Premium default begets claim-payment crisis in general insurance

SBC plans tough legal weapons to recover premium from errant ins companies as unpaid claims pile up

Published :

Updated :

Premium default begets claim-settlement crisis in general insurance that prompts the state-owned Sadharan Bima Corporation (SBC) to reinvent legal instrument to realise reinsurance premiums from private insurance companies, officials said.

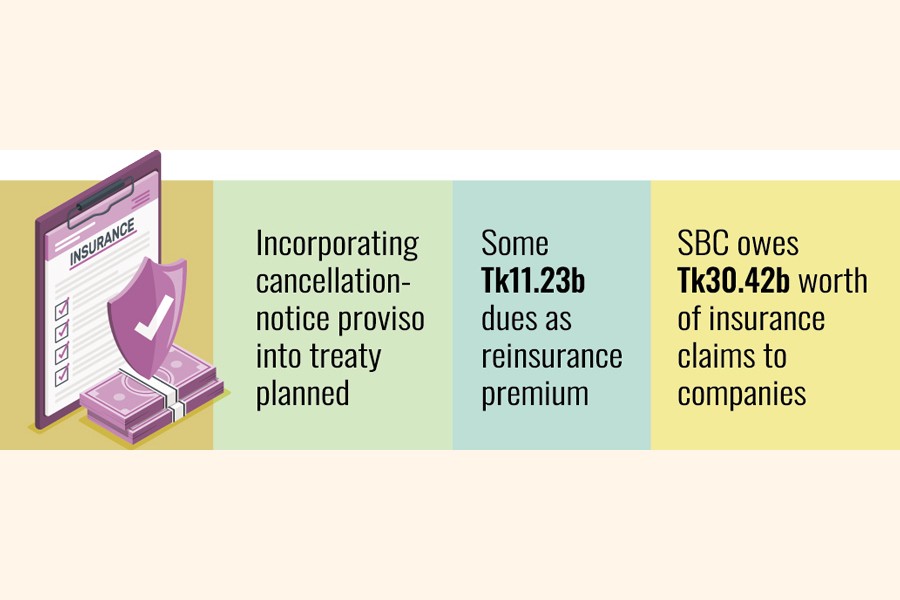

From the current treaty year (April-March) in the insurance business, the SBC wants to insert the provision of 'notice of cancellation' into the treaty documents applicable to premium defaulters in each quarter.

Recently, the state reinsurer got approval from the Ministry of Finance for getting armed with the notice-of-cancellation weapon.

Also, the ministry has advised the corporation to follow rules of the Insurance Act 2010, the Insurance Corporation Act 2019 and other existing rules and regulations in case of failure in payment of insurance premium by the insurance companies.

The SBC has 50-percent reinsurance treaty with 12 companies and 100-percent re-insurance treaty with 33 companies out of 45 non-life insurers.

The corporation in a recent letter to the finance ministry has mentioned that it issues notice to the insured companies each quarter to make payment of premium. However, many companies seek premium waiver instead.

"Thus, realisation of due premiums has turned into a problem for the corporation," the letter reads. Especially, fire reinsurance has fallen into a risk due to higher number of insurance claims in recent years, the SBC writes on a cryptic note.

Since last year, the SBC in the treaty-cover note has mentioned 'quarterly premium payment will be made end of each quarter. Notice of cancellation will be issued after ninety days from quarter-end'.

Now the corporation wants to incorporate the proviso 'notice of cancellation' into the treaty document to make it more effective and keep insurance companies under pressure, according to officials.

Moreover, SBC is informing the insurance companies that it would not bear the risk of reinsurance unless a due premium is paid.

The corporation could realise Tk 4.165 billion from the companies as reinsurance premium in 2024 while Tk 11.232 billion remained dues. On the other hand, it has some Tk 30.421 billion as unpaid insurance claims to the insurance companies.

The SBC letter also mentions that the corporation had long been following the procedures, in case of reinsurance treaty, contrary to the insurance policy. "Because, the premium is main 'consideration' of insurance and without realising premium no risks can be covered and thus insurance claims can't be paid."

Contacted Friday, a senior SBC official told the FE since last year, the corporation had tried to put pressure on the insurance companies so that the dues could be realised before signing a fresh treaty.

"This year we have already started signing treaties and trying to realise the dues," he said.

"The insurance companies are also cooperating with us."

The official, however, thinks the problem would not go overnight since the insurance companies are also passing bad days following last year's student uprising-related disruptions and overall business situation in the country.

syful-islam@outlook.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.