Cut-off yields of T-bonds fall sharply

Shrink banks' earning opportunities from risk-free govt securities

Published :

Updated :

The cut-off yield of Bangladesh Government Treasury Bonds (BGTBs), particularly of 15-year and 20-year-tenure ones, has dropped below 12 per cent, shrinking commercial banks' earning opportunities from investing in risk-free government securities.

This drop in 15-year and 20-year treasury bonds comes following a steady decline in all forms of treasury bills, creating a perception among investors that the yield in the market of government securities will continue to drop.

As a matter of fact, the investors, including the banks, keep offering lower yield in the auctions so that their biddings are accepted in the current macroeconomic situation when investment scope is very slim.

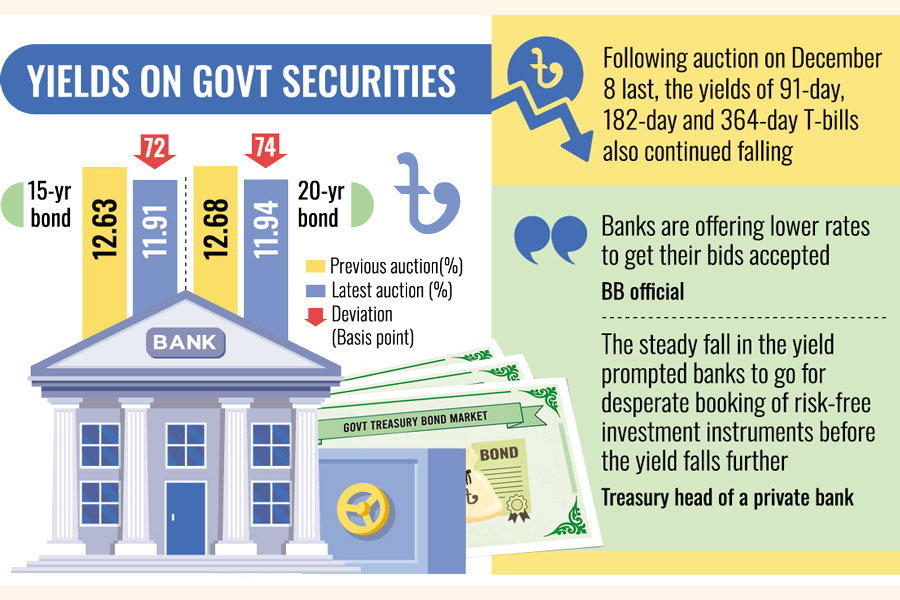

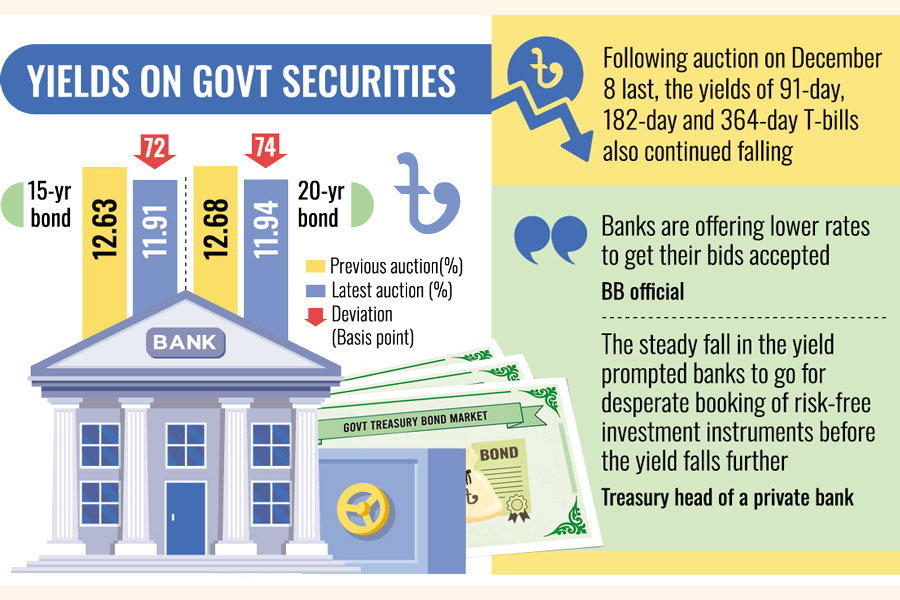

According to Bangladesh Bank (BB) statistics, the cut-off yield for 15-year bond dropped by 72 basis points to reach 11.91 per cent on Tuesday from the previous yield of 12.63 per cent.

In terms of 20-year bond, the cut-off yield after the latest auction reached 11.94 per cent, declined by 74 basis points from the previous auction's yield of 12.68 per cent, the data showed.

In fact, most banks find government securities a lucrative option to gain largely amid a persistently sluggish investment climate.

Many of them bagged a good volume of operating profits by the end of 2024 riding on the high-yield T-bills and T-bonds through which the government meets its major portion of domestic borrowings to meet budgetary shortfalls, according to bankers and officials.

Seeking anonymity, a BB official says banks have now been offering lower rates at the auction to get their bid accepted by the auction committee, leading to a slide in the yield on both bills and bonds.

As the government has decided to borrow funds not more than notified amount from the market due to lower funding requirement, he adds, the committee shuts the auction once the notified amount is met.

For an example, according to the central banker, the government had scheduled to borrow Tk 15 billion each through 15-year and 20-year T-bonds through Tuesday's auction.

"The committee accepted bids within the amounts. I think the banks having a good volume of funds amid lower credit demand by entrepreneurs intentionally offer lower rates so that their bids are accepted," he told the FE.

The cut-off yields of 91-day, 182-day and 364-day T-bills were recorded 11.65 per cent, 11.90 per cent and 11.99 per cent respectively on December 08, disclosed the data.

Since then, the yields for three segments of such bills continued falling to reach now 11.13 per cent, 11.29 per cent and 11.55 per cent respectively, according to outcomes of last Sunday's auction operated by the central bank.

On condition of anonymity, treasury head of a private commercial bank said the steady fall in the yield prompted banks to go for desperate booking of risk-free investment instruments before the yield falls further.

As a result, the supply rises significantly against the lower demand. "So, banks offer lower yield so as to get their bids accepted. That is why the yield is falling," he explains the conundrum.

According to the treasury official, there are many institutions like corporate entities which lost their trust in keeping their funds in the banking system because of negative media reports in recent times.

As the treasury market is secure with comparatively better returns, he says, such investors keep switching their funds to treasury bills. The government can get a good portion of their funds at weighted average rates.

jubairefe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.