Published :

Updated :

Bangladesh saw a notable surge in card-based transactions in May 2025, reflecting the country's growing shift towards digital payments in both local and foreign currency operations.

The number of debit, credit, and prepaid cards issued continued to rise, alongside significant jumps in transaction volumes and values, according to the latest data from the Bangladesh Bank (BB).

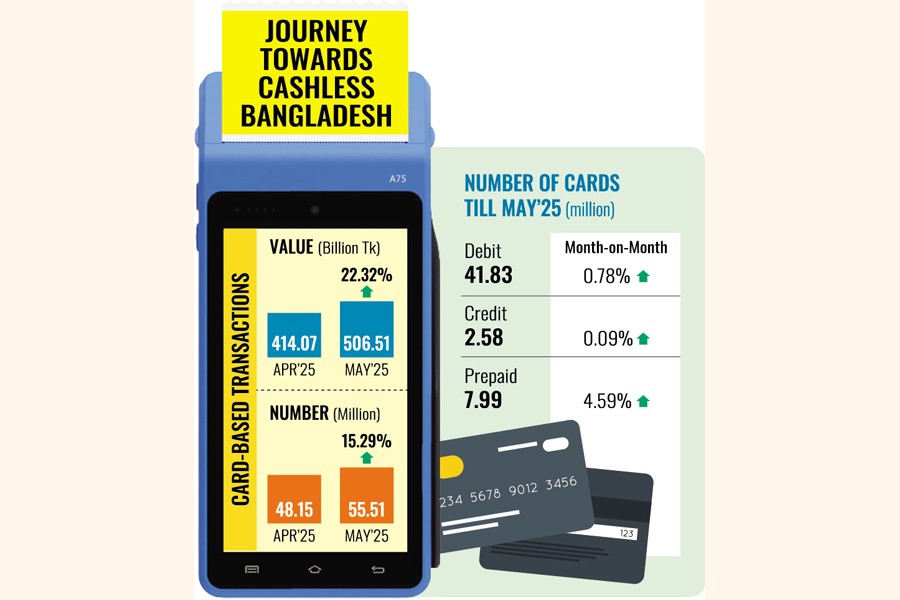

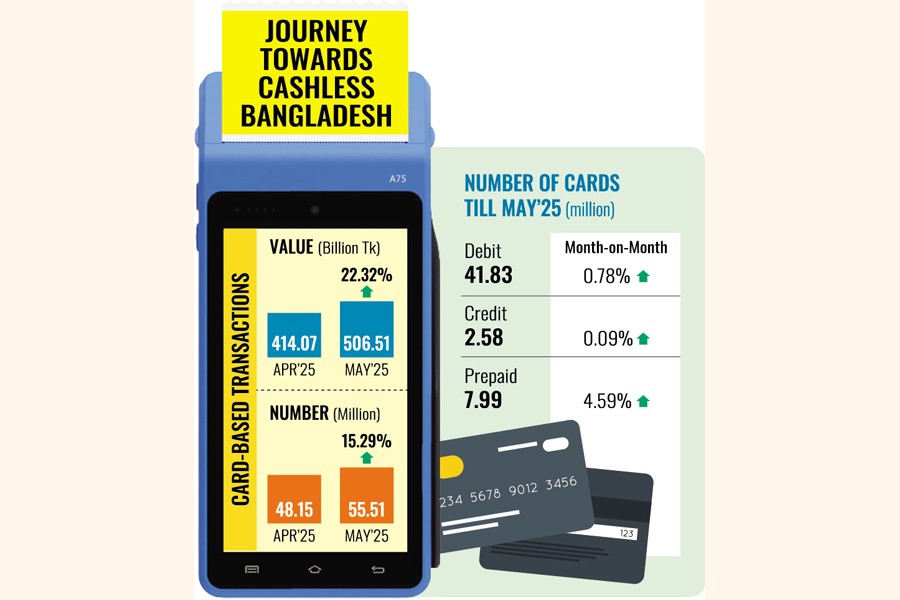

As of May 2025, the number of debit cards stood at 41.83 million, credit cards at 2.58 million, and prepaid cards at 7.99 million.

These figures represent a month-on-month increase of 0.78 per cent, 0.09 per cent, and 4.59 per cent, respectively, compared to April 2025.

Industry insiders say the steady rise in debit cards reflects continued demand from salary account holders and remittance receivers, while the noticeable growth in prepaid cards signals rising popularity among e-commerce shoppers and the youth segment.

Using these cards, the number of transactions in local and foreign currencies reached 55.51 million in May, involving a total transaction value of Tk 506.51 billion.

Compared to April 2025, the number of transactions rose by 15.29 per cent, while the value surged by 22.32 per cent, the Bangladesh Bank data shows.

The total transaction value in local and foreign currencies through cards was Tk 414.07 billion in April 2025.

Also, the number of transactions in that month was 48.15 million.

Stakeholders attribute this growth to the expansion of digital retail networks and greater acceptance of cards across merchants and service providers.

Bankers say while mobile financial services (MFS) remain dominant in small-value digital transactions, the growth in card usage signals increasing trust in formal banking channels for higher-value purchases, travel, and subscription payments.

People familiar with the development also believe this upward trend will continue as banks offer more user-friendly products, enhance security, and expand partnerships with global payment networks.

The central bank's push for wider digital financial inclusion is also expected to sustain the momentum.

AKM Fahim Mashroor, chief executive officer of Bdjobs.com, noted that the current number of plastic cards issued in Bangladesh is still far below the potential. "The card base in the country remains relatively low. Regulatory barriers in issuing credit cards continue to hinder growth," he said.

He also observed that many banks tend to focus on issuing cards primarily to financially well-off customers rather than expanding access to a broader population.

This practice, he added, further deepens the country's digital divide.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.