Published :

Updated :

Bangladesh government moves to import re-gasified liquefied natural gas (RLNG) from India through cross-border pipeline under a greater contingency plan for failsafe fuel supply, amid volatility on global energy market.

In an initial bid, around 300 million cubic feet per day (mmcfd) would be brought in from India's H-Energy by 2025, State Minister for Power, Energy and Mineral Resources (MPEMR) Nasrul Hamid has told the FE.

He said state-run Petrobangla would also get an additional 200mmcfd gas by then from private company Dipon Gas, which is planning to import around 500 mmcfd of RLNG from India. "They would sell the remaining 300mmcfd to private consumers."

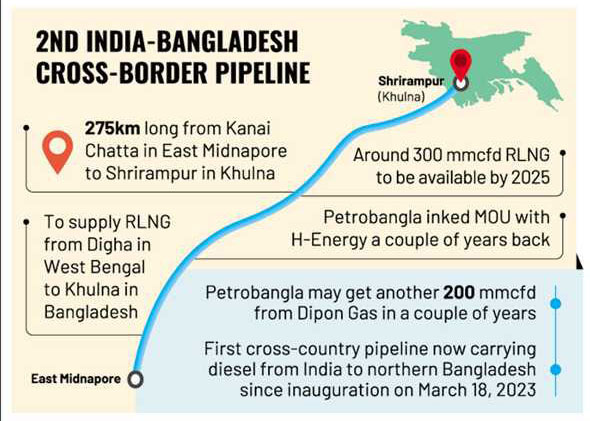

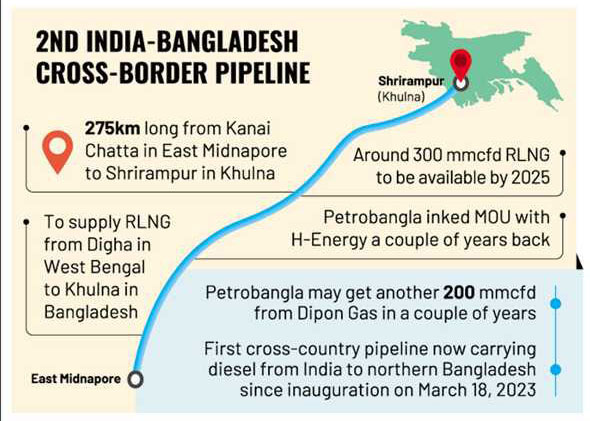

This is going to be a second cross-country pipeline between India and Bangladesh for carrying energy. The first one has been carrying diesel from India since its inauguration on March 18 last, said sources.

India's H-Energy, a subsidiary of Hiranandani Group, has intended to supply RLNG from Digha in West Bengal to Khulna in Bangladesh after laying a 275-kilometre cross-border pipeline from Kanai Chatta in East Midnapore district to Shrirampur in Khulna.

With this end in view, the state energy corporation, Petrobangla, had inked a memorandum of understanding (MoU) with H-Energy a couple of years ago.

The initial target is to import RLNG equivalent to around 1.0 million- tonne per annum (MTPA) from H-Energy through this pipeline to feed the 800MW Rupsha combined-cycle power plant, owned by state-owned North West Power Generation Company Ltd (NWPGCL), for 22 years.

"The Indian company will have an option to increase the RLNG supply equivalent to around 2.0 MTPA of LNG," said one source.

Prior to the H-Energy accord, India's state-owned Indian Oil Corporation Ltd (IOCL) also had inked an MoU to supply RLNG to Bangladesh.

The under-construction 800MW plant at Rupsha in Khulna would be the major consumer of the imported fuel. The plant will require around 130mmcfd RLNG to generate electricity.

The remaining natural gas could be supplied into the national grid.

The Asian Development Bank (ADB) has agreed to lend US$ 600 million and the Islamic Development Bank (IDB) around $200 million to implement the Rupsha power-plant project with two gas-fired units, each having 400MW capacity. The Bangladesh government intends to provide the remaining $ 150 million.

Alongside RLNG imports, Bangladesh has planned to augment LNG imports, said Mr Hamid, adding that Bangladesh eyes inking more sale and purchase agreements (SPAs) with the suppliers.

"Nigeria and some other countries have sent proposals for striking SPAs to supply LNG under long-term arrangements," the minister said.

Recently, Petrobangla inked two new SPAs with QatarEnergy and OQ Trading of Oman to import up to 3.0 MTPA of additional LNG from 2026 onwards.

The cabinet committee on economic affairs also has approved signing three more new SPAs to import LNG under long-term deals from Malaysia's Perintis Akal Sdn Bhd, local Summit Oil and Shipping Company Ltd. (SOSCL), and Excelerate Energy Bangladesh Ltd, a subsidiary of U.S.-based Excelerate Energy.

Imports under the new deals would start in 2024.

Bangladesh has planned to get two more FSRUs built by US's Excelerate Energy and Summit Group with the re-gasification capacity of 3.75MTPA each by 2027 to facilitate new LNG imports, Mr Hamid said.

With these two new FSRUs, Bangladesh's operational FSRUs will be four by 2027.

The country's maiden 7.50MTPA land-based LNG terminal is also expected to be built by 2027.

"With plenty of long-term LNG suppliers booked, Bangladesh is expected to squeeze LNG imports from the volatile spot market after 2027," Mr Hamid said about the forward energy planning, apparently necessitated by crises coming in lockstep with one another on the global landscape that sometime imperil supply chains.

Since the beginning of LNG import from the spot market on September 25 in 2020, Bangladesh had imported a total of 36 LNG cargoes until August 2023, according to state-run Rupantarita Prakritik Gas Company Ltd (RPGCL) statistics.

Apart from the plan to augment imports, Bangladesh has also chalked out a plan to boost natural- gas supply from the local gas fields, said Mr Hamid.

A total of 15 gas wells will be drilled within next one year and 31 more within next several years to augment the country's overall natural-gas output, he said.

"A 65-km pipeline will be built within several years to bring stranded gas from Bhola island into the mainland," he added.

Chevron Bangladesh has also planned to augment natural gas supplies from new areas by 2027, he said.

The US company already got a new flank area adjacent to the country's largest-producing Bibiyana gas field for exploration. It initiated drilling BY-27 well in late August, which is set to be completed within several months, according to Petrobangla.

The US oil major is also in talks with Petrobangla to expand its exploration area further especially in the unexplored onshore Block-8 and Block-11, Mr Hamid said.

Chevron, along with another American firm, ExxonMobil, also is in talks with the government to carry out offshore exploration, he said.

Azizjst@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.