Quick clearing of payment backlog

Foreign banks easing credit lines for BD lenders

Published :

Updated :

Foreign corresponding banks start easing line-of-credit tightening for their Bangladeshi counterparts as quick payment of overdue import bills following governance change pays off, officials and bankers say.

Large international banks that typically act as correspondents for commercial banks here had squeezed limit of their lines of funds for the Bangladeshi banks from the outset of the financial year (FY) 2024-25 mainly because of overdue bill buildups coupled with unrest stemming from the latest mass uprising.

And it put the country's commercial lenders in serious trouble in dealing with international trade, according to them.

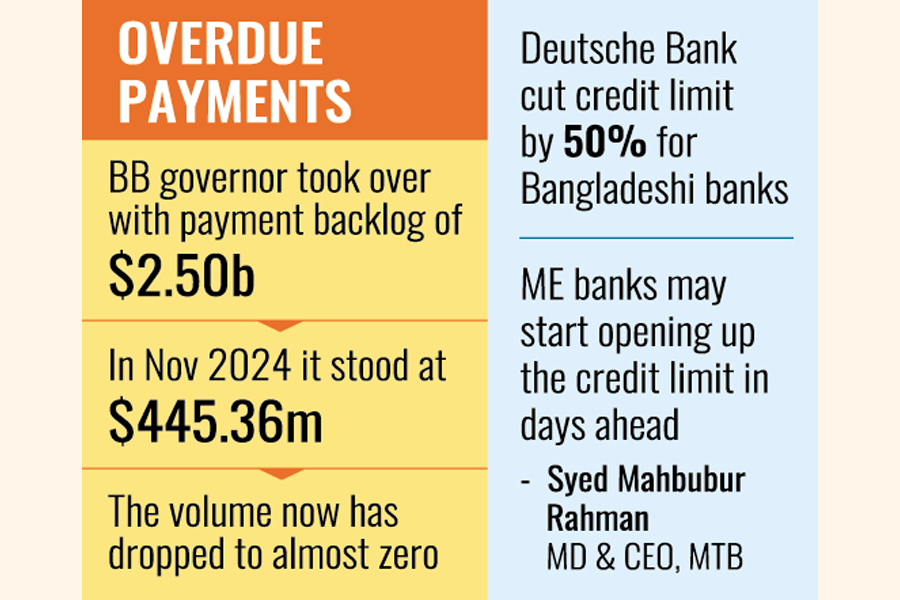

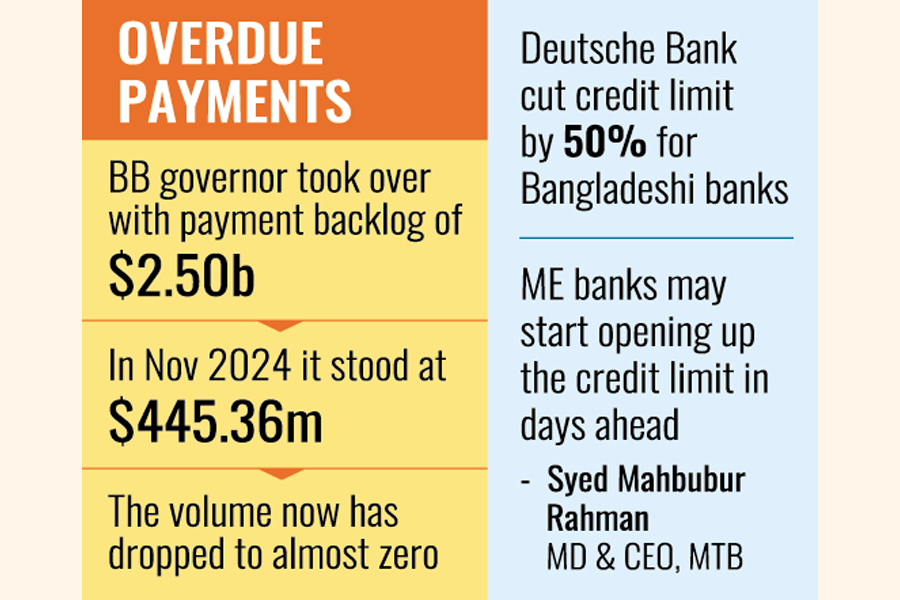

After changeover in state power following the July-August mass uprising, the leadership in the central bank changed with Dr Ahsan H. Mansur appointed its governor who gives utmost priority to clearing off the overdue import payments amounting to over $2.50 billion.

Practically, the volume dropped to almost zero, riding on growing inflows of foreign currencies, the American greenback in particular, which prompted the overseas correspondent banks to change their line- of-credit policies regarding Bangladeshi banks.

Correspondent banking is the provision of banking services by one bank (correspondent bank) to another bank (the respondent bank). Bangladeshi banks mostly act as respondents. By establishing multiple correspondent relationships globally, banks can undertake international financial transactions for themselves and for their clients in jurisdictions where they have no physical presence.

Seeking anonymity, a BB official says the banking regulator repeatedly asked the banks to clear the back pay as soon as possible as the payment delays tarnish image of the banking system globally and increase import costs.

And the central bank constantly followed up on the payment situation and that yielded remarkable achievement. Citing BB data, the official says the outstanding volume of overdue payments came to $445.36 million by the end of November 2024.

"Now, it dropped to almost zero. Such development encourages the global correspondent banks to start easing the limit of line of credits for our banks, which is a good sign for our economy," the central banker notes.

In a recent television interview in Washington, BB Governor Dr Ahsan H. Mansur said with the footing of the overdue bills international correspondent banks started re-diverting their attention to Bangladesh.

Giving a recent example, the governor said Frankfurt-based Deutsche Bank, which cut down the limit of credits by 50 per cent for Bangladeshi banks, lifted the restrictions and some other respondent banks started following suit.

"Yes, the international correspondent banks start opening up their line of credits, which is a good sign," says managing director and chief executive officer of Mutual Trust Bank (MTB) PLC Syed Mahbubur Rahman.

He says the Middle-Eastern banks have not fully opened up yet, but expects that will gradually release the limits.

"I hope they will start opening up the limit of line of credits like before in the coming days with the improvement in forex reserves and overall payments behaviour of the banks," the experienced banker adds.

According to the BB data, the gross volume of foreign exchange held by commercial banks stood at $4.26 billion at the end of December 2024. Since then, the figure keeps increasing to reach $4.54 billion in January 2025.

The upturn in forex holdings of the commercial lenders continues, coming to $4.63 billion and $5.11 billion in February and March respectively, according to the latest statistics available with Bangladesh Bank, the country's central bank

Managing director and chief executive officer of BRAC Bank PLC Selim R. F. Hussain says they have planned to arrange a meeting with Middle East-based correspondent banks in Dubai next month, where the BB governor is expected to be present.

This meeting will provide a forum for the central bank governor to share latest updates of the country's forex and other macroeconomic fundamentals with the representatives of the foreign banks over there.

"I believe that correspondent banks will get an update on the latest economic fundamentals of the country and will take positive steps with regard to their credit lines for Bangladeshi banks," the career banker adds.

According to the industry players, there are around 70 foreign active banks having their corresponding relations with the Bangladeshi banks in global trade transactions.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.