718MW JERA MEGHNAGHAT POWER PLANT

Commercial operation date first, tariff re-negotiation later

Published :

Updated :

The interim government has backed down from its "prior re-negotiation" on tariffs as the pre-condition for approval of the commercial operation date (COD) of the 718MW JERA Meghnaghat power plant.

The state-run Bangladesh Power Development Board (BPDB) now intends to approve the COD of the Japanese JERA-owned gas-fired combined cycle power plant before tariff re-negotiation, a source close to the matter told The Financial Express Monday.

"During the recent negotiation between the BPDB and JERA, it has been decided that the plant will get the COD first," he said.

The negotiation over tariff reduction would take place after the COD approval, he said.

COD is the mutually agreed date of initiating commercial operations of any plant.

The COD of the plant owned by Japan's Energy for a New Era, mostly known as JERA, is expected this month, a senior BPDB official said.

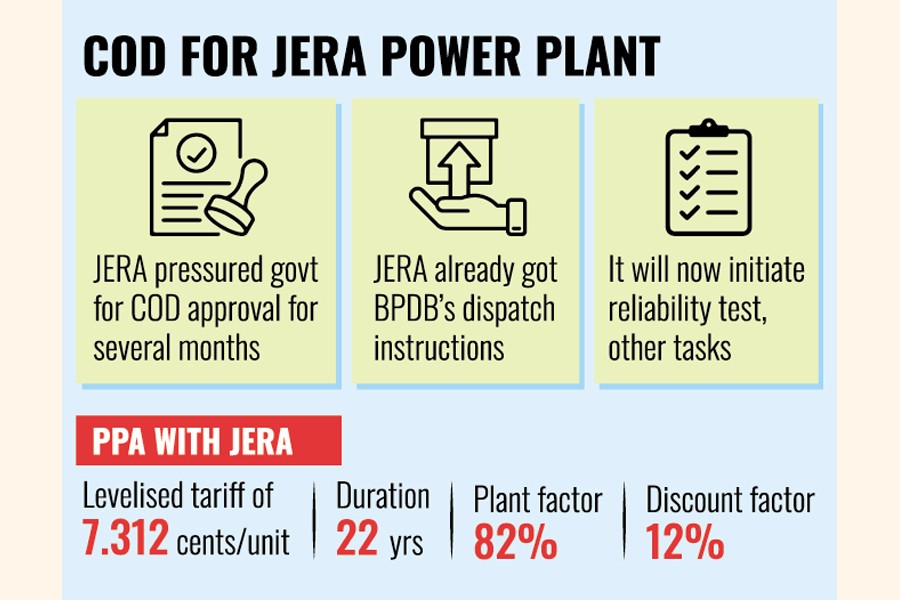

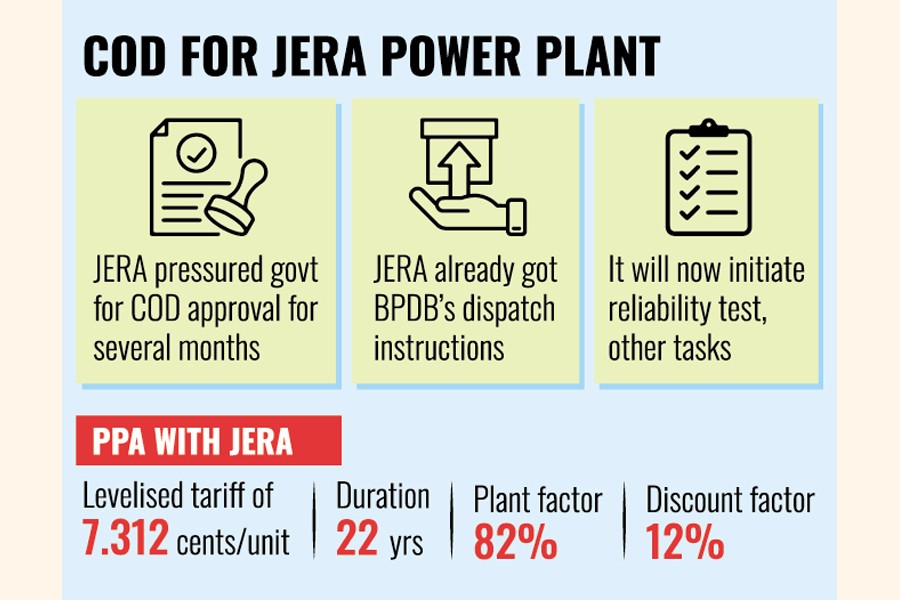

JERA has already received dispatch instructions from the BPDB and will initiate the reliability test and other necessary tasks for achieving the COD soon, said the official.

With the COD of this plant, the number of the country's total operational plants will be 134 from the current 133, he said.

Sources said the BPDB previously stuck to the idea of negotiating down the plant's tariff rate before approving the COD.

But as they realised that getting the decision on reducing tariffs from the project financiers would take time, the BPDB opted for approving the COD first, they said.

Both JERA and the BPDB officials expected during the meeting that the financiers, such as the Asian Development Bank (ADB) and the Japan Bank for International Cooperation (JBIC), will understand the necessity to reduce the plant's tariff, they added.

The interim government seemed "harsh" over re-negotiating the plant's tariffs as it was the only private power plant project awaiting COD after completing construction, sector insiders said.

The government is trying to cut power plant costs as dozens of plants were awarded during the previous regime without competitive bidding.

Two similar plants built in the same area - 589 MW Summit Meghnaghat II and 584MW Unique Meghnaghat - fortunately achieved CODs by April 2024 during the previous regime, which was ousted in August that year.

Both the plants, however, were also readied for initiating operations ahead of the JERA's plant, insiders said.

As per the power purchase agreement (PPA), the BPDB is expected to purchase electricity from the JERA plant at a levelised tariff of 7.312 US cents per unit (1 kilowatt-hour) for 22 years with 82 per cent plant factor and 12 per cent discount factor.

Tariffs of the Summit Meghnaghat II and Unique Meghnaghat plants are a little lower than that of JERA, insiders said.

Sources said JERA was building pressure on the interim government over the past several months to approve the COD.

The Prof Muhammad Yunus-led interim government initiated a move to re-negotiate tariffs with plant owners to reduce "excessive" tariffs or "additional" costs as inscribed in the PPAs inked during the previous Awami League government.

Most of these plants were awarded on the basis of unsolicited offers under the now-defunct Speedy Supply of Power and Energy (Special Provision) Act 2010, which had a provision of immunity to those involved with the quick-fix remedies.

The state-run Petrobangla, which was "made to commit" to supplying natural gas to the gas-fired power plants, does not have sufficient gas to run the existing gas-fired facilities, said a senior official of the organisation.

Petrobangla is currently able to supply only less than half of the volume of gas required to feed the gas-guzzling plants, to the tune of around 1,053 million cubic feet per day (MMCFD), against a total requirement of 2,420 MMCFD, according to official data as of July 13, 2025.

To supply natural gas to the newly-built large gas-fired plants, Petrobangla will have to cut supply from other gas-guzzling consumers, the company official said.

Energy expert Prof Mohammad Tamim accuses a vested interest group of projecting inflated electricity demand on money-spinning motives.

"This resulted in the installation of plants having more capacity than the requirement and entailing huge capacity payments," noted Mr Tamim, who was the vice chancellor of Independent University, Bangladesh.

Azizjst@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.