JALALABAD COMPRESSION PROJECT

Chevron yet to confirm timeframe despite full payment clearance

Petrobangla urges Chevron to begin project without delay

Published :

Updated :

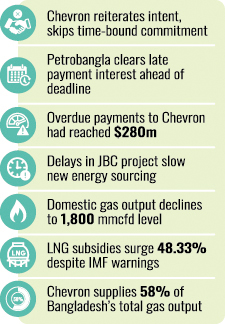

Bangladesh government has cleared all outstanding payments, including late payment interest, to Chevron Bangladesh, but the US energy giant has yet to reveal any time-bound plan to resume its held-back US$75 million investment in the Jalalabad Compression Project (JBC).

After clearing late payment interest amounting to around $30 million, along with overdue payments, state-run Petrobangla urged Chevron a couple of weeks ago to start the project as soon as possible, seeking time-bound actions.

"Petrobangla is requesting Chevron Bangladesh to start the Jalalabad Compression Project as soon as possible. Your timely action in this regard will be highly appreciated," Petrobangla' s Director (Finance) AKM Mizanur Rahman wrote to Chevron Bangladesh President Eric M Walker on August 31.

In response, Chevron Bangladesh reiterated its intention to move ahead with the project but stopped short of committing to a timeline.

"I am writing to reiterate the intention of Chevron Bangladesh to proceed with the Jalalabad Compression Project," Mr Walker wrote in reply to Petrobangla's letter.

He thanked Petrobangla for ensuring continued timely payment of monthly gas and condensate invoices and for clearing the late payment interest.

"Chevron Bangladesh looks forward to continuing its investment in the JBC to unlock additional natural gas resources for the country," his letter stated.

Sources said Petrobangla cleared the late payment interest to Chevron Bangladesh on August 28, one month ahead of the stipulated timeframe.

Earlier, on June 22, Mr Walker had written that "the continuance of the JBC is dependent upon Petrobangla remaining current with its monthly gas and condensate invoices and fully repaying all late payment interest amounts due by September 30, 2025."

Petrobangla had already cleared overdue payments, which rose as high as $280 million last year.

Market insiders say delays in Chevron's JBC project are slowing the government's pursuit of new energy sources.

Bangladesh is urgently seeking fresh investment and opportunities to boost oil and gas exploration, against the backdrop of dwindling natural gas reserves and rising subsidies to import expensive liquefied natural gas (LNG).

Currently, natural gas production from domestic fields has declined to around 1,800 million cubic feet per day (mmcfd), comparable to levels in 2008-09. Supply has steadily fallen since peaking in fiscal year 2016-17.

The country recorded its highest-ever daily gas production of 2,786 mmcfd on May 6, 2015.

Bangladesh has consumed an estimated 15 trillion cubic feet (Tcf) of gas to date, with remaining reserves standing at less than 9.0 Tcf. At the current pace, these reserves are projected to run out by 2030.

Meanwhile, government subsidies for LNG imports surged by 48.33 per cent year-on-year to Tk 89 billion in fiscal year 2024-25, according to Petrobangla data.

This increase comes despite authorities raising gas tariffs at least five times over the past six years, amid repeated calls from the International Monetary Fund (IMF) to phase out energy subsidies.

Petrobangla received Tk 60 billion in subsidies from the Ministry of Finance (MoF) to import LNG in FY2023-24. Since LNG imports began in 2018, the government has spent over Tk 367.12 billion on such subsidies.

Chevron Bangladesh had deferred the JBC investment through a letter to Petrobangla on April 4, 2024, saying the project would remain on hold until overdue payments were fully cleared.

Initially, Chevron had planned to start the project in 2023 with an approved budget of $65 million. However, Petrobangla struggled to pay Chevron in recent years due to economic turmoil caused by the Russia-Ukraine war and currency depreciation.

According to Chevron's earlier projections, the project could unlock an additional 352 billion cubic feet (Bcf) of gas from the Jalalabad field.

"After the project's implementation, it will significantly arrest the declining production trend," said a senior Petrobangla official.

Failure to complete the project in time, he warned, would lead to a substantial drop in gas output, undermining the main objective of extending production periods for blocks 13 and 14.

Asked about the investment plan, Chevron Bangladesh Media and Communications Manager Shaikh Jahidur Rahman said, "Over the last 30 years, we have worked in partnership with Petrobangla and the Bangladesh government to support the country's energy needs."

He added, "We are continuing discussions with the government on potential opportunities. While we don't disclose specific commercial plans, Chevron Bangladesh remains committed to providing affordable, reliable and ever-cleaner energy to the nation."

Chevron is currently the largest gas producer in Bangladesh, supplying around 1,047 mmcfd from its three onshore fields - Bibiyana, Jalalabad, and Moulvibazar - located in blocks 12, 13, and 14. This accounts for about 58.16 per cent of the country's total domestic production of 1,800 mmcfd, according to Petrobangla data as of September 14.

azizjst@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.