directors, is one of the reasons behind the fall in the number of listed companies issuing bonus shares.

"Many companies previously issued bonus shares. But presently they are refrained from bonus declaration to avoid dilution effects," he observed.

Mohammad Ali, chief operating officer of Dhaka Bank Securities, said the dividend recommendation entirely depends on the board of directors.

"The board decides whether the company needs further capital expansion. The rising trend of issuing cash dividend is market-friendly," he further said.

The tendency of issuing bonus shares has been observed more with the local companies than the multinational ones listed with the bourses.

The multinationals, such as - British American Tobacco, Marico Bangladesh and Reckitt Benckiser etc, issued cash dividend up to 750 per cent in recent years.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.