BD gains in trade competitiveness as Taka depreciates slightly

Published :

Updated :

Bangladesh's currency shows signs of losing its value against the greenback-for the first time in many years-helping some improvement in the country's international-trade competitiveness.

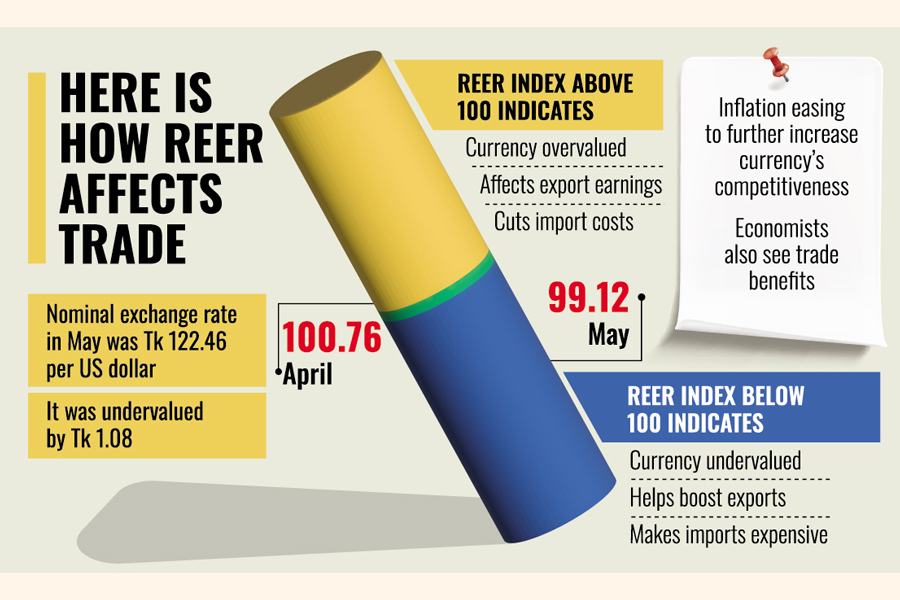

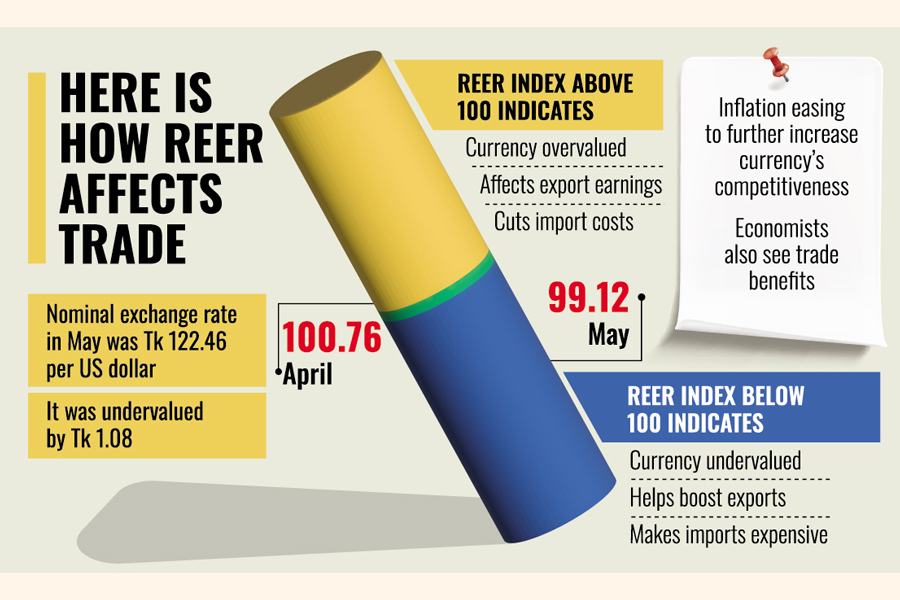

According to Bangladesh Bank, Taka's real effective exchange rate (REER) index climbed down from 100.76 in April 2025 to 99.12 in May. The fall in the index reflects a modest gain in Bangladesh's price competitiveness relative to its trading partners.

The REER is calculated against a basket of 18 currencies (base year FY2016 = 100), incorporating data on exports, imports and remittances.

In financial literature, a REER below 100 indicates a currency is undervalued-and it helps boost exports while making imports more expensive. And a value above 100 implies the reverse.

As per the REER index, the theoretical exchange rate in May should have been Tk 121.38 per dollar. However, the nominal exchange rate stood at Tk 122.46, meaning the taka was undervalued by Tk 1.08 in the month.

One central banker, speaking to the FE on condition of anonymity, said: "We've regained competitiveness with our trading partners after many years. This will help increase our export receipts."

He adds if inflation continues to ease in the coming months, the currency's competitiveness globally is likely to improve further.

The point-to-point inflation in the country eased to 9.05 per cent in May 2025, down by 12 basis points from the previous month's count.

The central banker further says the Bangladesh taka (BDT) now operates under a floating exchange regime or market-based and that the current undervaluation is a positive signal, suggesting greater stability of the foreign-exchange market.

During the tenure of former Bangladesh Bank Governor Abdur Rouf Talukder, now in hiding following the regime change through mass uprising, the taka was reportedly overvalued by as much as Tk 6.0 to Tk 7.0.

Independent economist Dr Zahid Hussain observes that the taka's historical overvaluation was largely due to persistently higher inflation in Bangladesh compared to its trading partners.

The recent slight drop in inflation helped push the currency below its equilibrium level.

"Although inflation has eased a bit, there are concerns it might rise again, especially due to rising prices of essentials such as certain rice varieties," he cautions.

In contrast, several key trade partners of Bangladesh have seen low inflation or even deflation.

China is currently under deflationary pressure, recording inflation of just 0.1 per cent in May. India's inflation stood at 2.82 per cent, while the Euro zone registered 2.2 per cent for the same month.

Dr M. Masrur Reaz, Chairman and CEO of Policy Exchange Bangladesh, also sees trade benefits out of an undervalued currency.

"An undervalued exchange rate strengthens export competitiveness. With exports already on the rise, Bangladesh may benefit further, especially as the ongoing US-China trade war could work in our favour."

Merchandise exports have shown a solid rebound, posting a 10.36-percent year-on-year growth during July-May of FY25, compared to a 4.28-percent decline during the same period in FY24.

Meanwhile, with greater stability of the foreign-exchange market, Bangladesh Bank sold a net amount of $503.38 million on the interbank market during July-May of FY25-deep down from $9.81 billion in the same period a year earlier.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.