Published :

Updated :

Single-month export earnings last May recorded a double-digit negative growth year on year and also fell far short of the monthly target as Bangladesh's main exportable apparel shipments plummeted, official statistics show.

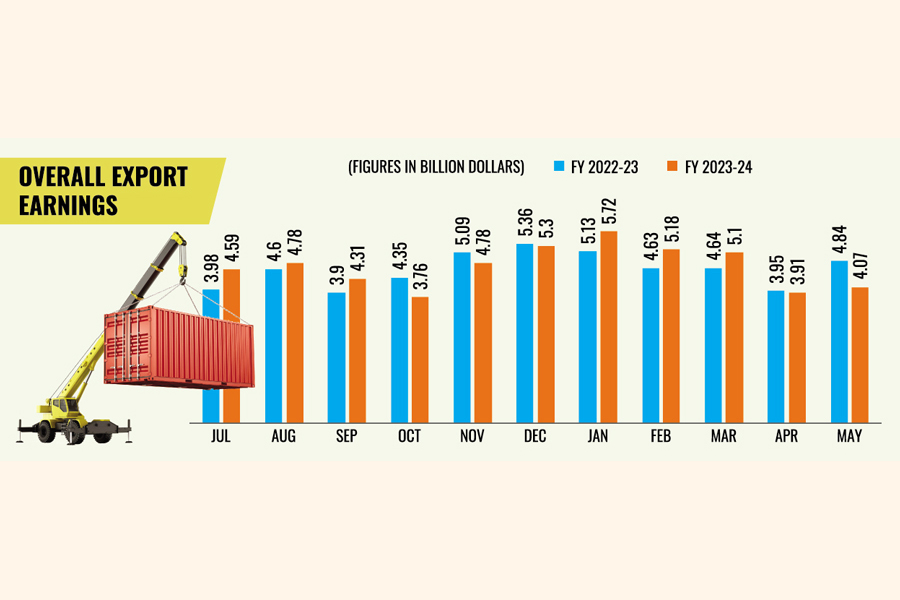

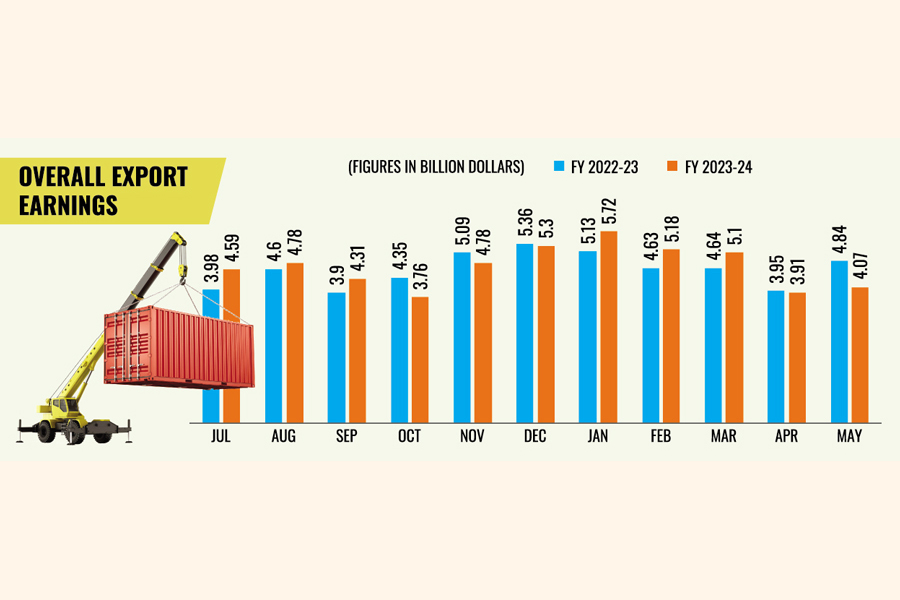

Overall exports fetched Bangladesh US$4.07 billion in May this year, in a 16.06-percent negative growth over May 2023, according to Export Promotion Bureau (EPB) data released Wednesday.

Also, the May export earnings fell far short of the monthly target by 23.75 per cent.

The government set a target of US$5.33 billion for this past May.

Out of the total US$4.07 billion targeted for May, readymade garments earned US$3.35 billion in a 17.19-percent fall from the earnings worth $4.05 billion in May 2023.

Overall export trade of the country during the past eleven months of the current fiscal year (FY) from July to May marked a slow growth by 2.01 per cent or US$51.54 billion.

But the overall earnings were also 8.47-percent lower than the target set for the period.

During the July-May period of FY2022-23, Bangladesh earned US$50.52 billion, the EPB data show.

As usual, apparel shipments overwhelmingly dominated the invoice in both cases because of lack of major breakthroughs in governmental emphasis on diversifying the export basket and market.

Out of the total US$51.54 billion, readymade garment fetched US$43.85 billion during the July-May period of 2023-24 fiscal, marking a 2.86-percent year-on-year growth.

The knitwear sub-sector earned US$24.70 billion in a 6.15-percent growth and woven wears fetched US$19.14 billion, marking 1.09-percent decline over the corresponding period, according to the EPB data.

On the downside, the home-textile subsector witnessed a decline of 24.29 per cent during the last July-May period, with earnings amounting to $776.06 million.

Talking about the trade performance, SM Mannan Kochi, president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said global demand for apparel items declined due to high inflation and bank-interest rates.

"As a result, major RMG destinations-the European Union and the US-have also reduced their imports following a declining trend in their retail sales," he said to explain the export fall.

Besides, prices of locally-made major garments had also decreased by 8 per cent to 16 per cent in the past eight months, the BGMEA president said, attributing the RMG dive to those factors.

On the other hand, cost of local production has also gone up due to wage hikes, high cost of utilities and transportation while bank-interest rate rose up to 15 per cent, he said. As a result, they are lagging behind in global competitiveness.

He expressed concern over the recent decision about not providing gas and electricity connections to factories outside industrial zones, arguing that the move would hamper investment and export.

According to the EPB data, exports of jute and jute goods during the period under review amounted to $784.69 million, registering a fall of 7.53 per cent.

Earnings from agricultural items like vegetables, fruits and dry foods, however, registered a growth of 8.2 per cent to $846.33 million during the eleven months.

Export earnings from engineering products decreased by 7.52 per cent to $479.96 million in July-May.

Frozen and live fish exports decreased by 13.56 per cent to $344.98 million.

The country received $961.49 million from the export of leather and leather goods in July-May, registering a negative growth of 14.17 per cent.

Pharmaceutical exports fetched $184.25 million, in a 14.32-percent growth.

Exports of footwear other than leather items also increased 6.87 per cent to $463.33 million.

The EPB data also show that exports of plastic products posted a 16.39- percent growth, reaching $222.25 million.

Bangladesh in the last fiscal year bagged a record-high $55.55 billion in earnings from merchandise exports, riding on a double-digit growth for readymade garments.

Munni_fe@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.