Agent banking lending jumps to Tk 350b

Rural borrowers dominate as deposits, remittances post steady growth

Published :

Updated :

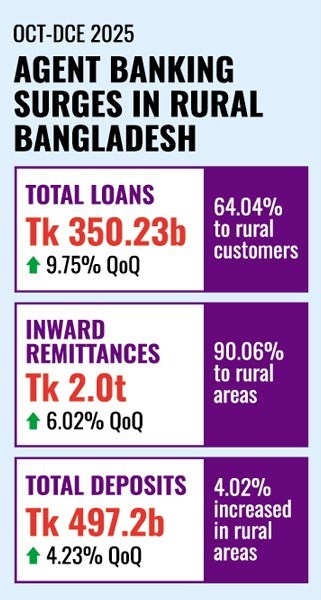

Lending through agent banking rose sharply to Tk 350.23 billion by the end of December 2025, underscoring the rapid expansion of this alternative delivery channel, particularly in rural Bangladesh.

The latest data from Bangladesh Bank (BB) show strong quarterly growth in credit, deposits and remittances, reflecting rising public confidence in agent-led financial services.

According to BB data, the volume of loans disbursed through agent banking grew by 9.75 per cent in the October-December quarter compared with the previous quarter, driven largely by robust demand for formal finance in rural and semi-urban areas.

Lending through agent banking stood at Tk 319.10 billion at the end of September 2025.

As of December 2025, rural customers had received Tk 224.28 billion, or 64.04 per cent, of the total loans disbursed through agent banking channels, underlining the model's pivotal role in expanding access to credit beyond urban centres.

At the end of December, lending through female-owned outlets amounted to about Tk 24.42 billion. Meanwhile, lending through rural outlets stood at Tk 12.82 billion during the period.

However, female customers continue to lag behind their male counterparts in accessing credit. Female-owned outlets accounted for only 6.97 per cent of total credit disbursed through agent banking.

Deposits through agent banking also increased during the quarter. In the December 2025 quarter, deposits rose by 4.23 per cent compared with September 2025.

Total deposits through agent banking reached Tk 497.20 billion at the end of December, up from over Tk 477 billion at the end of September.

Deposits in rural areas increased by 4.02 per cent, while urban deposits rose by 5.28 per cent over the previous quarter.

Deposits from male customers grew by 4.21 per cent, while deposits from female customers increased by 3.24 per cent during the period.

Inward remittances channelled through agent banking also recorded notable growth.

As of December 2025, the amount of inward remittances processed through agent banking exceeded Tk 2.0 trillion, marking a 6.02-percent increase over the September 2025 quarter.

The rise in remittance inflows through agent banking is seen as a positive outcome of the government's 2.5 per cent cash incentive on inward remittances.

Rural areas received 90.06 per cent of the total inward remittances routed through agent banking, highlighting the channel's crucial role in delivering the hard-earned income of non-resident Bangladeshis directly to their families.

As of December 2025, the top five banks accounted for 74.81 per cent of total agent outlets nationwide. Dutch-Bangla Bank PLC ranked first, operating 5,631 outlets, 27.47 per cent of all agent outlets in operation.

The top five banks also held 88.77 per cent of total accounts opened through agent banking. Dutch-Bangla Bank PLC led in this segment as well, with 7,844,166 accounts, representing 30.36 per cent of the total accounts opened under the agent banking framework.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.